Should we worry about the Great Trade Slowdown?

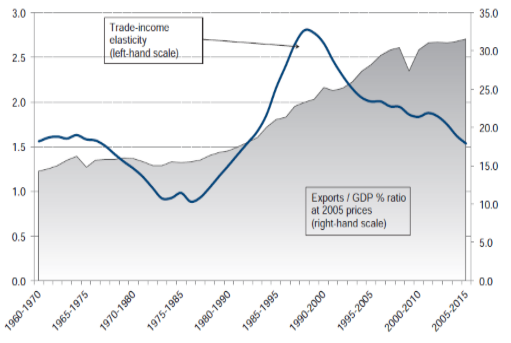

China’s recent decision to allow a very slight devaluation of the Yuan caused a momentary panic in stock markets around the world. Behind the extreme reaction are concerns about China’s slowing growth and the effect it will have on exports to China by the rest of the world. But these trade concerns are not limited to trade with China. In fact, world trade, the sum of exports and imports of goods and services, which used to grow much faster than world GDP, has barely matched it over the last four years. Based on historical relationships, an elasticity of world trade to GDP typically between 1.5 and 2 (Figure 1), world trade should be growing about 1.5% to 2% faster than it actually is.

Figure 1: World trade – GDP ratio and trade – income elasticity (1970-2015)

Source : Escaith H. and Mirodout S. (2015).

Struggling with slow growth at home as well as sluggish exports, most countries, advanced and developing, have allowed their currencies to slide against the U.S. dollar. Until recently, China, the world’s second largest economy, stood out in resisting this trend, and indeed had seen a large appreciation against the US dollar over several years. So, not surprisingly, many saw its abrupt change of course not only as signaling deep trouble in China but also as opening the door to a bout of destabilizing currency competition.

These troubling developments raise an important question: does the trade slowdown call for specific steps by policy-makers over and beyond their continuing efforts to reignite economic growth at home? The answer is no, but to arrive at that conclusion, we need to understand what caused the great world export slowdown in the first place.

Causes of the Great Trade Slowdown

There is a broad agreement among economists that cyclical factors have played a very important role in the trade slowdown relative to GDP. More specifically, the global financial crisis has had a disproportionately severe effect on regions and industries that rely heavily on trade. The European Union, which is struggling to recover from a chronic sovereign debt crisis, accounts for roughly 1/5 of world output but about 1/3 of world trade. Furthermore, faced with sluggish demand, firms across the advanced countries have delayed replacing machinery, while nervous consumers have delayed buying houses, furniture, and washing machines. The production of these investment goods requires a lot of back and forth of raw materials, parts, and components across nations, as they are often at the core of so-called Global Value Chains. The import content of investment goods, for example, is estimated to be twice that of consumer goods, so that the slowdown in investment had a large disproportionate effect on trade. The

slowdown in investment – which more recently has spread to developing countries – together with the European recession could easily have accounted for more than half of the slowdown of world trade relative to GDP.

If this interpretation of the trade slowdown is correct, then trade growth is likely to resume to something much nearer to its customary rapid pace once the world economy returns to its trend growth path. There is nothing new, additional, or specific that is required of policy-makers beyond the mandate to reignite economic growth, which of course is a tall enough order. What must be avoided, however, is that policy-makers misinterpret slow exports as caused by currency manipulation or protectionism by their trading partners, which could easily trigger a race to the bottom. This leads us to the next important reason for the trade slowdown.

With the fall of the Berlin Wall and against the background of stable economic growth, which came – mistakenly as it turns out - to be called “The Great Moderation”, trade growth was extremely rapid by historical standards throughout most of the 1990’s and early 2000’s. As the Soviet Union dissolved, and its satellites in Eastern Europe and Vietnam moved to the market, India also engaged in substantial trade liberalization, and, most importantly, China became rapidly integrated into world markets. In this process, production patterns were recast along new lines of comparative advantages and large new trade and foreign investment opportunities arose. In the 1990’s world trade grew almost 3% faster than GDP, a difference of about 1.5% a year more than the period from 1950 to 1990 (Figure 2).

Figure 2: Total exports and production, by decade.

Source : WTO (2014).

However, the transition from central planning is largely done, and such a one-time boost to world trade growth is unlikely to be repeated in the foreseeable future. Policy-makers cannot change this fact and they should moderate their export expectations accordingly.

Yet another argument put forward to explain the trade slowdown is that there is a declining need or desire to operate global value chains [Constatinescu et al.]. China, the argument goes, is refocusing its economy away from exports and manufacturing and towards consumption, services, and domestic markets, at the same time it is also learning how to rapidly produce sophisticated components at home instead of importing them. Meanwhile, American firms have become more aware of the cost of coordinating global production chains, and are bringing production back home to take advantage of low domestic energy costs and advancing automation. Although these arguments contain a kernel of truth, the empirical evidence in support of them is mixed and open to different interpretations. For example, China’s decelerating exports and increased reliance on domestic demands – which have contributed to reduced imports of components – is at least in part due to the cyclical demand effects outlined above. And, despite America’s much heralded manufacturing renaissance, new jobs created are overwhelmingly in services while manufacturing employment remains well below its pre-crisis peak. The high dollar is, if anything, likely to reinforce these trends.

But even supposing the argument that firms are durably retreating from global value chains is correct, which I doubt, such a trend would only mean that firms have found a more efficient way to produce and market. Policy-makers should be aware of this trend, but there is no need for them to interfere with it.

The remaining possible explanation for the world trade slowdown is a resurgence of protectionism. However, the evidence that protectionism has played a significant role in the slowdown remains unconvincing, in my view. Several experts have scrutinized the indicators of new protectionism, such as those made available by the WTO’s Secretariat, the World Bank, and by the NGO Global Trade Alert. They have found no evidence of an across-the-board deterioration,although some countries, such as Brazil and Indonesia have enacted a number of egregious measures that significantly affect specific sectors. In fact, taking a longer view, there are important reasons to believe that trade is freer today: according to a recent paper by OECD and WTO economists, over the last twenty years, the tariffs of WTO members have declined by 15% and transport costs have declined continuously from 7% to 5% of the value of trade. Moreover, today, 80% of exports from developing countries enter advanced countries duty-free as compared to 55% 20 years ago. Nor can one ignore the fact that the spread of the internet and of electronic commerce has spawned a multitude of “micro-multinationals”, small firms that export (and buy) all over the world, a trend that is bound to be reinforced in the future.

Additional Policy Considerations, and a look at Morocco

In determining how policy should react to the great trade slowdown, it is important to dispel a common misconception. This is the view that exports play an essential role in stimulating aggregate demand. Seen from an individual country at any point in time that is true, but since the world does not export to Mars, in the aggregate world exports must equal world imports, so the effect of world trade on world aggregate demand is exactly zero. The vital benefit of world trade is not that it stimulates global aggregate demand but that it expands global supply by enabling the division of labor and allocating resources more efficiently across the world.

That is why policy-makers must, above all, continue to guard against protectionism, and also to deepen their country’s connections to the world through better transport, communications, and internet links. As for reigniting the rapid growth of trade over the next year or two, nothing is more important than measures to accelerate the pace of domestic recovery from the financial crisis.

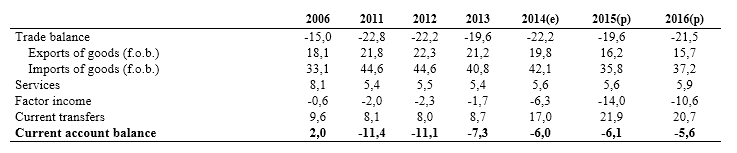

Morocco has clearly not been immune from the global trade slowdown. While from 1990 to 2011 Morocco’s trade to GDP ratio increased by almost 40%, it appears to have declined in recent years (Table 1)

Table 1 : Current account (percentage of GDP at current prices)

Source : African Economic Outlook, African Development Bank.

A crucial factor in this disappointing trade performance has been Morocco’s excessive reliance on European markets where the combination of the global financial crisis, the Eurozone competitiveness, the sovereign debt crisis, and the rapid fall in investments have caused a very sharp slowdown in imports from the rest of the world. Unfortunately, Morocco has taken only modest advantage of the transition of China, Vietnam, and the Former Soviet Union to the market. There is little evidence that Morocco has suffered from an escalation of protectionism in its major markets. However, difficulties in meeting rules-of-origin requirements to take advantage of the Morocco – EU free trade agreement remain, and access to markets in neighboring countries in North Africa remains problematic for many reasons.

Looking forward, as suggested by the forecasts of the African Development Bank (Table 1, above), it appears unlikely that Morocco’s export markets and world trade will return to the extraordinary pace observed in the pre-crisis years anytime soon. Those years benefited from buoyant global demand as well as the opening up of vast new markets. However, Morocco’s exports should see modest growth again, helped by the recovery in Europe, which appears to be solidifying despite the travails of Greece, as well as by new investments in the automotive and aerospace sector, which may herald a diversification of exports into new areas and lay the ground for increased foreign investment in related sectors.

The Great Trade Slowdown also provides a salutary lesson for Morocco as it does for all developing countries: development is more sustainable if it is based on a diversification of markets and activities, both domestically and internationally. Countries should leverage export markets to achieve rapid growth, but they should not become over-reliant on exports, especially exports that are concentrated in a single region or sector. Instead, they must seek productivity improvements across the whole economy, including in domestic activities ranging from services to public utilities.

The trade slowdown also underscores the importance of a flexible exchange rate, which can respond to large shifts in markets and to adjustments by competitors, many of which tend to react to slowing exports by allowing their currency to devalue. What must be avoided is the temptation to use the exchange rate as a competitive tool or as a hidden export subsidy.