From a Bleak Global Outlook to Speculative Strategies: Understanding the Downturn in Metal Prices

Prices of nearly all industrial and precious metals have been on a downward trend for several months. A tightening US monetary policy and the subsequent dollar appreciation partly explain this trajectory, but it is above all the mounting global macroeconomic gloom that has depressed markets. Escalating trade tensions between the United States and China, among other countries, are not likely to be conducive to global growth and in that respect, to the demand for metals. However, not everything can be justified by market fundamentals. Speculative dynamics are clearly at work and also account for the scale of this decline.

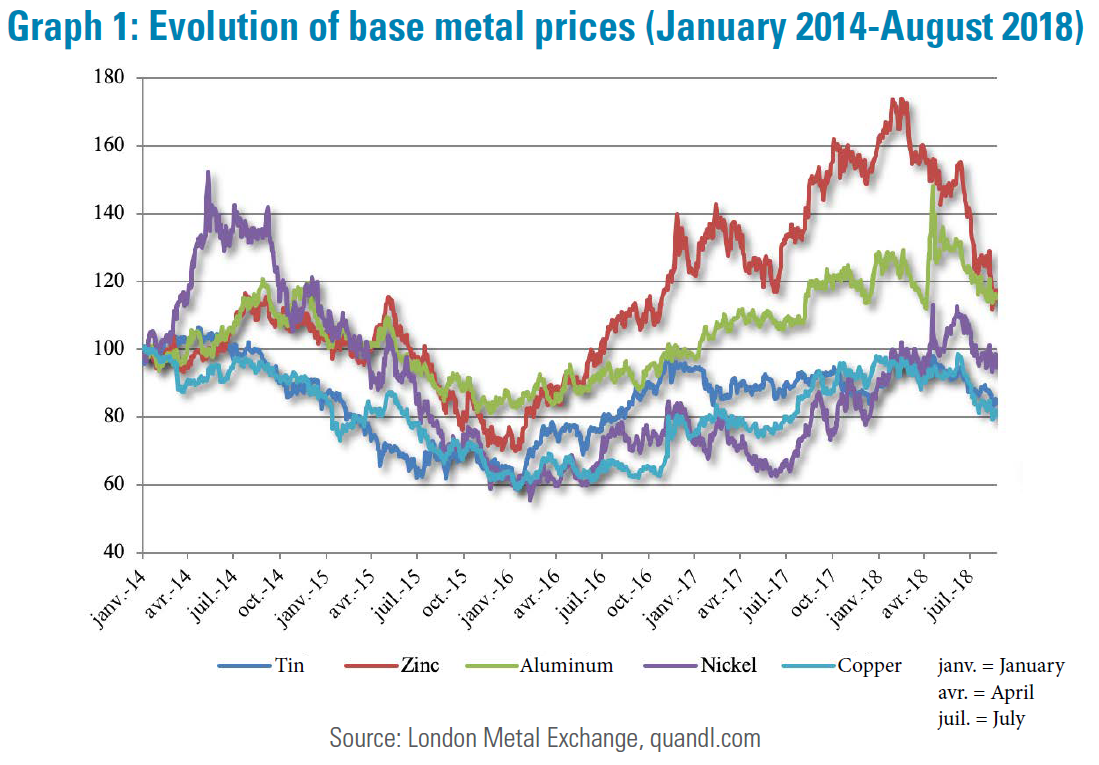

Years go by, but do not resemble each other: this absolutely trivial observation in the commodities world is particularly relevant to the minerals and metals sector, particularly in Africa. While dismal 2015 appeared to have been forgotten for good, the specter of a steep downturn in prices now looms. Over the first ten months of 2018, base metal prices fell sharply on the London Metal Exchange, ranging from nearly -4% for tin to -20% for zinc. Copper fell by more than 14% and zinc by 4.5%. Cobalt on the rise for the past two years also followed the same path, falling by nearly 21% over the same period. The same applies to precious metals: silver, gold and platinum fell by -14.4%, -5.5% and -10.8% respectively. Palladium, with an increase of more than 5% is in fact the only exception . How could this reality be explained and is it likely to continue?

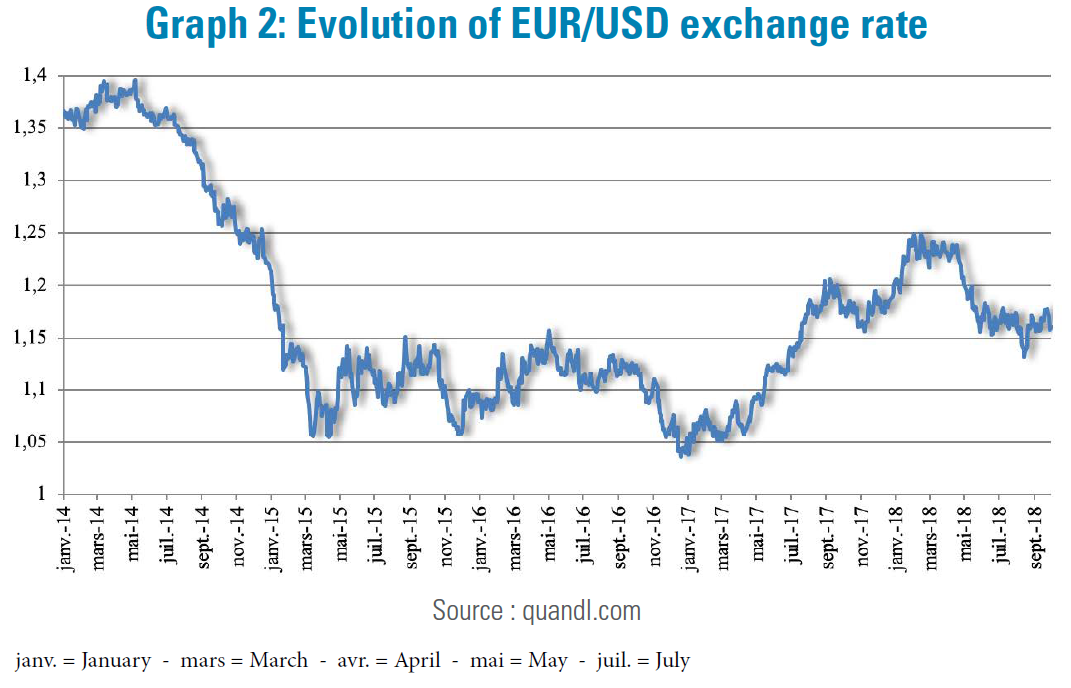

Clearly, the US situation partially explains this trend reversal. Two mechanisms are at play. One is familiar and relates to the value of the dollar. The gradual tightening of US monetary policy, ceteris paribus, makes the greenback more attractive to international investors, which in turn leads to an appreciation of the dollar against other currencies. Commodities, most of which are quoted in US currency, then see their prices mechanically increase once converted into the currencies of purchasing countries. Similarly, one may assume that dollar appreciation increases, on an unchanged export volume basis, the revenues of producing companies, allowing them to maintain high supply levels even when prices fall. Two additional increases in Federal Reserve key rates are expected for 2018 and 2019 and it made sense for the U.S. currency to return to an upward trend. In early February, the EUR/USD exchange rate stood at around 1.25 dollars to the euro, the lowest level for the US currency since the beginning of the year. It came to around $1.13 at the end of October 2018, up almost 6% since the beginning of the year, meaning a higher cost of purchasing raw materials and consequently, a decline in demand.

The second mechanism is clearly tied to the impact of the trade war waged by the United States on China, as well as to the effects of US sanctions on a number of Russian leaders, including raw material producers. Beyond the imposition of duties on Chinese aluminum and steel, which logically affects metal prices, the protectionist withdrawal advocated by the Trump administration is not conducive to global growth, one of the key drivers of hard commodities consumption. As evidenced in the latest International Monetary Fund report on global economic prospects (IMF, 2018), global growth was projected at 3.9% in 2018 and 2019, in the wake of the previous year. These expectations were nevertheless revised downwards in early October 2018. At issue is the specter of escalating protectionist measures on the global economy. While the United States’ macroeconomic situation remains fairly favorable in the short term, global growth has been moving out of synchronization, and this cannot be beneficial to world trade. This applies in particular to emerging and developing countries, whose performance differs due to idiosyncratic factors and also to a different macroeconomic exposure to oil prices. While some non-renewable commodity exporting economies have been able to take advantage of the rebound in prices observed since late 2015, others such as Venezuela, whose oil production has continued to fall, have collapsed. Other risks are also present and explain the gradual darkening of macro-economic prospects. It is indeed essential to consider the high indebtedness of both private and public actors in a context marked by an upswing in US rates, the subsequent dollar appreciation, inflationary pressures due in particular to rising oil prices, and increased uncertainty on the financial markets. This is one of the reasons why Turkey, Argentina and South Africa saw their currencies plunge. All this, not to mention, the political and geopolitical uncertainties that are always very difficult to translate into macroeconomic scenarios. While the budgetary and monetary policies of major economies today have few degrees of freedom, some of the more pessimistic economists, such as Nouriel Rubini, do not hesitate to announce the return of a financial crisis and consequently an economic recession for 2020 . This naturally impacts expectations of operators in the mineral and metallurgical sectors.

Beyond macroeconomic explanations....

Specific explanations for each of the metals also apply. Copper, often labelled as "Dr Copper" - one of the good health barometers of the global economy, saw its production increase sharply during the first half of 2018 according to statistics from the International Copper Study Group. World mining production amounted to 10.012 million metric tons over the period from January to June 2018 compared to 9.526 million for the same period in 2017. This boom however follows a slowdown in previous months, and the drop in prices can likely be interpreted as a pendulum effect within a trend that remains bullish. Driven by the growth of urbanization and electro-mobility - and in particular by the bright prospects for electric vehicles that are heavy users of copper - the outlook for the copper industry remains all the more favorable as mining production is highly localized, metal grades are declining and no major new deposits have yet been discovered. Geological constraints explain part of this reality, but the direction of mining exploration budgets is also at the root of a probable shortage in the medium term. The latter have thus favored the search for deposits close to current ones to the detriment of new geographical areas, and this is likely to reduce the probability of discovering major deposits. In this context of likely imbalance between supply and demand, the possibility that prices might exceed the 7,500 USD/t threshold beyond 2022 can no longer be ruled out for some analysts .

Aluminum, a key metal in the industrial world, was not placed under the same omens. Its price has fluctuated according to market perception of the reality of US sanctions against Oleg Deripaska, leader of Rusal, the world's second largest aluminum producer, behind China's Hongqiao . The price of aluminum rose by over 32% in early April, from USD/T 1967 to USD/T 2602 in less than two weeks, following the Trump administration's announcement that it would sanction the Russian oligarch. It then receded significantly as a result of the successive postponements of the measure ordering US companies to no longer do business, commercially or financially, with the Russian giant. The deadline for compliance originally set for June 5th then October 23rd, is now set for November 12. If implemented, the US decision could remove close to 1.5 million metric tons from the market, inevitably leading to higher prices. This occurred, in part, in early October when Aluminum prices skyrocketed past USD 2200/T, after hovering around USD 2000/T throughout September, the level prevalent before Deripaska's inclusion on the US blacklist.

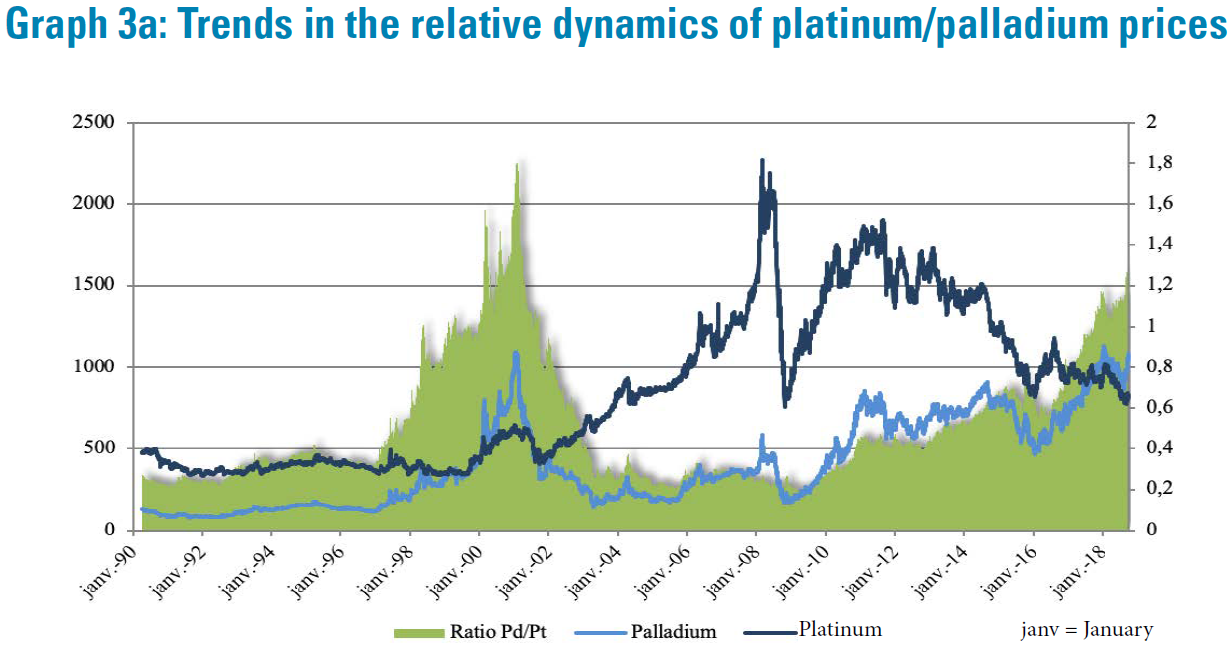

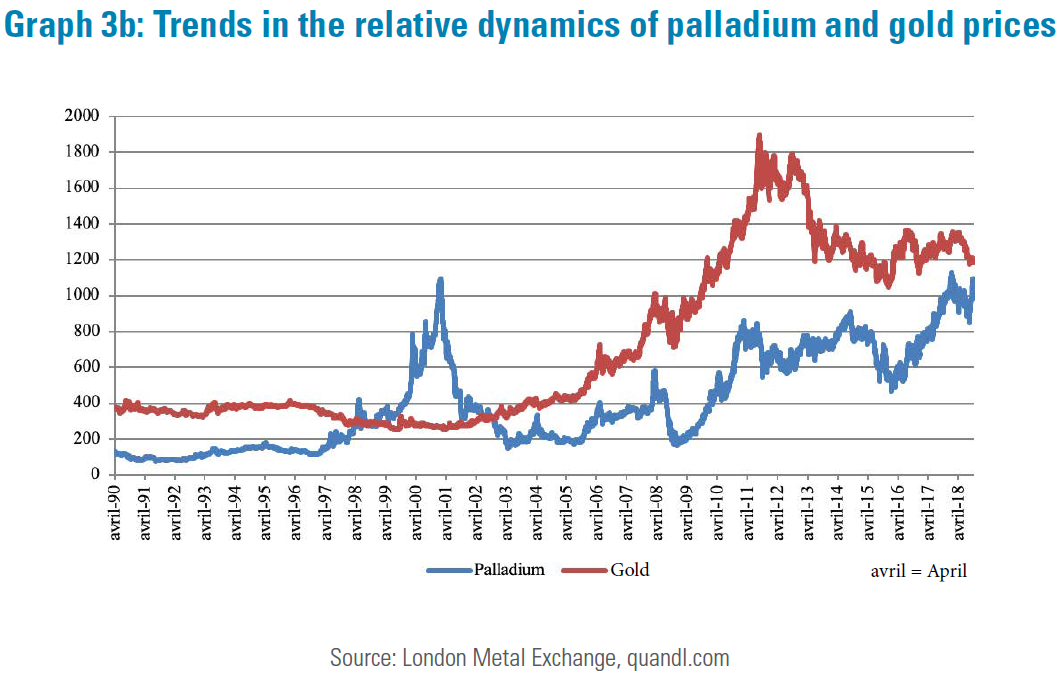

A strong heterogeneity prevails in precious metals, with in particular an inversion of the relative dynamics of palladium and platinum prices. Used in diesel catalytic converters, the latter has seen its price steadily deteriorate to the point where it is now lower than that of palladium . Palladium prices exceeded USD 1080/ounce at the London fixing in late October, while platinum prices stood at USD 830 (Graph 3a). Palladium, with a strong rebound since mid-August, could arguably dethrone gold in the coming months. While it is true that the gap between the two metals has narrowed sharply since the end of the super-cycle (2012), from more than USD 1150/ounce on some days in 2011 and 2012 to less than USD 100 at the end of September 2018 (Figure 3b), this is to be interpreted with caution: this situation has not been seen since 1998, when palladium prices traded well above gold prices for almost four years. During this period, exports from Russia, the world's largest producer, were largely constrained, while demand rose sharply due in particular to a surge in demand for semiconductors. The situation is obviously very different today, and it is equally in the gloom of gold prices that one explanation for this convergence can be found.

Is gold a commodity? This question, seemingly surprising, deserves to be asked when demand factors for gold are explained: if the jewelry sector is obviously a very large consumer of gold and industrial demand is also present, gold is also just as much a value reserve for central banks as a private investment medium in coins and ingots, intermediated or not by investment funds (such as Exchange Traded Funds - ETFs). Gold market drivers therefore respond to both a logic specific to commodity markets and a logic specific to foreign exchange and traditional financial markets. Oscillating between these two paradigms, gold has hardly benefited from global geopolitical uncertainties: down nearly 5% between January and October 2018, its price stood at around 1200 USD/ounce, thus returning to the level it had reached in July 2016. Two closely related mechanisms combined to explain this decline: the traditional dollar effect raising the cost of acquiring gold for all buyers outside the dollar zone and the real interest rate effect. The gradual tightening of US monetary policy, resulting in higher yields for lenders on international bond markets, has thus limited the attractiveness of gold. While inflationary pressures in the United States could have encouraged investors to buy the metal, they were not strong enough to allow this to occur. This is all the more true as statements that gold and US currency prices are negatively correlated and that gold is a bulwark against inflation per se need to be interpreted with caution. The many econometric studies on the economic or financial properties of gold cannot be overlooked, as they reveal all the subtleties of interrelationships between gold and the macroeconomic variables mentioned above (see box below). This allows a broad understanding of current price levels.

As Otaviano Canuto (2018) points out, while fundamentals explain the decline in metal prices to a very large extent, it is not clear that they fully legitimize the extent of this decline, nor do they explain the sharp increases observed since the low point reached between late 2015 and early 2016. It should be recalled here that most of the listings come from Commodity Exchanges which, although firmly rooted in the economic reality of physical operators, have made speculation a sine qua non condition for their liquidity and therefore, for their sustainability.

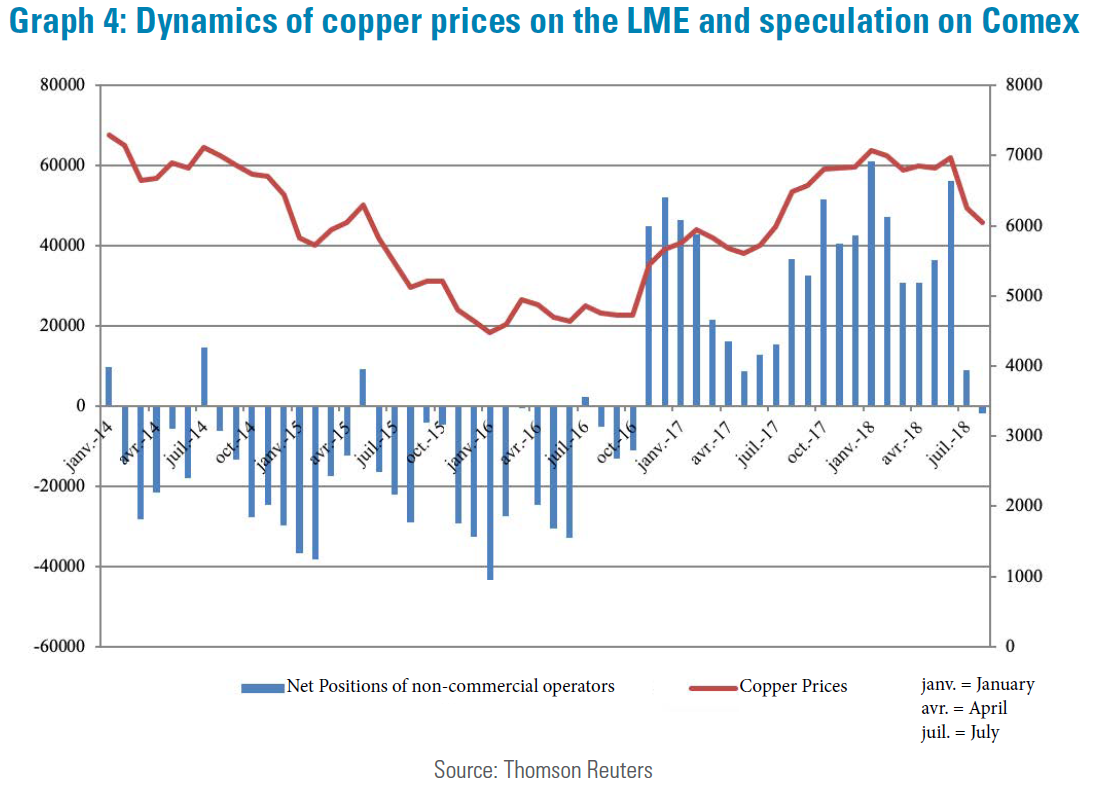

Copper is probably one of the base metals to best illustrate the importance of speculative dynamics. Figure 4 below relates copper price dynamics to the size of non-commercial operators' net positions on Comex , a subdivision of the Chicago Mercantile Exchange Group. It is very clear that the direction of copper price variation is strongly correlated with the nature and extent of speculation in the market. This correlation alone cannot suggest that one of the variables can explain the other, nor can it inform on the meaning of a possible causal relationship between them. It nevertheless reflects the fact that it is hardly possible to ignore the importance of speculative intensities on the price of metals, whether copper, other base metals or precious metals. Technical analysis, a tool of speculators, seeking buy and sell entry points in stock market price movements , is used extensively on metal markets, including copper. In reality, only steel, whose financialization is not only more recent but also much more limited, and minerals (so far) escape this observation .

The impossible distinction between wheat and chaff: a constant on commodities markets?

Let us agree that speculative strategies are at work today, as they have always been, since the launch of financial futures markets, and that it is an absolute platitude. The durability of a financial futures market requires that speculators have an interest in processing the said future contract in order to provide liquidity and correct the natural asymmetry of hedging (Houthakker, 1968; Yamey, 1971) . The important thing, however, is to qualify and measure the speculative intensity of markets such as those for base or precious metals. While many of the most serious empirical studies have focused on doing so in the context of the commodity super-cycle, it must be noted that this approach can only be limited. There are several reasons for this.

First of all, futures markets should not only require operators buying and selling derivatives to declare the type of activity they engage in, as the Commodity Futures Trading Commission in the United States does, but also that this information be made available. To our knowledge, this is not yet the case. Second, a distinction should be made between the different forms of financial speculation in order to understand their effects on price dynamics. Speculation by index funds, widely present during the super-cycle, is traditionally similar either to a succession of long positions in futures contracts or, as with gold ETFs, to the purchase/resale of physical products (bullion, coins, etc.). This form of "long" speculation has little to do with "more aggressive" strategies that multiply buying and selling short, in order to take advantage of the leverage offered by futures contracts. Precisely measuring the extent of the speculative phenomenon would ultimately require taking into account the existence of speculative stocks. While official LME or Shanghai Futures Exchange (SHFE) stocks are widely observable and observed by metal sector operators, these speculative stocks are unobservable: they are private in nature - and therefore not subject to reporting obligations - and are speculative only because of the type of expectations of those who hold them. Holding stocks can, in fact, correspond just as much to a desire to secure supply within a value chain, to the intention of rewarding warehousing activity in a so-called "in contango" market environment, as to a postponement of sale (an anticipation of purchase) because it is considered, in a speculative logic, that prices will be more favorable (unfavorable) in the future. Speculative stocks therefore do not exist as such. To understand the speculative reality of stocks is, therefore, ultimately, to know the aggregate reality of agents' expectations on the market and no expert can claim to have this omniscience.

Should we, then, resolve ourselves to an admission of impotence in the face of the difficulty of distinguishing, in the dynamics of metals as in most commodities, the wheat from the chaff? Probably not, but the greatest caution is called for when proposing a forward-looking analysis of the level of commodity prices in an economic and political context as volatile as the one we are experiencing today. The idea that certain metals, such as cobalt and copper, will, despite the decline in their prices since January 2018, reach new highs in the coming years, seems to us to have to be put into perspective. It is not our intention to deny geological (on the metal supply side) and industrial (on the demand side) evidence, but we must remember that there is also a "rhetoric of scarcity" fueled by certain political movements and also by those investment funds whose ambition is to benefit from rising prices. However, that which is anticipated through long-term price dynamics seldom happens. Today's environmental revolution and its impact on the automotive market are bringing copper, lithium and cobalt to the forefront, while the price of platinum continues to fall in the wake of the decline in diesel vehicles. While the supply of cobalt (ore and metal) is expected to be a major issue over the next decade, could the possible growth of hydrogen fuel cell vehicles not largely reverse this trend in the years to come?

Extending the satirical phrase often attributed to Thomas Carlyle, and echoed by Canuto (2018) to the context of raw materials, the parrot who is taught the words "supply" and "demand" to become an economist should in reality be made to repeat "ceteris paribus" at will to truly become so. However, this will only give him a very limited ability to anticipate long-term price dynamics, because if there is one certainty in the world of raw materials, it is that an economist cannot, on his/ her own, comprehend all the technological changes at work in the extractive sector and in the industrial worlds transforming and consuming non-renewable resources.