Free Markets vs.a Producer Price System: Why are Commodity Markets Becoming Financialized?

The price explosion for most commodities between 2007 and mid 2008 positioned the issue of their financialization at the center of concerns in national and international policy spheres. Thus in 2011 the agriculture ministers of the G20 countries agreed to temper speculation in food commodities and, consecutively, to limit price volatility to which it was readily associated. The academic community was also naturally interested in this issue by questioning the origins of this price spike and in particular the role played by speculative activities. Two approaches stood out. Schematically, the first postulates that affirming commodities as a separate asset class should strengthen certain anomalies and in particular foster increased correlations between the prices of commodities having a priori no common dynamics. The second approach looks at the behavior of investment funds and aims to explain the price increase by the increased placement of Exchange-traded funds (ETF), which offer indexed yields on the evolution of these products to those who subscribe.

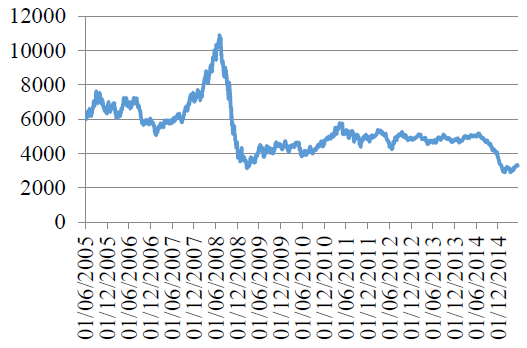

Figure 1: Evolution of the S&P GSCI (06/2005-05/2015)

Source: Data stream

These approaches, offering sometimes contrasting conclusions, call for two closely related points. The concept of financialization is ambivalent in the first place because it reflects both the idea of a growing influence of external stakeholders, be it investors or speculators, within the financial commodity markets, as well as the broader but also prominent idea notion of the increased role played by financial markets in organizing agricultural sectors or those of hard commodities (energy, minerals). Second, most recent empirical studies do not question -or question little- the deep origins of the financialization of the markets. This could be explained by the aim of investment funds to take advantage of the performance and diversification potential that commodities offer in order to optimize the performance of financial portfolios they manage. This approach leaves little doubt. A look at older academic work that still is relevant, however, offers a more fundamental understanding of the elements, based on the organization of sectors.

The existence of a financial market for commodities cannot be disconnected from the economic realities of a sector and often responds to stakeholders’ inability to cooperatively manage the price risk related to the technical and business transformation of a product. It may indeed be assumed internally by negotiating long-term supply contracts for which prices are set annually. Climatic uncertainties affecting agricultural production, power relations -sometimes unbalanced- that can occur in metals sectors, stockholder requirements, logistical constraints, or the importance of counterparty risk are all factors that can limit the use of such a practice. In such a context, the development of a spot market strengthens the market price volatility and reaffirms the role of traders, whose economic function includes managing the resulting risk. For this, implementation of risk management solutions is needed and the flexibility offered by the derivatives markets is often unavoidable. By multiplying the potential counterparties through the clearinghouse, they make it possible to divide the risk over time and space. For example, agricultural commodity exchanges that emerged, in their modern form, in Chicago in the mid-nineteenth century;it was indeed the merchants who were faced with the seasonality of grain supplies who favored the boom.Defining a futures price thus facilitated the negotiation of credit lines to finance the accumulation of stocks. The corollary of this financialization was the development of speculative activities often enabling the imbalances to be corrected between the "physical" operators and therefore to support prices. This was the case for the Dojima rice market, a district of the city of Osaka, which began to function in the early eighteenth century and was thus the first commodity finance market in history. The market allowed the exchange of certificates guaranteeing ownership of warehoused rice, met the needs of brokers willing to exchange this grain without necessarily transporting it, and also the expectations of the seigniorial power of that time. Representing nearly 90% of"Shogun" tax revenues, the rice was indeed of considerable strategic importance and the development of a financial market was one of the means planned to try to curb the downward momentum that had begun in recent years.

A second explanation, which complements the aforementioned one but is specific to the mineral commodities (metals and energy), must be mentioned. Due to the capital intensity of most mining and its relevant start-up barriers, these sectors have historically functioned under a regime called ‘producer price’ in which the operations of production and primary processing are widely integrated and where adjustments are made by quantities. The existing explicit or implicit agreement between producers makes market regulation possible by varying the quantities produced or stocks in case of temporary shock. The price of the raw material market, relatively stable over time, is thus higher than cash costs of major producers and the competitive fringe, but less than the cost of developing new production units by external players in this sector that have a certain number of comparative advantages, particularly energy.

Such producer price systems persisted so long as the super profits from this dominant position allowed the adjustment costs to be absorbed from aggregate demand. Beginning in the late 1970s, the significant increase in these costs was combined with the political will to encourage free competition and explains why the number of sectors operating on this principle decreased considerably in favor of free market systems. Under such an approach, adjustments are no longer based on a change in quantities, but instead on price.

The financial risk that operators must then assume is therefore important, which calls for the development of derivatives markets to manage it (Figure 2). Although the financialization is almost always presented as a consequence of the gradual abandonment of the producer price systems, it is, conversely, possible that the implementation of a financial futures market is also a reason for this development. The launch of a futures contract on aluminum by the London Metal Exchange in 1978 sounded the end of the oligopolistic equilibrium then prevailing by increasing price volatility and ultimately the cost of maintaining a market regulated by volumes.

Figure 2: Dynamics of mineral sector financialization

The rise of free markets was of course accompanied by stabilization attempts for commodity prices under the aegis of international organizations such as those adopted in 1976 by the Fourth United Nations Conference on Trade and Development (UNCTAD), under the framework of multilateral cooperation agreements (Lomé Conventions, International Tin Council) or producer countries associations (Group of Bogotá). Yet, whatever were the privileged mechanisms, these initiatives rarely bore fruit, which lead some economists to suggest a "utopia of stabilization" (Chalmin, 2008). Traditionally aimed to smooth prices and/or protect commodities exporting economies from slumps, these measures have, sooner or later run into many obstacles that led to their gradual abandonment: a cost rapidly becoming unbearable when the fall proved sustainable, heterogeneity in expectations and commitments by partner countries and, consecutively, a political inconstancy to respect them. When these agreements bound several producing countries in an attempt to create a supply cartel, the differences in production costs, yields and logistical or commercial constraints limited not only largely any interest in stabilizing prices, but also favored the behavior of free-riders, leading de facto to an implosion of agreement systems.

This dynamic of commodities market financialization already began several decades ago, but the rise of China's financial markets, such as Dalian, Shanghai and Zhengzhou today makes it completely relevent.

In the world of commodities, as elsewhere, history is not static, nor are the irremediably established power relations and it is likely that the development of futures on the stock markets is needed internationally, one way or another, which will change the appearance of many sectors: the recent history of the iron ore market is a primary example.