The roller-coaster ride of Chinese commodity markets

To no-one’s surprise, the Chinese equity markets have recently plummeted, putting an end to a tremendous increase over the past year and more. Indeed, both the Shanghai and the Shenzhen SE composite indexes dropped by respectively 35pc and 52pc within a month from their six-year high hit at the beginning of June 2015 (graph 1). It is no secret that history often repeats itself, especially where financial markets are concerned and this episode is no exception to the rule. The upward trend that started in July 2014 can be explained by more than acceptable macroeconomic results but also by the speculative fad of Chinese citizens for stock exchange investment. The number of new brokerage accounts for trading purposes moved from an average of 181,000 per week in 2014 to 1.5 million in 2015 and this infatuation is such that there is now a slang word in Chinese for speculation: “Chaogu”. This hasn’t sprung out of the blue though, and there is no escaping the fact that the Chinese government has much to do with this roller-coaster ride unseen since the dot-com speculative bubble. As always, the momentum began with a monetary stimulus program initiated in the wake of the 2008 financial crisis. Lowered interest rates and ample liquidity pushed mom and pop investors lured by promises of high profit to jump into the stock market with the blessing of the government: the wild ride up has indeed been a financial bonanza for the economy, allowing for example state-owned enterprises (SOE) to sell highly valuated shares to repay their debt.

Graph 1: Chinese stock index dynamics (Jan 2014- July 15)

Source : Datastream

The willingness to put financial markets at the very heart of the Chinese growth strategy isn’t confined to stock markets as it also concerns commodity exchanges. In just a few years, the Shanghai Futures Exchange (SHFE), the Dalian Commodity Exchange (DCE) and, to a lesser extent, the Zhengzhou Commodity Exchange (ZCE) have proved to be front line actors in world financial markets that can fully compete with historical marketplaces such as Chicago, New York or London. As far as commodity futures are concerned, the SHFE is the world’s fourth biggest market in terms of notional turnover (graph 2) and the first when the number of contracts traded is considered.

Graph 2: World commodity exchanges (Monthly notional turnover on commodity futures, USD, 01/2015)

Source: World federation of exchanges

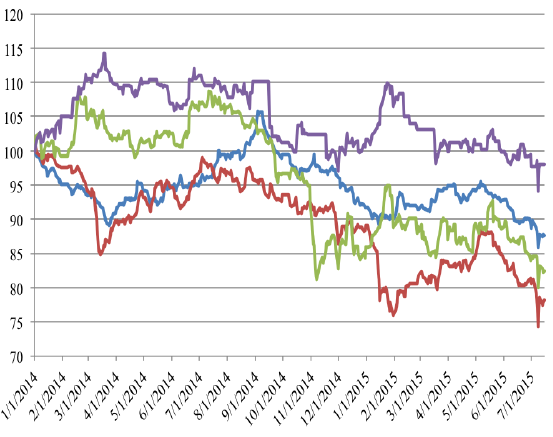

The growth of Dalian and Shanghai is remarkable with an impressive increase in their activities in commodity futures of respectively 232 pc and 380 pc over the past six years (graph 3). In light of this, one question is worth asking: to what extent is Chinese commodity market activity driven by speculation purposes rather than hedging strategies? In other words, could these markets, especially those for base and precious metals, suffer the same mis-fortune as the stock market? This question may sound surprising for there is, for sure, no speculative euphoria on commodity markets in 2015, rather the opposite since the end of the so-called “super-cycle”. However, financial instability is not necessary a matter of “manias, panic and crashes” but also potential excessive volatility (graph 4).

Graph 3: Chinese commodity exchanges turnover (Notional turnover on commodity futures, ‘000.000 USD, 01/2015)

Source: World federation of exchanges

Answering it would require an extensive econometric analysis that is far beyond the scope of this article. Besides, the impact of speculation, namely index trading, on commodity price dynamics has been extensively studied in the recent academic literature2 without a definitive conclusion as yet. However, several points have to be brought forward. First, it is in the Chinese economic interest to fully support the development of their commodity exchanges. Indeed, we should not forget that those markets not only provide hedging instruments to producers, physical traders and end-users, but also encourage the emergence of price references, which could affect the entire international trade system. There are for example only two internationally recognized prices for cocoa: London and New York. It is fully legitimate for China to ensure that its ambitions in this area can be realized. Second, it is worth noting that the size of a future contract in China is usually much lower than in the US or European market.

The size of the copper futures contract is for example 5 tons on the SHFE but five times more at the London Metal Exchange, the historical world marketplace for base metals. Similarly, the silver futures contract is 15 kilograms in Shanghai and 5,000 troy ounce in Chicago, i.e. around 150 kilograms. This doesn’t necessarily mean that the Chinese futures markets are more speculative than others, but they seem more retail-oriented and as a consequence do have the potential to become so. This is even truer for metals that are historically viewed in China as an interesting investment support.

Graph 4: SHFE commodity price indexes (Jan 2014- Jul 15, Base date: 01/01/14)

Source: Datastream

As awkward as it may seem, speculation isn’t a problem as such when kept within acceptable bounds. Besides, if we recall the Dojima rice market experience in the early 18th century or the grain markets regulation in the US at the beginning of the 20th century, there is no denying that governments have always adopted an ambiguous posture towards trading: tolerating or promoting it when price support was needed, and curbing it otherwise. For several years, the Chinese authorities have been going down this path. In 2010, the government decided to clamp down on speculation and both margin requirements and daily price limits were increased on the SHFE. As a consequence, commodity futures trading tumbled 30 pc in the first semester of 2011. This is no longer so in the current bearish market environment. Nonetheless, the recent stock crash may cast doubts on the ability of regulators to engage this subtle doubled-edge strategy. Yet, the very promising future of the Chinese commodity markets will be closely tied to the international role of the Yuan, but also to the ability of regulators to perform this delicate balancing-act that not only favours speculation while limiting noise trading, but also ensures that market participants from national and international commodity industries find the appropriate hedging tools they need. At stake here is the credibility of the Chinese commodity markets.