The development of the liquefied natural gas spot market: origin and implications

Designated by a common term, commodities are in reality very different from each other, particularly with regard to the nature of commercial contracts uniting stakeholders from the value added chain in question. In this sense, the liquefied natural gas (LNG) market is hardly comparable to those of other fossil fuels. In economics, and in particular in the field of commodities, however, nothing is immutable: the mode of operation and organization of particular markets can change significantly within just a few months. In this regard, history has shown how the introduction of a futures contract had radically changed the face of the market for primary aluminum. The financialization phenomenon is among the major changes that a value added chain can experience. Often defined by speculators increased role in determining prices, it should actually be understood more broadly, that is to say, as the development within a supply chain of an organized financial market where one of the consequences is increased speculation. As rapid as it may be, at the least this financialization imposes that a number of conditions are satisfied. Significant international trade volumes, a search for greater price transparency, the development of a spot market, and in turn, greater price volatility are thus essential criteria for such an evolution to occur.

The notion of a developing spot market reflects the idea that the standard commercial contracts in force in the sector gradually abandon the long-term and fixed price clauses (subject to revision in the case of multi-year contracts) in favor of short-term and “price to be determined” clauses: the price at which the exchange will occur will then intrinsically be determined by market conditions at the time of the transaction. Thus, in the case of an import / export commercial contract for periodic delivery of ore over a one-year period, only the reference prices and the price formula are known at the time of signature. The price formula specifies that the transaction value is equal to the sum of the price of valuable metals contained in the ore (copper for example, as well as silver or gold), minus deductions or penalties for the presence of arsenic or lead. The price of each metal is, meanwhile, the average spot price from the London Metal Exchange (financial market reference for base metals) for each delivery month. With this configuration, the flow of goods is in theory secured (since the quantities exchanged are defined), but prices are not, which has the advantage of reducing the incentive for either party to breach its contractual obligations. We then understand that the higher the price volatility, the greater the fixed price contracts are difficult to enforce. Any significant deviation from the market price compared to the defined fixed price can indeed lead to breach of contract in particular due to the buyer or seller’s likely opportunism. Both being aware of this reality, this type of contract is then gradually abandoned. The resulting need for risk management instruments can consecutively promote the development of a futures market to implement hedging strategies (Figure 1) and whose equilibrium price is intended to establish itself as the trading reference price.

Figure 1: Simplified development dynamics of commodity spot markets

The organization of commodity markets is rarely dichotomous and LNG is a perfect example. In this booming market, three main types of pricing coexist, depending on the geographical area in question: spot, indexed to the price of crude, or indexed to oil prices (or other energy). This indexing can in these cases take different forms: either linear (straight line contract) so that the increase in oil prices translates into a proportional increase in gas prices, or nonlinear in the form of S-curve. Under such pricing, growth in gas prices is lower than that observed for the crude, since its price is below and above threshold values. On an intermediate basis, the price evolution remains the same (Figure 1).

Figure 1: The pricing of long-term LNG contracts

.png)

Source: Ernst & Young (2014)

LNG markets have historically privileged indexed long-term contracts. This is explained in large part by the physical characteristics of the product and the constraints in terms of infrastructure that its

international transport imposes. The significant development costs in this industry, particularly related to the need for liquefaction terminals (export) / gasification (import) and methane terminals that permit the maritime transport of gas, create indeed an interdependence between producers and users and explain the existence of long-term trade relations. Importing countries largely depend on fossil fuels and cannot fully benefit from the pipelines that secure their supplies, while exporters in this long-term relationship have a guarantee of future income that allows them to calmly consider investments in necessary logistics. Crude indexing in turn is explained by the fact that natural gas historically does not have a natural market and was defined primarily as an alternative energy to oil and ultimately to other fossil fuels. Studies such as those of Brown and Yücel (2009) demonstrate that the determining factor of co-movements observed between gas prices in the US and Europe is their dependency on oil prices and not on tradeoffs between the two markets.

Figure 2: LNG import demand (In billions of cubic meters)

Source: Thomson Aikon

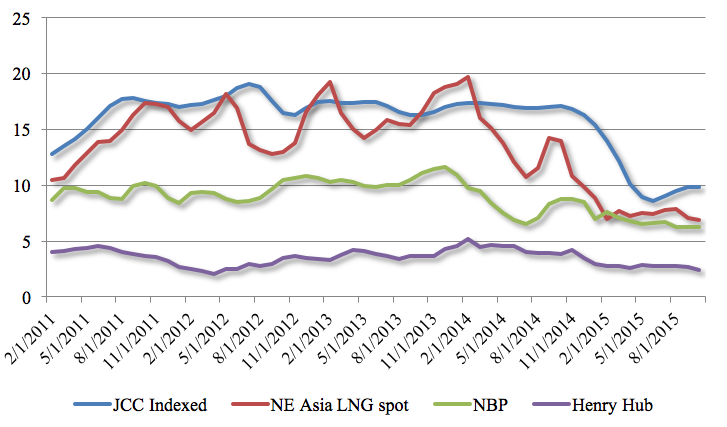

Operating under such a system, the LNG market was in reality never unbalanced insofar as investments in export and production capacity were only implemented when the market opportunities were insured. Fueled by the growth of anticipated long-term demand and by the idea that environmental trade-offs would be made in favor of natural gas in European countries (at the expense of oil and coal) and by some countries’ desire to overcome certain geopolitical constraints linked to the supply by pipelines, prospects of a better future however pushed producers to finance an additional offer for which the price would be based on the spot market, and in particular in the United States. With the improvement of liquefaction technology and amortization of existing structures, the idea was also to compete in certain geographic areas with the natural gas pipeline supply so that the LNG price equates, by trade-off, the price of terrestrial gas once the costs of transportation and gasification are taken into account. Once again, however, things do does not always take place as anticipated. The combination of the shale gas revolution in the US, the rise of "new" producer countries like Australia, a more favorable political environment for renewable energy than natural gas, and slow growth in Europe has indeed created the conditions for an oversupply that has logically resulted in a significant decline in gas prices and a change in the balance of power between suppliers and buyers (Simonneau and Koenig, 2015). The markets in the Asia-Pacific region, historically LNG markets that offer more competitive prices compared than the rest of the world, have reinforced the desires of world producers: deprived of US and European markets, excess LNG supply is now focused in this area. The prices thus fell, particularly in Northeast Asia (Japan, South Korea), where the spot gas price collapsed by nearly 50% between September 2014 and September 2015 (Figure 3). The spot market, disconnected from oil prices, and which was originally the expression of a residual supply and demand, is logically growing stronger, to the detriment of long-term contracts. Freed from the need to secure its supplies and careful to receive the best prices while increasing the flexibility of their trade relations, the countries located in this region indeed play on this paradigm shift to catalyze this fundamental change in pricing practices.

Figure 3: Evolution of hub gas prices (NBP and Henry hubs) and LNG (US $ per MMBtu)

Source: Thomson Aïkon

The financialization of the LNG market, like the state of the natural gas market, should be a logical consequence of this developing spot market. As indicated in Figure 1, the development of a spot market, which expresses a desire to increase the flexibility of LNG delivery / supply policy, could likely reinforce price volatility. This involves the development of financial instruments for risk management, with futures first and foremost. Attempts have already been taken in this direction. The International Continental Exchange (ICE) offers "cash settlement" futures contract for Japanese and Korean LNG, like in China, which in July 2015 launched the Shanghai Oil and Gas Exchange to exchange LNG and pipeline gas futures contracts. In January 2016, the Singapore Exchange is slated to do the same. There is certainly no guarantee that these markets have sufficient short-term liquidity to establish themselves as hedging instruments. As the history of financial commodity markets testifies, this could however not be considered in the broader sense as a refusal of the sector players to become financialized, but instead as a first attempt to do so.