Will the Emerging Market Turmoil be Contained

• Emerging market economies (EMs), as a group, continue to exhibit solid growth. This is the case especially in Asia and among oil-exporters, supported by growth in the advanced economies, the recovery in world trade, and the resilience of non-oil commodity prices.

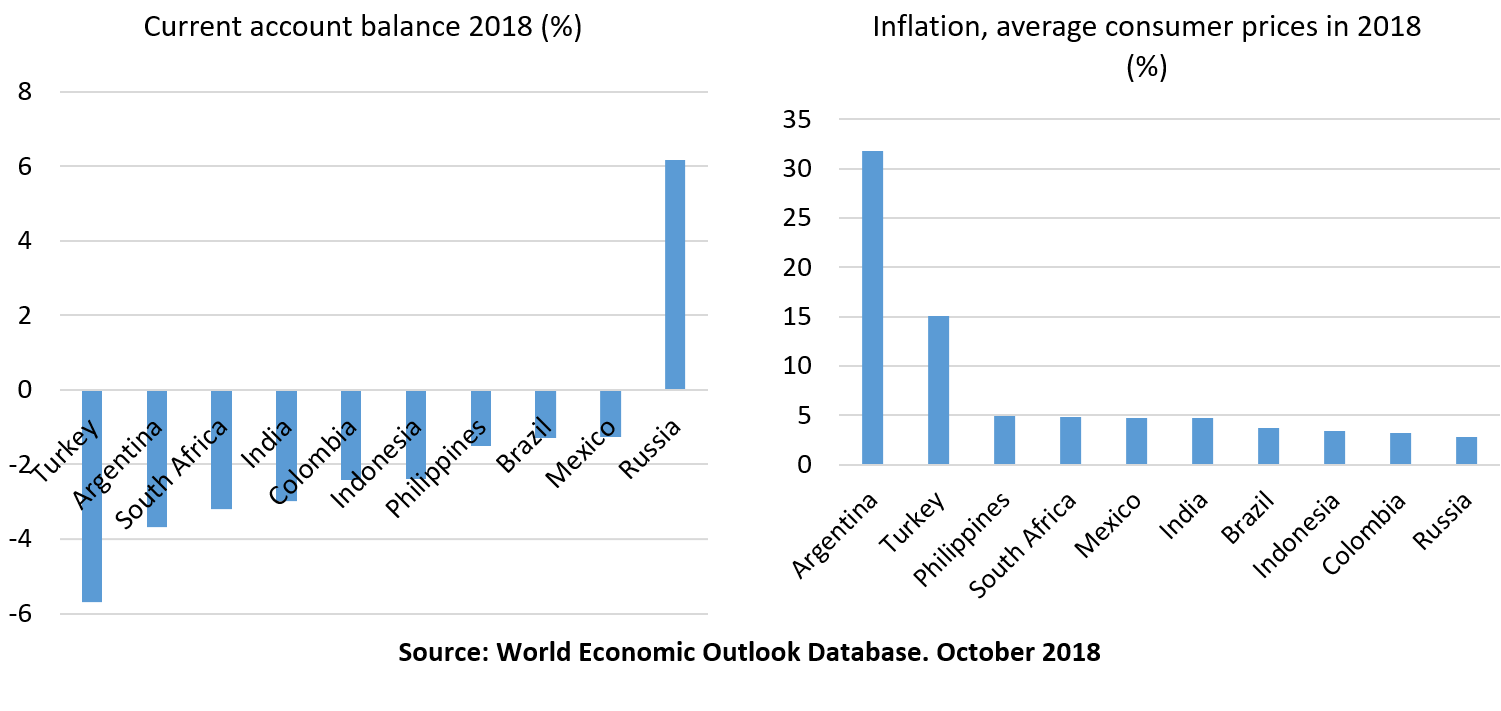

•However, financial markets have become very nervous about the prospects for several EMs, reflecting specific weaknesses in several countries – Argentina and Turkey stand out - and the prospect of higher international interest rates.

•Though many lessons from past crises have been learnt, economic fundamentals in the EMs vary greatly, and contagion is quite possible.

•The current episode will probably remain contained and the ongoing global economic expansion is unlikely to be derailed. However, if international risks – such as an escalation in trade conflicts – materialize, this picture could change quite suddenly.

•The MENA region is more sheltered than other EMs from the turmoil, but it is certainly not immune, and caution is required.

1. Developing Country Growth Remains Solid Overall, but with wide variance

Emerging Markets (EMs) continue to grow, supported by the global expansion, and it is inappropriate to speak of a generalized crisis. Consensus forecasts still call for aggregate developing country growth of 4.5% to 5% in 2018.

2. Currencies of Emerging Countries have Depreciated against the US Dollar

A climate of uncertainty reflecting the prospect of monetary tightening in the United States, a strong US dollar, trade skirmishes, and the fear of a global economic slowdown have raised concerns about EMs. The most affected currencies, the Argentine peso and the Turkish lira, have depreciated by 96 % and 54 % respectively against the US dollar between January and October 2018.

This depreciation – combined with higher interest rates that these countries pay, implies a far higher real debt-servicing burden, and has a large impact on domestic inflation and the living standard of citizens. The South African Rand, Brazilian Real, Russian Ruble, and Indonesian Rupiah have also seen large depreciation.

.png)

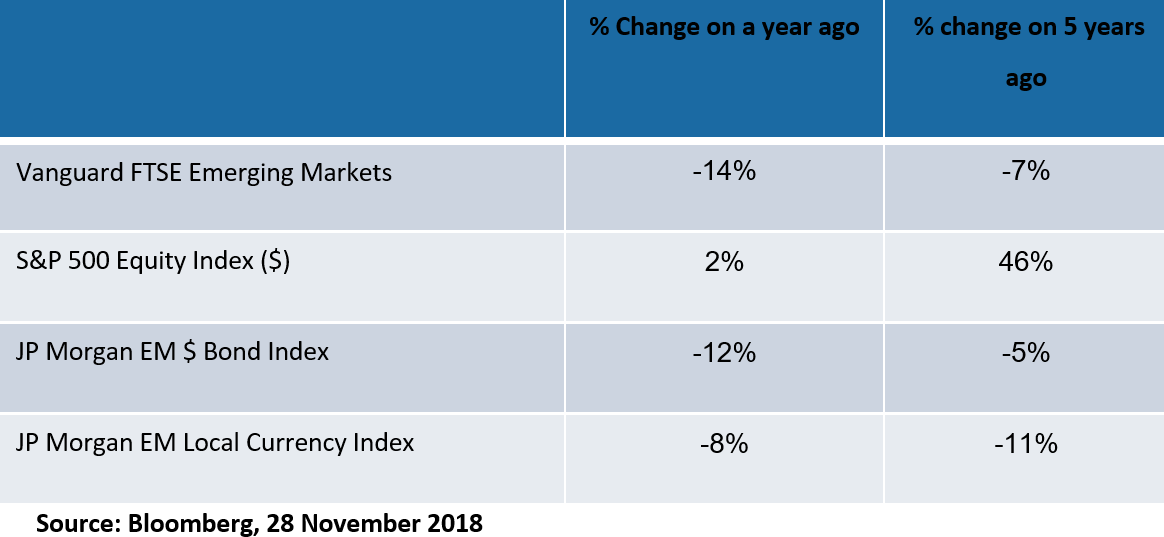

3. EM Stock Market and Bond Indices have Declined Sharply

The FTSE EM index (equity in $) is down 14% over a year ago; and down 7% (cumulative) over the last 5 years. The JP Morgan EM Bond Index ($ bond index) is down about 12% over a year ago, and it is down 5 % over the last 5 years. The JP Morgan EM local currency index has lost about 8 % of its value over a year ago and is down 11% over the last 5 years. These disappointing returns compare very unfavorably with those of the S&P 500, which is up marginally on a year ago and nearly 50% on 5 years ago.

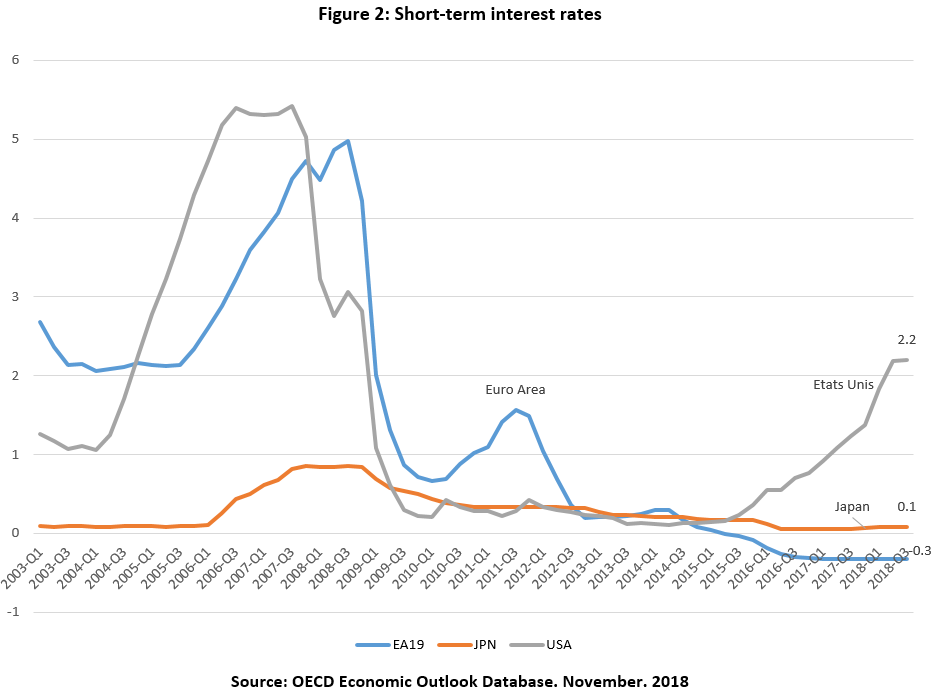

4. The Big Fear: Higher Policy Interest Rates

With the Fed leading, American short-term interest rates have increased from zero in the beginning of 2015, but remain very moderate, slightly exceeding 2% and in line with inflation, implying zero real interest rates. In the euro zone, short-term interest rates remain near zero, implying negative real interest rates of around 2%. Low interest rates since the outbreak of the Great Recession have facilitated a foreign currency debt build up in many EMs, especially in dollars, increasing vulnerability, but it is difficult to describe the current interest environment as dangerous of itself. A higher dollar increases the real cost of servicing debt, but it also boosts export volumes and the value of exports expressed in domestic currency.

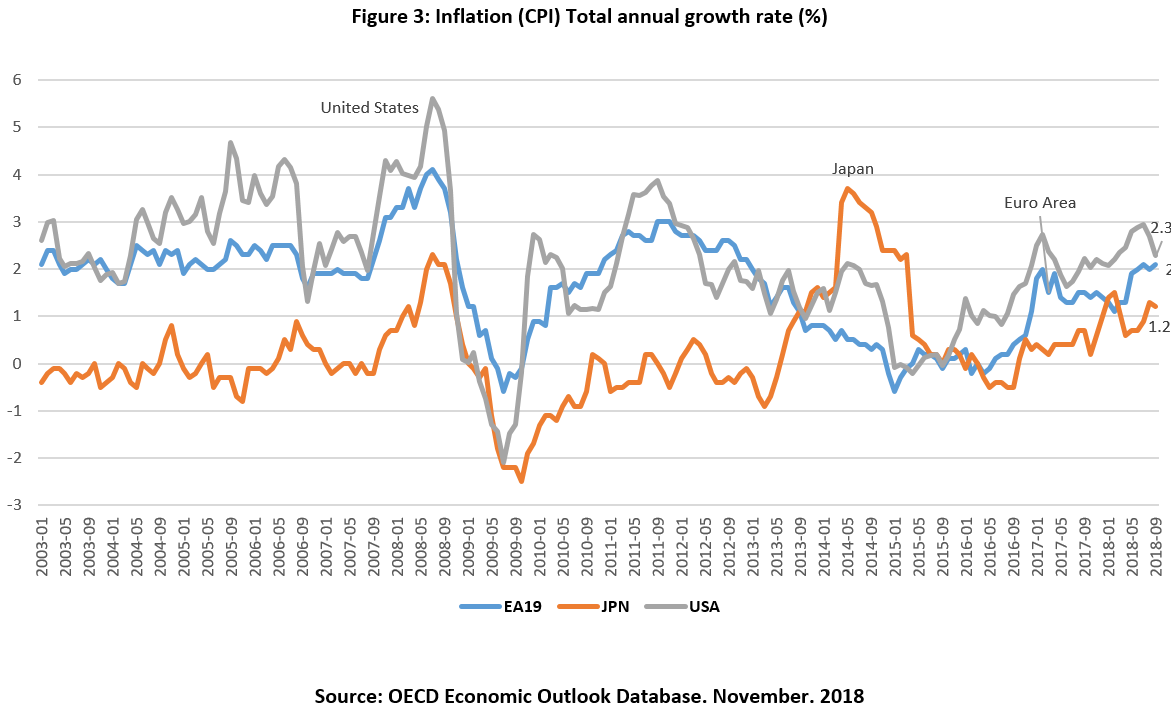

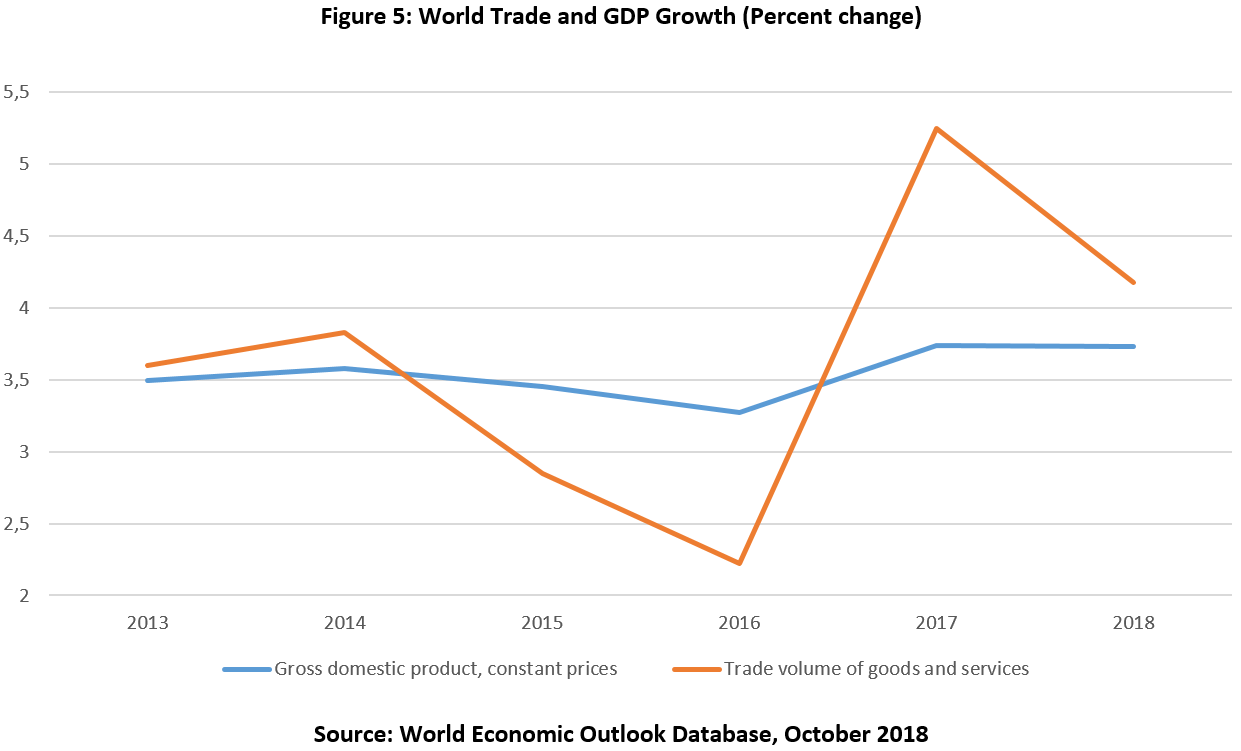

5. The Other Fear…a Slowdown in Global Economic Growth

Though there are signs of deceleration of economic growth, especially in Europe, overall, the global expansion remains robust at present, and the latest indications are that the growth of world trade volumes is at a quite healthy 4% at annualized rate; non-oil commodity prices, expressed in US dollars, are on a gradual upward trend since the start of 2016. Oil prices have recovered sharply since their trough at the start of 2016.

.png)

6. The Orderly Financing of EMs always depends on confidence

“Normal” Financing Requirement of EMs need to cover the Current Account Deficit (or surplus) + Short-Term Debt + Long-Term Debt Coming Due + Profit Repatriation. When there is confidence, this financing is easily available. In a “Jitters” scenario, only a part of “Normal” Financing Requirement is available, as some short-term and long-term debt coming due will not rollover. New inflow of foreign investment slows. In this case, Foreign Exchange Reserves can usually fill the gap.

However, in a “Crisis” scenario very little debt is rolled over and there is little or no new foreign investment. Domestic residents and foreigners try to liquidate domestic assets and large-scale capital flight can ensue. Often, foreign reserves are inadequate to stem the bleeding and IMF or substitute help is needed.

In an “Extreme Crisis” scenario, a large part of M2 (cash plus bank deposits) tries to exit, as do foreign investors holding liquid assets. Even with external help, the currency devalues massively and – as liquidity dries up – the economy suffers a large contraction, unemployment soars, and real wages decline sharply. Default and rescheduling of foreign debt usually follows.

Confidence loss can become self-fulfilling even when an economy’s fundamentals may not warrant it. When fundamentals are weak, maintaining confidence is a precarious balancing exercise, like walking on a tightrope. Some countries in trouble, namely Argentina and Turkey, have high financing requirements. Others also have high financing requirements but maintain confidence.

7. EMs have become more resilient by taking certain precautions

Emerging countries have learned much from previous crises, such as the Asian crisis of 1997-1999 and the Debt Crisis of the 1980s. Most have opted for preventive measures to improve the macroeconomic fundamentals of their economies. Although success in implementing these measures varies greatly, nearly all EMs have undertaken some of the steps listed:

•Moderate fiscal deficits (<3%), inflation targeting (<5-6%) and moderate current account deficits (<4% of GDP).

•Adequate reserves (>6 months of imports).

•Flexible Exchange Rate (Shock Absorber).

•Selective Capital Account Liberalization (Encourage FDI and long-term borrowing and discourage short-term borrowing; exchange controls/limits on certain transactions).

•Encouragement/development of domestic debt markets (local currency).

•Banking regulation – capital requirements (often well in excess of 10% of assets).

•Limits on foreign borrowing by the private sector. Especially short-term borrowing by the banks, and by corporates that are domestically oriented (i.e. do not have a “natural hedge”).

...All these measures require discipline, an ability to take a long-term view and a willingness to confront powerful interests.

Still, the precautions remain insufficient in some countries.

8. The Situation of Argentina

Argentina has lost macroeconomic control and is experiencing a sharp recession, high inflation and a large current account deficit. The country suffers from long-standing structural weaknesses and mismanagement. Remarkably, the share of exports in its GDP fell from 24% in 2005 to 11 % in 2017.

The current problem of Argentina is a classical fiscal overextension reliant on foreign borrowing. In addition, the government's delay in fiscal consolidation has led to a widening fiscal deficit and an increase in public debt in US dollars. Furthermore, the inflation-targeting framework has lost credibility due to the very high level of inflation, about 26 % in 2017.

At the same time, the economic recovery and structural weaknesses led to widening current account deficits, a high external financing need and a loss of confidence in the currency. Moreover, capital outflows have reached about $2 billion a month.

Finally, foreign currency liabilities are disproportionately in debt (not equity), and particularly in short-term debt. Gross external financing needs are projected at 20% of GDP; i.e. over $100 billion a year in coming years. A 30% real depreciation could lead to an increase of foreign debt/GDP from 48% currently to 70 %. Argentina is in the second round of a risky IMF program that requires a large fiscal adjustment and currency depreciation against a background of recession and high inflation.

9. The Situation in Turkey

With a GDP of $851 Billion and a population of 80 million people, Turkey’s problems are different from Argentina. In fact, large indebtedness and currency exposures are in the private sector. Unlike Argentina, Turkey has a successful manufacturing base and a history of large and growing exports. However, following the coup attempt in 2016, a fiscal expansion ensued, and a large increase in loan guarantees to the private sector for PPP partnerships was granted. The Credit Guarantee Fund is in the process of disbursing around 7% of GDP, surging investment mainly in the non-tradable sector (e.g. construction), which led to 7.4% growth in 2017, while much of the private sector financing was, and is, done through banks intermediating short-term borrowing in foreign currency. Reserves in 2017 were substantial at $107 billion. However, the gross external financing requirement was about 25% of GDP or over $200 billion a year.

The economy’s overheating and rising inflation was not met with adequate monetary restriction. Mr. Erdogan does not like higher interest rates. A high real exchange rate (devaluing in 2017, now about in line) combined with structural weaknesses led to a widening current account deficit. Financing is, therefore, complicated by domestic and geopolitical uncertainties, increased risk aversion, limited foreign exchange reserves, and government’s increasing contingent liabilities.

Public debt is low at 28% of GDP but it is short-term, and its annual rollover ratio of approximately 100% is high. Banks appear satisfactorily capitalized but significant bad loans are emerging. Bank short-term borrowing in Foreign Exchange is now about half of their capital, though some banks may have equivalent off-balance sheet hedges. The banking system is exposed to foreign currency risk because outstanding loans mainly finance the non-traded sector (in construction, energy, etc.) in domestic currency.

In its last Article 4 consultations, the IMF argued that monetary policy remained too loose, as was fiscal policy and that there needed to be deeper structural reforms (especially labor market, macroprudential regulation, and increased VAT take).

10. The Situation in the MENA Region

The current economic situation of the oil exporting countries is favorable mainly due to the increase in oil prices over the period 2016-2018, which has very recently been only partly reversed. Oil importers, on the other hand, are vulnerable to a major slowdown in world trade, especially European and Turkish imports. However, their exposure to other emerging regions remains low.

In addition, sizable current account deficits need to be financed or cushioned by reserves. The cost of new financing is likely to increase. However, since most financing is long-term (FDI. long-term borrowing) and the capital account is controlled (less risk of capital outflow), financing needs in 2018-2019 are moderate and likely to be met - perhaps with help from official creditors. Countries with a recent history of turmoil, including Egypt and Tunisia, confront a large adjustment problem with the help of the IMF.

In the event of a widespread EM crisis. MENA oil importers are likely to see slowing growth, exchange rate depreciation and higher financing costs.

11. Why would trust in EMs be Lost? The five most common reasons….

In assessing EM prospects, history helps. It shows that the confidence of investors in EMs has been profoundly affected by one or more of the following:

•Global recession coupled with inflation (“stagflation”) as in the early 1980s, especially if coupled with a surge in interest rates and/or a surge in oil prices (which hurt oil importers).

•Loss of macroeconomic control.

•The banking sector becomes overextended and takes high risks in international and national markets. Credit growth is too rapid and sometimes fuels an unsustainable construction boom. The situation is exacerbated if the banking and corporate sector become overly reliant on borrowing in foreign currency, especially if the funding is of a short-term nature.

•Disruptions such as political strife, military coup, and/or civil war, Etc.

•Contagion: confidence is lost as investors fail to distinguish between “sound” EMs and “unsound” EMs.

12. EMs are unlikely to derail the global expansion but they could slow it significantly

In a generalized EM crisis, the main channel of transmission is likely to be through reduced import demand. Since EMs now account for about half of world trade, the effect could be significant. The financial risk associated with EMs is borne to a significant degree by retail investors, who hold Exchange Traded Funds and Mutual Funds that have the characteristics of equity, so the risk is spread quite widely.

However, some major banks also have significant exposure to EMs. In a period of high and rising profitability, the shock can be managed, but there may be repercussions on confidence in fragile situations (e.g. Unicredit in Italy). Turkey and Argentina represent only around 2% of world imports and GDP – so their direct effect is small, however, a contagious 2-year 5% decline of GDP in the largest EMs (except China) would shave nearly 1.5% off world GDP by the end of year 2. If China were to be affected – partly for independent reasons, namely the over-indebtedness of its corporate sector and trade wars – and lose, say, 3% growth for 2 years that would shave an additional 1% of world GDP by the end of year 2.