Multilateralism: what is the political (geo) resonance for steel?

While energy products are clearly at the heart of geopolitical relations, other commodities should be taken into account to explain certain changes in the international economic and political environment. This is the case for steel since the 19th century. What about today? In a context of sluggish domestic demand, the considerable expansion of Chinese production and exports weigh heavily on the health of steelmakers, which are "historic" producers. Anti-dumping measures have thus been adopted in the United States, Europe and Morocco with the aim of restoring the competitiveness of local industries in national markets. It is up to the appropriate authorities to assess the legitimacy of such measures, but it is important to note the importance of the political stakes in this field, both nationally and internationally.

A diffuse phenomenon, long forgotten but now of global scope, protectionism is a temptation to many political leaders. Whether it is circumstantial rhetoric or a veritable ideological rupture, this illustrates, if it were still necessary, that economic arguments do not always prevail over political ideas. What is interesting to analyze, beyond the characteristics of a complex phenomenon in essence, are the origins of evolution of this political thought. Thus, among the many variables that can explain it, recent developments in the commodity market cannot be excluded. The argument is hardly new because historically nothing seems to be more at the crossroads of economics, politics and geopolitics than natural resources. In this area, oil and gas have legitimately been the subject of numerous analysis. From the export embargo on the Soviet Union decided by Jimmy Carter in early 1980, wheat has asserted itself as the key agricultural product to exemplify the reality of certain interstate relations. Except for gold or rare earth, most minerals and metals seem to escape this logic, while their political weight cannot be neglected. One area for reflection: the combination of a very strong inequality in the geographical distribution of essential mineral resources and a demand for them, which is mostly global, provides the conditions for (inter) dependence between importers and exporters whose roots are not solely economic. Thus, from 2009 onwards, the strengthening of China’s positioning, as well as that of India or Russia in the raw materials sector in Brazil, Argentina, Ecuador or Venezuela could, in part, be explained by the political shift that these countries have experienced and their willingness to free themselves from their North American neighbors and the famous "Monroe Doctrine."1 The political argument concerning the investment and exchange strategies implemented in the raw materials sector is also probably valid for the French mining policy in New Caledonia or, among so many examples, for lithium.

With this perspective, it is interesting to look at the impact of the development of steel markets in order to understand the reality of discourse aimed at justifying the return to different forms of protectionism. These are indeed one of the important meso-economic variables necessary to attempt to analyze the reality of the political tensions between China and, to a lesser extent, Russia and the rest of the world. Does this mean that the steel market today has a geopolitical dimension? Probably not, but the answer nevertheless calls for caution. Recall that the geopolitical aspect of steel in history, both ancient and modern, is clear. Whether it be the steel produced in Toledo and Damascus during the Middle Ages, or in Germany or Sweden two centuries later, this metal was an indispensable element of the power of nations. In the aftermath of World War II, did France not suggest that the Ruhr should become an international state, with its own currency, whose steel production would be divided among European countries? And although this project never came to fruition in this form,2 the process of European regional integration was partly based on steel for the creation of the Economic Community of Coal and Steel (ECSC) in 1952. History evolves, of course, and steel today probably does not have the same strategic aspect, due to its industrial uses sometimes different from what they were at the beginning of the 20th century and because of competition with aluminum. Its political resonance is nevertheless important, as is its impact on the quality of international trade relations. A geography of steel does indeed exist (Florida and Kenney, 1992) and, with it, a strong political resonance. Overwhelming Chinese competition and the employment aspect of the steel industry are combined to explain the recent tensions between producer countries and the consequent adoption of important anti-dumping measures by Europe, United States and Morocco. From this perspective, these two aspects may partially explain the success of the political speeches advocating a return to protectionism and, indirectly, the results of major elections, first and foremost those of the President-elect of the United States, Donald Trump. The rust belt states (Pennsylvania, West Virginia, Ohio, Indiana, Michigan, Illinois, Iowa and Wisconsin) largely voted in favor of the Republican candidate, following a long decline in the manufacturing industries since the 1970s.

The contrasted reality of the steel markets

To understand the political importance of steel markets, it is important to recall two fundamental characteristics of their trajectories over the past decades. World steel production has risen sharply since the mid-20th century, from 172 million tons in 1943 to 1.6 billion tons in 2013, according to USGS data, an increase of more than 840% (Figure 1). The need to satisfy demand from emerging countries, including China and India, is at the origin of this very strong growth over the past two decades. Through the building and construction industry, the rise of these economies resulted in a sharp increase in national demand for steel and, consequently, a considerable effort to satisfy it locally.

Figure 1: World crude steel production and prices (USD / ton, current and constant, and in billions)

.png)

Source: US Geological Survey

The growing importance of emerging Asian producers, the second fundamental feature of market developments, is indeed clear. During 2006-2015 period alone, crude steel production in China rose from 421 million tons to 803 million tons, an increase of over 90% in under 10 years (Figure 2). During this same period, it fell sharply for many other producing countries: -19.6% in the United States, and -9.5% in Japan. China's dominance is clear in this area: throughout the course of October 2016, China accounted for 50.1% of the supply (68.5 million tons), while Japan's production, ranked second globally, accounted for only 6.6%. This dynamic is not specific to steel and applies to several other raw materials, with aluminum being in the forefront.

Figure 2: Evolution of steel production by country (1996-2015, Millions of tons)

.png)

Source: Worldsteel

The Chinese supremacy expresses itself differently when productive enterprises are examined. ArcelorMittal is indeed the world leader in this industry, with 97 million tons produced in 2015, leaving the Chinese conglomerate Hesteel Group (known as Hebei before 2016) in second place, far behind with 47.75 million tons during the same year. Among the world's top ten producers, five are nevertheless Chinese (Figure 3, in blue), representing a cumulative supply of 143 million tons, equal to about 8.8% of global production in 2015. The consolidation effort is in process, as Baosteel absorbed WISG (Wuhan Iron and Steel Group) to become China Baowu Steel.

Figure 3: Production of the top 10 global steelmakers (Millions of tons, 2015)

.png)

Source: Worldsteel

However, production is not the same as exporting, and China’s dominant position would have had little impact on the international political and economic spheres if it had not been explained in recent years by a decrease in domestic demand and, consequently, by an increase in exports. Despite a commitment to reduce production capacity by 45 million tons in 2016 and from 100 to 150 million tons within 5 years,3 the supply surplus on the Chinese domestic market seems to have been managed primarily by an aggressive export policy, for which the other producing countries have paid the price. While China consumed 705 million tons of steel in 2015 (compared to 740.28 in 2014 and 765.75 in 2013), its exports of steel products in finished or semi-finished form increased between 2013 and 2016, growing from 61.54 million tons in 2013 to 111.56 million tons in 2015. Chinese consumption decreased by 1.9% between January and July, according to China Iron and Steel Association (CISA) data. Exports grew by 5.8% compared to July 2015. An immediate consequence was a drop in steel prices in 2015 and with it the price of the inputs needed to manufacture it, Including iron ore, coking coal, and manganese. Another major consequence is the progressive imposition of anti-dumping protectionist measures by many producer countries with the objective of defending local industries. For example, the European Commission decided on October 7, 2016 to impose a provisional duty on Chinese imports from 13.2% to 22.6% (depending on the producer) on hot-rolled flat products, iron, non-alloy steels or other alloy steels, and between 65.1% and 73.7% for certain heavy sheets of non-alloy steels or other alloy steels. This is part of an arsenal of 37 anti-dumping and anti-subsidy measures on steel products adopted by the European Commission, 15 of which are on Chinese products.

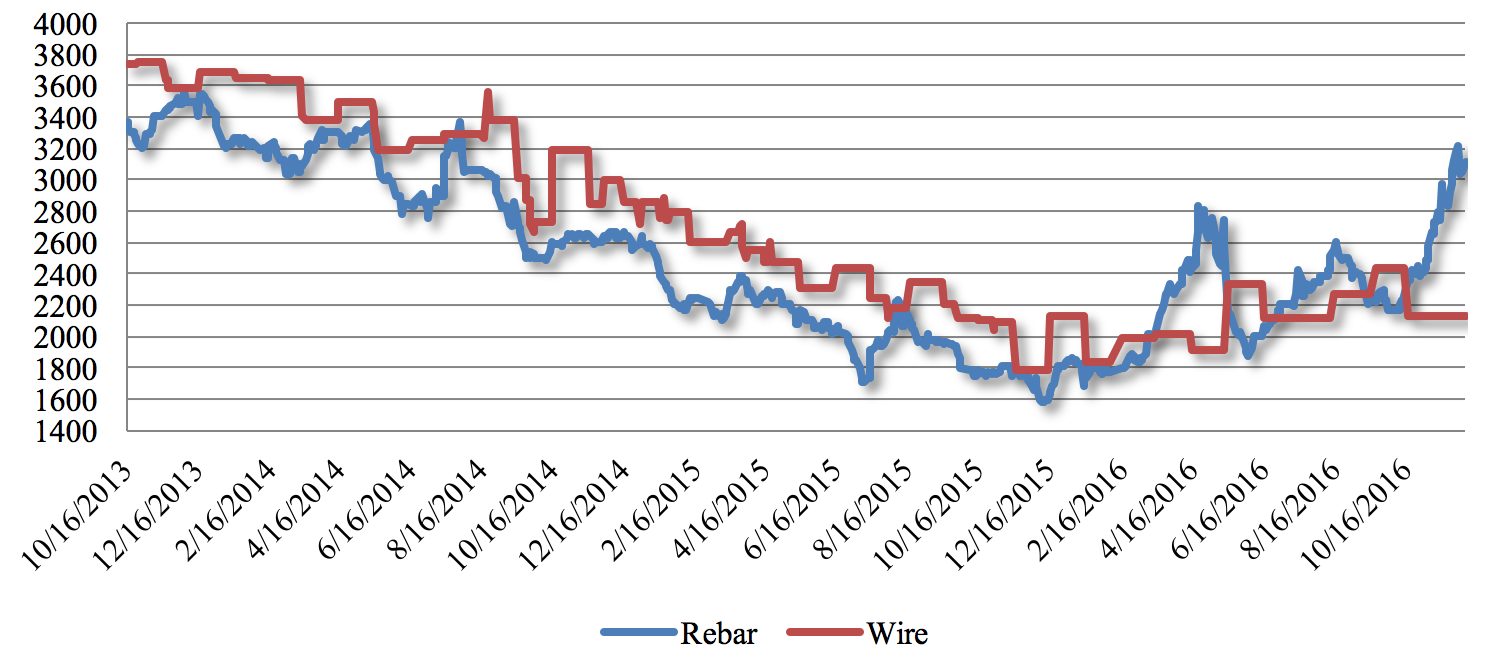

Figure 4: Changes in steel prices on the Shanghai Futures Exchange (SHFE) (CNY per ton)

Source: SHFE, www.quandl.com

The tariff barriers for Chinese exports are in fact international: some cases that attest are Japan, which has measures similar to those adopted in Europe, as well as the case of South Korea, Brazil or Morocco. If this situation seems the same in the United States, the extent of the measures adopted differs quite widely from the European or Japanese case. In the U.S., a 522% tax is now imposed on imports of cold-rolled steel from China. These protection measures of unprecedented intensity originated with American producers effective lobbying, as they had advocated them for several years already. The reason: Chinese exports suspected of receiving State aid, direct or indirect, which artificially lower production costs and thus exert unfair competition. The problem is not unprecedented, and the latest measures adopted are only an extension of those adopted over the years. For example, the Bush administration introduced a tariff on steel imports in 2002, after the Asian crisis of the late 1990s pushed Chinese companies to sell below their production costs. The World Trade Organization (WTO) had lobbied for repeal, which was granted, but it is unlikely that this will happen again.

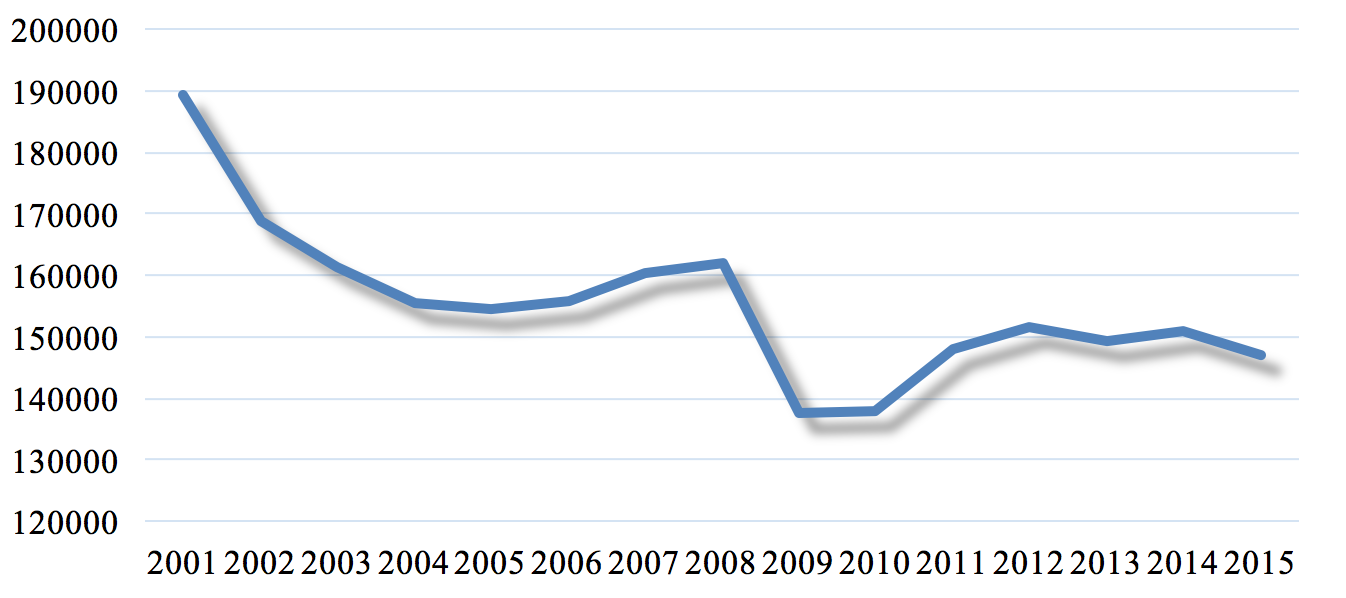

How then can we understand, beyond the direct financial stakes, the important political tension that fuels the Chinese strategy of massive exports? There are two closely related answers to this question. The first one, already mentioned, is due to the employment aspect of the steel sector and, in a consistently difficult economic context, to the political significance it fuels. The media response in France concerning the closure of the Florange blast furnaces attests to this reality. The same goes for the United States, which has witnessed Donald Trump defend national industries, of which is within the rust belt, one of his campaign themes. The nomination of Wilbur Ross as Secretary of Commerce, known for his investment in the US steel sector and for being an instigator of numerous restructurings, as well as Dan DiMicco, the former CEO of Nucor, the 14th largest steelmaker in the world, suggests an even more radical approach. Yet it is impossible to fully justify the political tensions presented by world steel market’s social reality. Some 150,000 people currently work in the US iron and steel industry, far from the 600,000 workers in the mid-1970s. Recall that in 1959 nearly half a million workers in the American steel industry went on strike to the point of threatening national economic growth and forcing President Eisenhower to invoke the Taft Hartley Act to put an end to it.

Figure 5: Employment trends in the US steel sector4

Source: US Bureau of Labor Statistics

Nothing of the kind exists today and here is another reason: steel has a symbolic meaning, that of a sector which catalyzed the United States and Europe, now bypassed by Chinese companies. However, that political discourse positions collective consciousness as a key element in the balance of power observed on the world markets: to the point of sometimes overestimating the economic importance of this sector. The situation of the iron and steel industry is not very different from that of the aluminum industry and the political scope of steel is therefore only valid in terms of what it reveals: a development in international trade relations which, whether we like it or not, ensures Chinese domination in many industries, precisely where Western countries have not displayed the ambitions necessary for their maintenance, which they regret today.