The Securitization Technique: a Relevant Tool for Financing the Mining Sector?

Like Morocco, Gabon and Indonesia, many commodi-ty-producing countries are engaged in major industrial development aimed at reducing the relative share of the mining activity in favor of ore processing. This is ambitious and many conditions must be met for such a strategy to succeed. Among these conditions is the ability to attract investors, especially international, which is essential to meet the large financing needs that such a development implies. From indebtedness by issuing bonds, to bank financing through the crea-tion of joint ventures, multiple strategies can achieve this. In this context, and although it was widely ques-tioned during the 2007 subprime crisis and the finan-cial crisis of 2008, the technique of securitization cannot be omitted. The securitization of off-balance sheet assets appeared in the early eighties in the US market and indeed offers interesting prospects. Two types of products must be distinguished here: asset backed securities (ABS) where the debts to be securitized are homogeneous, and collateralized debt obligations (CDOs) are non-homogeneous. The best-known ABS concern mort-gages, such as residential real estate (Residential Mort-gage-Backed Securities -RMBS) or commercial (Commercial Mortgage Backed Securities -CMBS),and any asset offering a stable income stream may be sub-ject to a securitization.

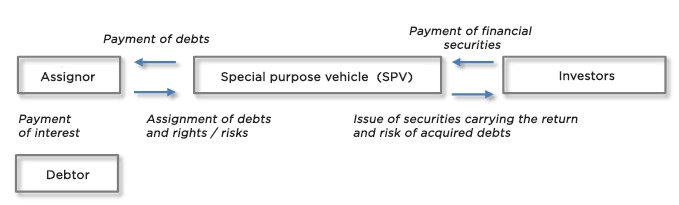

Box 1: The off-balance sheet securitization mechanism

In this type of financing, a country, bank or company (the originator or transferor) transfers debts and rights/obligations to an ad hoc legal vehicle or a special purpose vehicle (SPV) in exchange for a cash payment. To finance such a transaction, the SPV issues securities on the money markets. As the SPV was created for the sole purpose of achieving this securitization, it has no resources. An investor who holds such securities then has a return pledged on financial flows of the debt, often higher than under traditional debt, but bears all or part of the default risk. Meanwhile, the transferor a priori has less expensive funding than a bondissue,with the advantages of not influencing the level of debt.

Figure 1: Simplified diagram of a securitization transaction

In the case of asset-backed securities (ABS), the securities issued evenly carry the receivable credit risk. In the most complex case of collateralized debt obligation (CDO), assigned debts are usually fewer in number, but in larger amounts. Additionally, the securities are issued in representative portions, called “tranches” of different risk levels according to a subordination principle. Schematically, the equity tranche supports the initial risk of loss and intermediate tranches, called mezzanine, are only exposed to financial risk when the entire portion of equity is consumed. The final tranche is the least risky and traditionally enjoys AAA rating. The proposed yield for each tranche is naturally proportional to the risk.

Diverse procedures can hide behind the usual diagram of a securitization transaction. The securitization transaction may initially concern only the transfer of a risk and not an asset in the strict sense: an example is the regular transmission of cat bonds by the reinsurance industry, which transfers the risk of a natural disaster occurrence to investors in exchange for a priori attractive coupons. Secondly, in the case of asset securitization, it is not legally necessary that a receivable arise for a securitization transaction to be implemented. In Morocco, for example, the approval of the proposed amendment to Law No. 33-06 on securitization of debt, opens this business to more varied assets and reflects this reality. Article 16 specifies how these debts can result either from an existing or future act, with the amount or the due date either determined or not yet determined. Future income securitization can therefore relate to trade credit, rental income (leases, rents), or royalties just as did the singer David Bowie who securitized his copyrights in 1997. The principle is simple and close to a traditional securitization: exchange a future wealth linked to the perception of these revenues against immediate funding. Finally, remember that this technique is not specific to credit institutions or, more broadly to the private sector, and many governments have been using this technique. The recent funding of 380 million euros for a highway construction project in India is partly based on the securitization of toll revenue by the province of Hong Kong in 2004. The securitization of tax revenue was also used extensively between 1990 and 2000, notably by in South America.

Revenues from the exploitation of commodities,notably gas and oil, were also the subjects of securitization programs. The companies under state control in the Gulf countries and Latin America indeed quite widely practiced this technique. Qatar General Petroleum Company is one example: in 2003 it was able to launch a securitization program for its liquefied natural gas commercial revenues to finance the expansion of its gas production capacity amounting to 1.2 billion, of which 1/3 was by securitization. In the early 2000s,the public oil companies Petrobras and PDVSA implemented similar programs in Brazil and Venezuela.

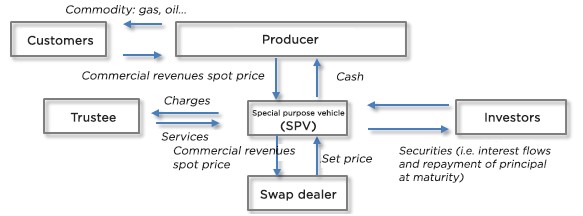

Encadré 2 : La titrisation de revenus futurs dans le secteur des matières premières

Under this type of financing, future commercial revenues are transferred to a SPV, which issues securities to finance the acquisition. A commodities swap can then be used to convert commercial revenue into fixed prices dependent on the spot prices of commodities in question, and thus provide a stable return to the investors who bought the securities issued. Under the Anglo-Saxon diagram, the presence of a trustee ensures investor protection by ensuring that the legal documentation of the transaction is compliant.

Figure 2: Simplified diagram of a commercial revenue securitization transaction

While the financial crisis largely stigmatized this financing, a comeback has been observed in recent months. Two examples illustrate this. In announcing on September 4, 2014 that the European Central Bank would engage in a securitized product buyback program, President Mario Draghi clearly gave the signal to the markets and the banking sector that securitization has again become a relevant funding tool for European economies. In 2013, Zhou Xiaochuan, governor of China's central bank said at an annual session of the Chinese People's Political Consultative Conference that all financial instruments used abroad, including securitization, will be considered to finance the country’s urbanization.

The commodities sector is not excluded from this process and several securitization transactions of financing commodities trading activities have recently taken place. In August 2013, BNP Paribas issued bonds backed by transactional commodity finance amounting to over 132 million. An indication that this revival is not unique to banking, the trading company Trafigura meanwhile launched an extensive securitization program of trade debts in 2004 and in 2012 was able to raise nearly USD 430 million from European and American investors. The new regulatory requirements stipulated in Basel III,weighing on commodity trade finance as well as on all financing activities, explains this outsourcing of financing risk.2As for producing companies, few operations appear to have emerged recently, but these is little doubt that they will emerge again when global macroeconomic conditions improve.

What will the situation be like for the mining sector? Just like the Democratic Republic of Congo had done, in August 2014Zimbabwe obtained financing from China in the amount of USD 2 billion pledged on future mining revenues, including diamonds, in order to expand its electrical plants and develop a mine. Close to an on-balance sheet securitization, this operation certainly confirms both that interest in this financing remains intact as well as increased financial demands by international creditors when the economic and political context is difficult. It is therefore not certain that the off-balance sheet securitization is positioned, in its current form, as an important means of financing production capacities in the mining sector. Besides issues related to political stability and investor protection, several fundamental elements must be taken into account for such a technique to apply. The size effect is the first of them. Reducing the risk borne by the investor often requires over-collateralization of 3 to 5 for 1, meaning that for 1 euro borrowed on the market 3 to 5 euros of physical assets must be pledged. Given the magnitude of capital required to establish a mine or a processing plant, it is therefore likely that other funding sources must be found. It is also important that the securitized assets are relatively liquid and ideally they benefit from a financial market both to continuously develop in value as well as implement hedging solutions ensuring more stable revenue streams for the investor. The relative predictability of supply and demand factors is just as crucial for the investor. Mineral based commodities do not have all of these features and from this perspective it is thus unsurprising that the use of securitization is much more common in the oil sector than for other commodities. Finance is, however, not a static field, quite the contrary. It is not impossible that other securitized financing methods emerge, like covered bonds, to ensure the financing needs of the mining industry if it strengthens. The quality and stability of the legal and regulatory environment for financing and investing activities are essential for the development of these industries and for all of a country’s companies or sectors of growth. The recent bond issues by major African groups certainly reflect investor interest in companies offering a coherent and fully identified industrial strategy. But above all it shows that regular access to capital markets is a prerequisite for their long-term economic performance. In a highly competitive environment, the ability of the Casablanca stock exchange to gain depth and of "Casa city finance" to innovate to establish itself as an international financial center should now be the subject of consideration.