Long-term finance and BNDES tapering in Brazil

One major policy issue in Brazil is how to boost productivity, while following a path of fiscal consolidation that will take at least a decade to bring the public-debt-to-GDP ratio back to 2000 levels (Canuto, 2016a). The productivity-boosting agenda includes not only the implementation of a full range of structural reforms, but also recovering and upgrading the national infrastructure and other long-term investments. Given that fiscal consolidation has already been leading to less transfer of funds—in fact, the reversal—from the Treasury to the National Economic and Social Development Bank (BNDES) and a consequent downsizing of the latter’s operations, pursuing the double objective of raising productivity and adjusting fiscal accounts will require an expansion of alternative sources of long-term asset finance.

As we illustrate here, developing alternatives of long-term funding will be equivalent to building a new private-to-private financial structure. While the public sector-funded BNDES has been the main source of long-term finance to the private sector, the asset management industry currently holds public-sector bonds as more than 70% of its portfolio. Switching to a private-to-private financial structure will therefore be a necessary component of the productivity-boosting-cum-fiscal-adjustment policy course.

A three-pronged policy agenda is hereby suggested. First, real interest rates need to decline, while over time public debt must shrink as the major absorber of private financial savings. Second, structural reforms aimed at reducing risks that are idiosyncratic to Brazil’s long-term private investments must be implemented. Finally, the BNDES portfolio tapering may be accompanied by a reorientation from crowding-out to crowding-in the private sector in supplying long-term finance.

Fiscal consolidation and falling real interest rates

Government occupies a peculiar position in Brazil’s long-term finance. On one side, public debt is a major absorber of the private sector demand for long-term assets. The asset management industry has over 70% of assets allocated to government bonds, instead of providing funding to the private sector (Chart 1). Corporate bonds represent less than 3% of its assets under management, while equities only 8.5%. In this sense, government bonds absorb a vast share of domestic savings and financial wealth.

On the other side, BNDES and other public sector-funded banks constitute the main source of long-term private sector investment finance. Such prominence rose in the recent past, as the BNDES portfolio increased from R$ 242.5 billion to R$ 677.6 billion over 2007-15, having fallen since then to R$ 530.4 billion last March (at constant prices of December, 2016).

Chart 1 – Brazilian Asset Management Industry: Assets Under Management (Jan/2017)

Bloating the BNDES balance sheet was part of the aggressive expansionary fiscal policy pursued by the Brazilian government in 2009-2014 (Canuto, 2016b). After making a countercyclical fiscal move in response to the first round of spillovers from the global financial crisis, which included the use of BNDES to supply subsidized credit, among other fiscal and quasi-fiscal stimuli, the government kept the expansionary stance even as the economy started to show signs of overheating (Canuto, Cavallari and Reis, 2013a) (Canuto, Cavallari and Reis, 2013b). Structural factors were then already leading to low private investments and slower sustainable growth trends, while the government attempted a subsidy-led shortcut to a new growth path, the result of which was mainly fiscal deterioration (Canuto, 2016c). Falling tax revenues and rising public spending during the deep GDP downfall from mid-2014 onwards led to a deterioration of the public debt dynamics.

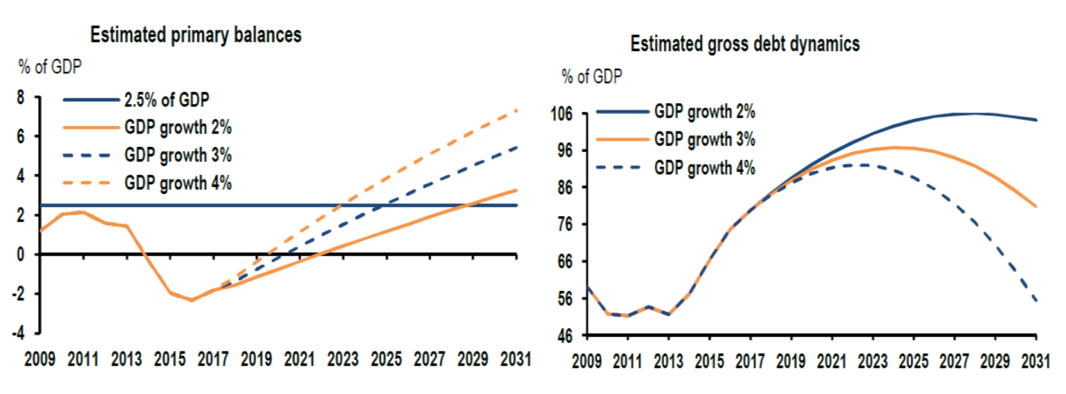

A first pre-condition for replacing the current pattern of long-term finance with rising private-to-private long-term finance flows will be a combination of lower absorption of private financial savings by the public debt and lower real interest rates paid by public bonds. Even with the constitutional amendment establishing a public spending cap in real terms approved by Congress last year, and assuming a range of levels for a few parameters, including potential GDP growth, debt-to-GDP ratios will start to decline only after several years ahead and not before topping around 90% (Chart 2) (Canuto, 2016a). In fact, Brazil’s fiscal deficit was 9.2% of GDP in the 12 months up to last March.

Chart 2 – Spending cap, public sector primary balances and debt dynamics

Return rates on private assets must compete with—and must offer a premium above—real interest rates paid by public bonds, which have been abnormally high in Brazil. Currently short-term real interest rates paid by the government debt have hovered around 5% a year.

One major reason behind Brazil’s high floors of domestic interest rates lies in the country’s risk premium being well above the average of other emerging markets, which is transmitted to domestic markets. The negative feedback loop between the fiscal trajectory and risk premium can only be closed through a sustained fiscal adjustment.

In addition to the risk premium, some factors have curtailed the effectiveness of monetary policy in the recent past, leading to a relation between inflation and interest rates with the latter at levels higher than would have been in the absence of those factors. For example, the effects of monetary policy were constrained by a sizable earmarked credit outstanding. These operations suffer near zero influence from policy interest rates. In other words, regulations based on a wide range of rationalities determine how the banking sector allocates a share of available resources with a distant connection to the monetary policy. While monetary policy had to fight high inflation through higher policy rates, credit supply from BNDES and other earmarked lines kept increasing. Indeed, data suggest that increasing BNDES lending-to-GDP ratio led policy real interest rates to be higher over 2004-14 than what would necessarily be otherwise (de Bolle, 2015).

That quasi-autonomous—and often uncoordinated—earmarked credit supply source had an important role in the Brazilian credit boom after the global crisis, while non-earmarked banking credit was relatively stable and policy rates kept high (Chart 3) (Canuto, 2017a). The government-driven credit expansion had nonetheless an insignificant effect on investment for publicly traded firms over 2004-12 (Bonomo et al, 2015). Moreover, a distortionary allocation resulted from such policy guidance, as it was mostly driven by rent-seeking behavior and adverse selection.

Chart 3 – Brazil: Outstanding Credit to Non-Financial Sector (% of GDP)

A second factor reducing monetary policy effectiveness has been a high inflation inertia constraining disinflation, as it has been highlighted in many occasions by the Brazilian Central Bank (for example, BCB, 2015). Propagation of inflation after price shocks became harder to contain as (backward looking) informal indexation was stronger than (forward looking) expectations affected by monetary policy.

Finally, fiscal and quasi-fiscal policies have been expansionary for the most part in recent years, taking an opposite direction to monetary policy during tightening periods. After the economic recovery from the global financial crisis, the government adopted successive rounds of economic stimuli, including sizable packages of tax exemptions, local-content policies and capital injections to public banks, among others (Canuto, 2016a)(Canuto, 2016b)(Canuto, 2016c). Central government primary expenditures rose to above 20% of GDP by the end of 2016—Chart 4—or to 34% of GDP when added with other government levels.

Recently announced fiscal reforms point to a change of path regarding the government crowding-out of the private sector. As noted, a constitutional cap has been approved to limit federal government expenditures in real terms, and ultimately to rebuild fiscal buffers. Per estimations from the Ministry of Finance, federal government primary expenditures will be reduced to around 16% of GDP over the next 10 years. Additional structural reforms and government expenditure reviews will be key to obeying this constitutional rule—particularly a pension reform (Canuto, 2017b).

Chart 4 – Brazil: Federal Primary Expenditures

Source: Brazilian Ministry of Finance

Monetary policy has in turn become more effective as deterrents have wound down, as earmarked credit has shrunk and higher policy credibility has increased the weight of expectations relative to indexation and inertia. In addition, fiscal and monetary policies ceased to be at log heads. While inflation expectations have moved down toward the 4.5% target, a substantive monetary policy easing has been in place since last year.

Level playing field and lower wedges between public and private interest rates

On top of interest rates paid by public debt, private assets must offer a premium to become attractive to investors. Such wedges or spreads along the forward curve reflect credit and liquidity risks that are intrinsic to private assets relative to public ones. Developing a private-to-private asset structure will require a set of “horizontal microeconomic reforms” addressing those private-sector risks and improving the risk-return profile of Brazilian private assets.

Brazilian business environment pitfalls are well acknowledged as sources of resource waste and productivity loss, at both country- and firm-levels (Canuto, 2016a). Some of them affect negatively the risk-return profile from the standpoint of financial asset holders. This is the case, for example, of time and value losses derived from inefficient processes of resolution of contractual conflicts and insolvency situations.

Per the World Bank Doing Business 2017, while a bankruptcy resolution takes approximately 4 years in Brazil, an equivalent procedure consumes on average 2.9 years in Latin America and Caribbean and 1.7 year in OECD high-income countries. Brazil’s recovery rate in such process is 15.8 cents on the dollar, while it is 31 cents in Latin America and Caribbean and 73 cents in OECD high-income countries. The negative implications from this weakness are straight for long-term financing and for firm-level dynamics. Much benefit could be reaped from upgrading the domestic insolvency framework.

Policymakers may also contribute by developing well-designed financial instruments. Clear and transparent legal frameworks help reducing credit spreads, being especially relevant for long-term financial instruments. Excessive litigation could result from dubious legislation with a direct impact on underwriting volumes and prices, such as through legal disputes over bond seniority or collateral segregation. One example of how innovations may help in that regard can be found in the covered bond for real estate loans (Letra Imobiliaria Garantida, LIG) created in 2014. This framework provides a clear segregation of mortgage loans designated as collateral in the financial institution’s balance sheet, also offering a mandate for the fiduciary agent to act.

Fostering the adoption of higher standards of corporate governance would also level the playing field. The “Car Wash” corruption probe has shown how some influential players developed a sui generis access to politicians and policymakers and how many negative spillovers came from corruption, from unfair competition to criminal liabilities. Those illicit practices already imposed huge losses to minority shareholders and bond holders, who had trusted externally audited balance sheets and supervisory authorities, and were not aware of such behaviors. Unfortunately, this poor legacy may weigh negatively for some time on capital market development.

Notwithstanding that legacy, the currently critical conjuncture is a great opportunity to spread high governance standards to promote both “inclusive economic and political institutions”, as shown by previous experiences in history (Acemoglu and Robinson, 2012). Translating these historical insights to policy making and best governance remains a challenge that must consider a broader policy approach (World Bank, 2017b). On the other hand, the ongoing corruption probe has already sparked what has been called a revolution in transparency and compliance of Brazilian companies.

Another related step forward would be to incentivize firms to access capital markets, especially through equity markets. Not only because companies need long-term capital to grow, but also because investors demand better corporate governance practices to provide resources to original owners. Company-level data show that half of initial public offerings (IPO) into global markets after 2008 came from emerging economies - with a high share corresponding to Chinese firms (Chart 5). The majority of firms that accessed corporate bond markets had been listed, despite some concerns related to regulatory and compliance costs (OECD, 2015).

Chart 5: Initial Public Offerings of non-financial companies in Emerging Markets

Source: OECD, 2015

Such dynamics were much weaker in Brazil. While a fast-track program was created in 2014 to incentivize small and medium enterprises (SME) to access equity markets, the poor macroeconomic performance has been an important constraint to market access. That happened despite a close engagement with market participants maintained by the main Brazilian stock exchange (B3) in promoting higher governance standards. Keeping the promotion of formal corporate governance adherence should remain paramount in the policymakers’ agenda.

Other possible measures to foster long-term financing and financial intermediation are those that may reduce information asymmetry. A reform to the collateral registry framework has recently been implemented in Brazil. The new centralized system will make it harder to use the same collateral to multiple credit operations. In the old system, the collateral information was recorded in one registry, without being shared to other registries, making it very costly to double check every registry. Another reform should aim to improve the current credit bureau, where any client must still authorize each bank to use its information in the credit history database. Other legal issues relate to prevailing limits to the use of utility bills to strengthen credit score assessments.

Finally, policymakers could help to coordinate private mechanisms for risk mitigation by providing clear and stable regulatory frameworks. One interesting mitigation initiative in Brazil comes from the credit guarantee fund (Fundo Garantidor de Creditos, FGC). In such arrangement, the banking sector capitalized a fund to guarantee banking clients to recover deposits or credits from a bank up to a certain capital amount in case of official intervention or bankruptcy. It has helped banks to fund themselves at lower interest rates in the market, something especially important for small and medium banks. Other private guarantee mechanisms could be designed to mitigate risks focusing on long-term finance.

Unwinding earmarked credit and re-designing BNDES operations to prioritize private-sector mobilization

The worst economic recession that Brazil has witnessed in the last 100 years took its toll on credit markets, also impacted by a corrective deleveraging (Canuto, 2017a). Since end-2015, credit-to-GDP ratio dropped 5.1% age points to 48.6 last March. However, the earmarked credit remains at 50% of the overall credit outstanding. While earmarked credit costs on average one-fourth of market credit, the fiscal burden of such operations reached 1.5% of GDP or 3.7% of government revenues in 2015 (Pazarbasioglu et al, 2017). Those expenses came especially from BNDES’ footprint, which reached just over 70% of this modality in 2015, or close to one-third of overall domestic credit outstanding.

Promoting long-term financing is not limited to unwinding and refocusing BNDES operations. The other 30% of earmarked credit need to be dealt with to foster development of capital markets. Although less relevant in the overall economy, these operations are significant for sub-sectors and specific markets. If banks must lend in certain sectors by regulation, such as real estate or agriculture, they may countervail the development of new financial instruments, especially if interest rates are lower than those imposed by market conditions. In fact, these regulations interfere in the competition among private funding sources, such as the recently created LIG.

Firm-level data suggest that BNDES did not systematically bail out failing firms, nor did it affect performance or investment over 2002-09. On the other hand, between 1995 and 2002, there is some evidence of a positive impact from BNDES engagement on firms facing binding credit constraints (Lazzarini et al, 2011). Still, a common finding of these studies is that a lower cost of debt for recipients was the major effect, challenging the argument that the broad BNDES footprint had a major social impact.

National development banks (NDBs) boosted their lending in the aftermath of the global financial crisis, as a part of the toolkit of countercyclical policies in many countries. Brazil’s BNDES was not an exception to this conduct (Chart 6). During spikes of risk aversion, private sources of financing usually become more scarce, especially in the case of long term. By mitigating credit rationing and promoting socially desirable projects, longer-term investments may, even if partially, keep being implemented with well-known positive spillovers to the overall economic dynamism. The one-billion-dollar question is: can national development banks efficiently balance costs and benefits? What could they do to maximize value for money (Canuto, 2014) (Pazarbasioglu, 2017)?

Chart 6 - BNDES: annual disbursement by sector

Source: BNDES

During normal times, NDBs may add maximum value by focusing on well-defined core functions. Surely, business models of NDBs, private banks, pension funds and asset managers are very different—from mandates to funding structures, from asset allocations to performance frameworks. In this sense, a more diversified financial sector has its advantages, such as lowering systemic risks. This fact does not mean that they should compete as funding providers in all markets. On the contrary, they must be complementary to create diversification and to crowd-in private capital.

Fiscal space has eroded in most of emerging markets and developing economies after the global crisis, including in Brazil. In parallel, governments have questioned themselves on how to address big gaps in long-term financing, while new rounds of capitalization stay constrained for state-owned banks. Some principles for NDB operations have been agreed in international forums on crowding-in private sector financing, such as being economically feasible, fiscally and commercially sustainable, risk-reward balanced, transparent, cost effective, and compliant to social and environmental safeguards (G20, 2017). In the case of BNDES, how could it provide the best value for public money?

First, the focus on mobilizing private capital should become the main driver of BNDES. This new focus gains relevance as the bank’s portfolio is bounded to taper toward smaller sizes and less-subsidized credit lines. The financial additionality may come from broadening the pool of private investors for each deal, for example in syndications or other forms of co-financing. It may also come from offering a firm bid in terms of financing, increasing chances of raising money from other investors. If BNDES is to provide money only because it is a less costly funding to a certain investment, then private capital should be preferred.

Capital market development may benefit most from a true complementary approach, which could even establish tighter ceilings for BNDES participation on each project’s financing envelope. Currently, the maximum participation of BNDES credit in a single project or capital good is 80%. While BNDES management has already begun its process of tapering, BNDES funding ratio in infrastructure sector has already dropped from 73% to 62% along 2015 and 2016 (Exame, 2017).

Occasionally, policymakers refer to the lack of depth and breadth in capital markets to provide long-term financing as a reason for a strong footprint from NDBs. In the Brazilian case, this justification has less traction when one considers that the annual underwriting volume of corporate bonds and equities in domestic markets reached around R$ 110 billion on average over the last 5 years (measured in 2016 prices), despite the hostile macroeconomic environment and the highly-subsidized participation level that BNDES had in the previous two governments. In many occasions, cheaper-than-market funding was provided to generate less expensive services, such as lower road tolls or tariffs. Under BNDES’ recent tapering policy, corporate bond participation in infrastructure sector—in projects that BNDES co-financed—increased from 11% to 15% along 2015 and 2016 (Exame, 2017).

From the perspective of fostering long-term financing and financial intermediation, these broader reforms should aim to reduce systematic risks for all private investments. By leveling the playing field to all businesses and in all sectors, competition leads to a better allocation of resources. Some years ago, evidence had already suggested that politically-connected firms—which made campaign donations to winner candidates—were more able to receive BNDES support (Lazzarini et al, 2011). In other words, policymakers should further focus on creating an investment-friendly environment.

Brazil’s government recently took the decision of phasing out the old BNDES loan-pricing method, which was very discretionary, and adopted a new rule-based framework. In this new policy, real interest rates on loans will be linked to medium-term government bonds. Positive spillovers are expected in terms of capital market strengthening, as more predictability has been added regarding competition among funding providers.

Second, BNDES may further develop its capacity to provide design additionality. In other words, the development bank could improve the project bankability in the preparation phase. By having a vast experience in assessing projects for decades, BNDES may provide feedback to investors on how to adopt best practices, including about complex regulatory safeguards and high corporate governance adherence. The lack of ready-to-implement projects and a deficient project preparation have recurrently been mentioned as bottlenecks to investment in Brazil.

In 2008, the government created a company (Estruturadora Brasileira de Projetos, EBP) to develop projects in infrastructure and social sectors for concessions and public-private partnerships (PPP), in which BNDES is a shareholder along with other financial institutions. Ideally, a project depository should be made available for infrastructure and social sectors, to be possibly implemented through concessions or PPPs. A better synergy between private and public sectors, including with the leadership of BNDES, on design additionality would help to develop capital markets and lift investments.

Third, BNDES can further contribute to the evaluation of development impact of projects, especially for concessions and PPPs. Such evaluation additionality could inform policymakers and market participants in terms of prioritization, and private-sector awareness to the prospective investment pipeline. This advantage would be especially important for complex projects, where intricate engineering planning is required. Another benefit from such a contribution would be to increase accountability and transparency on BNDES’ activities, reducing chances of political interference and encouraging a best-value-for-money approach.

Fourth, BNDES has a value in providing a demonstration additionality. BNDES could help develop innovative solutions that could later be turned into plain vanilla operations. Projects at frontier areas may benefit most from a BNDES participation, as its breadth for running due-diligences is higher than any usual investor.

Finally, BNDES may further work on risk-mitigation initiatives, or risk-sharing, aiming to improve the private sector risk-return tradeoff for certain priority investments. Financial mitigations could rely on guarantee funds or mezzanine instruments, depending on the specificities of sectors or projects. In any case, there is a role to be fulfilled by crowding in private investors that are intrinsically more risk averse. Those investors may be constrained by their mandates, such as being able to invest only in investment grade bonds. In such situations, the only way to access these saving pools would be to provide some guarantee, which may allow at least to raise additional financing by segregating the bulk of risks to other more sophisticated risk-prone investors.

For example, as we noted, the asset management industry is dominated by government bonds, which reflects up to a certain point a low risk appetite by savers. By mitigating or transferring a share of the risks, a wider pool of investors could be tapped for infrastructure or project bonds, including those less risk-averse investors. This does not mean that other risk takers would not keep demanding high-risk and high-return opportunities. It is worth remembering that the infrastructure business usually has a high recovery value during its brownfield phase, which could still attract many moderate-risk savers without much additional mitigation mechanisms.

In a nutshell, lack of positive evidence from the BNDES bloated balance sheet suggests that a more focused approach is desirable, such as lending where long-term credit constraints are binding and positive spillovers are evident. Attenuating long-term credit constraints also calls for crowding-in the private sector. Ensuring positive spillovers would come from a deeper assessment of development impact to pick high-impact projects. Moreover, that would be a way to justify subsidies, even if they are - and will keep - falling. Fiscal adjustment will impose a tapering of the BNDES balance sheet and therefore creates an opportunity to maximize its value added for money.

Bottom-line

Pursuing the double objective of raising productivity and adjusting fiscal accounts in Brazil will demand building a private-to-private structure of long-term finance. The latter must in turn be supported by declining real interest rates and public-sector funding needs, microeconomic reforms, as well as a reorientation of BNDES operations toward crowding private investors into buying private assets.