Africa-Atlantic Integration: Can the Economy Unite What Geology has Divided?

1 - The Atlantic Basin: a region of systemic importance The Atlantic basin has long been an area of systemic importance, both economic and geopolitical. The links between the two sides of the Atlantic, however, remain dominated by the South-South relationship, despite a certain momentum observed in many southern countries in recent years in terms of regional and international integration. To delimit the scope of analysis, this article will focus on the economic side, keeping in mind that the geopolitical factor is also important given the interactions it generates. The systemic nature of the Atlantic region is a result of two essential elements. First, is the importance of the Atlantic region, which includes two economic superpowers, namely the United States and the European Union. These two economies together constitute over 51% of global GDP (at market prices, constant dollar) and more than 35% in purchasing power parity. They also account for over 25% of global exports, 30% of imports, and 70% of the global outbound foreign direct investment (FDI) and 60% of incoming FDI.

The Atlantic basin’s second essential element is the importance of the northern part, specifically its impact on other parts of the world. These effects are transmitted via trade and investment flows, making it a major source of foreign demand for almost all countries in the world, especially as the US and EU share in global private consumption is over 50%. At the same time, the US and the EU are by far among the top destinations for migrants and therefore represent an essential source of emigrant income transfers and provide an environment that has developed a large diaspora population—a huge potential for the origin country provided that it is properly exploited.

The Atlantic also generates effects on other economies via the diffusion of technology and knowledge, since the northern area includes countries that are situated at the edge of the technological frontier among the global innovation leaders, along with certain Asian powers obviously.

2 - …which however remains very heterogeneous

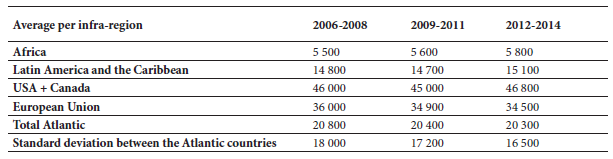

When its southern component is taken into consideration (Latin America, the Caribbean, and Africa), the Atlantic basin appears to be a very economically diverse area with significant differences between the North and the South in terms of importance within the global economy, per capita income, and technological development, despite a slight convergence in recent years. While the US, EU and Canada account for nearly 55% of global GDP (at market prices, constant dollar), the Latin American and African economies on the Atlantic coast account for about 6% and 1% of global GDP, respectively. Along with the difference in the size of their economies, the North and South Atlantic are also characterized by significant differences in per capita income levels. Over the period 2012-2014, the average per capita GDP of the area (USA + Canada) was 8 times more than that of the Atlantic coastal countries of Africa and 6 times more than that of the coastal countries of Latin America and the Caribbean. These ratios reach, respectively, 3 and 2.3 times when the two southern regions are compared to the per capita GDP average of the EU. It is indeed clear that despite the existence of an "σ-convergence" process, as indicated by the decrease in time of the standard deviation of per capita GDP in Atlantic basin countries and the slight increase in per capita GDP in Africa and Latin America (Table 1), the gaps remain important, both between the North and South as well as between the two Southern blocks of the region.

Table 1: GDP per capita per Atlantic Basin infra-region (in purchasing power parity, 2011 international dollars)

Source: Calculated from the WDI Database, World Bank

Despite higher GDP growth rates in African and Latin American countries, compared to those in the two North American economies and the EU, the income per capita convergence process has been insufficient due to faster population growth in the South Atlantic. These elements show that the southern economies in the region, especially in Africa, have not been able to generate sufficient growth to create jobs and increase the income of a young, rapidly growing population: a situation that is probably unsafe for the future social and political stability of many countries in the region.

3 – A long way to go to improve the integration of African countries in the Atlantic area

Despite the multiplicity of cooperation and free trade agreements signed between several South Atlantic countries and the most developed economies in the region, in addition to the preferential access arrangements enjoyed by the least developed countries, especially African, these countries are unable to capitalize on and ensure that efficient economic integration can generate positive externalities for their respective economies.

3 – 1 – Low synchronization of the economic cycle within the South Atlantic countries and Africa’s quasi-disconnection

Several indicators confirm the low degree of integration of South Atlantic countries in relation to other neighboring economies. It should be noted that the lack of integration of the southern economies in the region is observable at three levels:

- Africa is generally the least integrated region in the Atlantic basin;

- A lack of South-South integration between Africa and Latin America;

- A lack of infra-regional integration in the two southern blocks of the Atlantic basin.

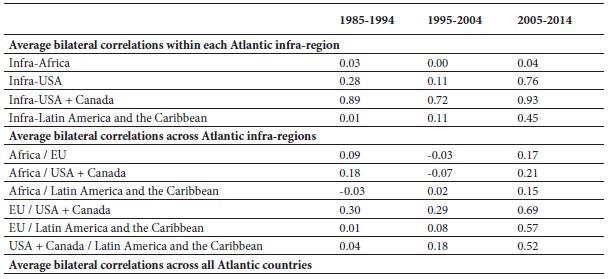

Africa is the least integrated region in the Atlantic basin: one way of assessing the degree of integration between the countries of a given region is to examine the synchronization between the growth rates of their respective GDPs. Table 2 reports the correlation coefficients between real GDP growth rates by decade. It shows that over the period 2005-2014, African economies of the Atlantic are the least integrated with other blocks in the basin, with limited correlation coefficients of about 0.21 compared to growth in the block (USA + Canada) and 0.17 compared to the European Union, while these coefficients were respectively 0.52 and 0.57 for the Latin American economies.

A lack of South-South integration between Africa and Latin America: the synchronization of the growth cycles between the two southern blocks of the Atlantic is very low, compared to that recorded between the two northern blocs of the region, at 0.15 compared 0.69. This result is not surprising given that for a long time, Atlantic relations were dominated by exchanges between the United States and the European Union in trade and capital flows, which helped strengthen economic cycle synchronization of the two superpowers.

A lack of infra-regional integration between African countries in the Atlantic Basin: If the African countries bordering the Atlantic display the lowest rate of integration compared to other blocks of the Atlantic, the same observation can be made about the degree of infra-regional synchronization. Indeed, the average correlation coefficient between the growth rates of different African countries of the Atlantic area does not exceed 0.04 over the period 2005-2014, compared to 0.45 among Latin American countries, 0.76 between European countries, and 0.93 between the United States and Canada.

Taken as a whole, the Atlantic area had an average correlation coefficient of around 0.38 over the period 2005-2014 for the economic growth rate of all economies across all blocks, whereas this coefficient was barely 0.05 during the 1995-2004 period. At first glance, this development can be interpreted as an indicator of stronger integration between the economies of the Atlantic, mainly driven by an improvement in North-South synchronization. However, these figures should be used with caution since the high correlation coefficient during the 2005-2014 period could be explained, in part, by the widespread impact of the global crisis that took place and, given its scale, was reflected in the growth rate of most economies in the region.

Table 2: Synchronization of real GDP growth rates across Atlantic Basin infra-regions

Source: Author calculations

3 – 2 –The structure of export flows confirms the low South-South integration in the Atlantic area and the lag by Africa.

In reviewing bilateral exports in the Atlantic area, it is apparent a priori that over the period 2012-2014, on average over 74% of the Atlantic Basin countries' exports are sold between them and only 26% goes to the rest of world. This could reflect significant trade integration in the region. However, a more detailed analysis per block of countries supports the hypothesis that South-South trade relations are far from adequate and that the overall performance of the Atlantic area in terms of trade integration is buoyed mainly by the US / European Union relations, intra-EU and intra-US links, and the North-South relations especially concerning Latin America.

Indeed, Table 3 shows that over the same period, only 5% of the exports by African countries bordering the Atlantic go to Latin America and barely 1% of exports from Latin American countries go to the African Atlantic countries. Similarly, the share of infra-regional exports does not exceed 11.1% for the African coastal economies and 13.6% for the Latin American countries. This weakness of South-South integration contrasts with the two blocks of the South Atlantic’s dependence on the US and European economies. Thus, African exports mainly go to the EU with a share of 33%, while exports to Latin America and the Caribbean are geographically concentrated in the USA and Canada at 42.2%.

Along with this dependence on North Atlantic trading partners and the weakness of the South-South integration, African countries in the region are also at risk of a ‘resource curse’ as the North-South trade relations are generally dominated by an operating pattern of energy and mineral resources. Indeed, many resource-rich African countries are still excessively dependent on export earnings from raw materials and therefore remain vulnerable to changes in international commodity price levels and their volatility. In addition, it is well recognized that the energy and mining sectors have limited externalities on the rest of exporting countries’ economic sectors given their low integration rate with other sectors. Secondly, they are highly capital-intensive and may not generate enough jobs for an African population considered to have the fastest population growth rate in the world. This refers to the urgent challenge of structural transformation, especially in several African countries whose economies show strong dependence on natural resource rents (Chart 1). Accelerating the process of economic transformation in these countries would allow them to better integrate into the global and regional value chains by diversifying into higher value-added activities.

Table 3: Distribution of exports of the Atlantic countries between the infra-Atlantic countries and the rest of the world (% of total exports by region, three-year average)

Source: Author calculations

Figure 1: Natural resource rent by Atlantic countries

Source: WDI Database, World Bank

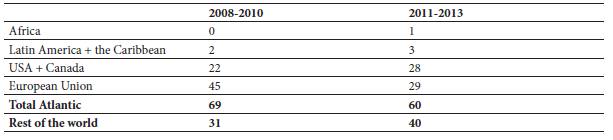

Alongside the trade flows, the lack of integration of African countries on the Atlantic basin is also reflected in terms of access to foreign capital, especially foreign direct investment (FDI). Thus, on average over the 2011-2013 period, African economies in the Atlantic region received only 2% of inward global FDI flows, considering that for all the Atlantic countries this figure exceeds 52%. Again, FDI flows are captured primarily by advanced economies in the Atlantic area i.e. the EU with 22% of the flows worldwide and the United States with a share of 16%. The FDI received by African countries is generally concentrated on extractive activities, services and infrastructure. Manufacture-oriented FDI is lower despite some improvement over time in some countries like Morocco and Nigeria. According to the UNCTAD World Investment Report 2015, the share of FDI that Africa as a whole received is 48% for services (including construction), 31% for the primary sector (mainly including the extractive industries), and 21% for the manufacturing sector.

Table 4: Distribution of FDI inflow (% of total world)

Source: Author calculations from the UNCTAD database

4 – Why doesn’t Africa capitalize on a more efficient integration in the Atlantic area?

The signing of free trade agreements remains a necessary condition far from sufficient to ensure successful regional and international economic integration. Indeed, before choosing where to export first, it is necessary to have an exportable supply. In other words, the capacity of African countries on the Atlantic coast to fit in their regional and international economic environment and occupy a privileged position in global value chains depends primarily on the level of development of their productive capacity and, therefore, the domestic reforms undertaken to increase their competitiveness and their ability to create complementarities with respect to the export structure of partners and competitors in the region.

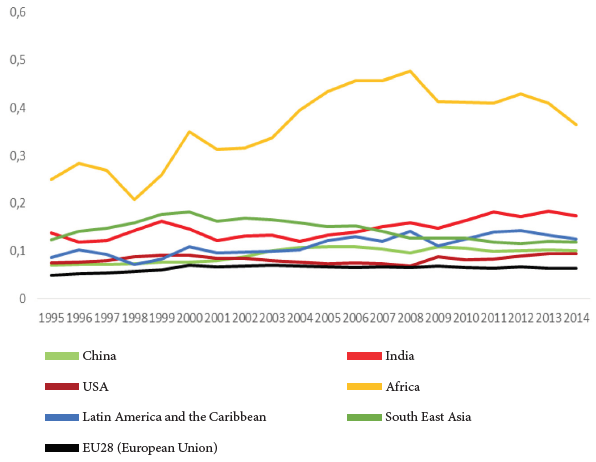

Several indicators assess the progress made in terms of African countries’ development of productive capacities. The first factor relates to the diversification of their economies. Generally, a diversified country has a wider productive capacity and a more resilient economy that is less dependent on any predominant sector. Diversification is also a sign of structural transformation and continuous development, although when some countries reach a high enough level of development, their diversification effort can decrease in order to specialize in a smaller number of sectors with high added value and high technological content (Imbs and Wacziarg, 2003). It is apparent from Figure 2, which outlines the evolution of the export concentration index by region, that African countries on average continue to show the highest concentration index and, therefore, prove to be among the least diversified economies in the world, despite some decline in the concentration since 2009. This finding could be explained by the delay and slowness by African countries in implementing a structural transformation of their economies, which hampers their competitiveness and affects their ability for regional and international integration.

Figure 2: Export concentration index

Source: UNCTAD

In addition to diversification, the sophistication of exported products may reflect the level of development of an economy’s productive capacity. One of the indicators used to assess this aspect is the economic complexity index (Hausmann and Hidalgo, 2009). This indicator reflects an economy’s ability to produce both a diverse and sophisticated range of products, which would enable it to position itself in the most dynamic production regions for global exports. Again, the ranking of African countries according to economic complexity index is far from satisfactory. Since 2014, no African country has been among the top 30 countries with the most complex production structure. Indeed, Tunisia, South Africa, Egypt and Morocco, which are among the economies with the most complex productive capacities on the continent, are globally ranked between 46 and 77 out of 124 countries. In addition, compared to the 2004 ranking, nearly 45% of the 29 African countries for which the complexity index is available had lower global rankings. This means that these economies were not able to strengthen their productive capacities and competitiveness over the last decade, and, even the countries that had undertaken reforms in this area were not sufficiently efficient and were outpaced by the other regions in the world.

The lack of sophistication is substantiated by the structure of African exports broken down by technology content and expertise. Indeed, the share of products with high and medium technology and skill content is only 61% for the African economies (North Africa included), while the proportion was almost 80% on the other side of the South Atlantic (Latin America + the Caribbean) and in ASEAN countries.

Figure 3: Distribution of manufacturing exports by technological and skill content (in % of total manufacturing exports, 2014)

Source: UNCTAD

Finally, it is important to note that in addition to the aspects of diversification and sophistication of the exportable supply, which imply an ongoing development of productive and absorptive capacities, and in particular research and development and the quality of education and vocational training, another equally important factor should be taken into account. It concerns the anticipated complementarity among the African countries for a win-win integration strategy instead of engaging in intra-African competition in low-technology and labor-intensive industries and only taking advantage of the low cost of labor. Such a situation, called ‘race to the bottom’ (Bowles et al., 1990; Stiglitz, 2012; Storm and Naastepad, 2012), would only hinder the per capita income growth process and minimize the expected gains for African countries as a whole. Indeed, exports by Atlantic coastal African countries have very low complementarity indexes, both with respect to the Atlantic and Latin American countries, with coefficients of 0.16 each. In addition, the average infra-Africa complementarity in the Atlantic basin is even lower, at 0.14. For comparison, the complementarity index of Latin American economies in relation to all Atlantic countries at 0.23, although relatively small, is still higher than that of Africa. In this respect, it might be beneficial for African countries to build their industrial policies by taking into account the synergistic constraints and by identifying niches and target sectors that would provide a higher level of complementarity between the African economies. Consequently, they could benefit from a booming African consumer market (growing middle class) while combining their productive structures to reach a critical size, enabling them to better integrate in comparison to their partners both from the Atlantic coasts and the rest of the world.

Table 5: Complementarity Index (average 2011-2013)

5 - Future opportunities and challenges for Africa

Africa's economic integration process in the Atlantic area means that in the near future, the African continent should seize the opportunities that present themselves while facing the significant challenges that proved to be a great source of uncertainty. Africa is often cited as the last source of global growth and is an increasingly attractive destination for foreign investment. This is indeed an opportunity for several African countries with enormous financing deficiency and insufficient domestic resources to finance their infrastructural needs. Similarly, a larger influx of European and American foreign investment can help develop the local productive capacity through the transfer of technology and know-how, and the creation of new employment opportunities in the continent. That said, it is important to note that these positive externalities for Africa first require a minimal domestic absorptive capacity, which in reality is lacking in a number of countries in the region.

Meanwhile, according to some analyses, the proposed Transatlantic Trade and Investment Partnership (TTIP) agreement between the two giants, the United States and the European Union, could represent a real opportunity for developing countries, particularly in Africa. Positive effects for Africa can materialize by opening up to a wider market of North Atlantic consumers as well as by pushing African exporters to improve the quality and range of their products in order to be more competitive and aligned with the requirements of northern partners. It should be stressed that in order to achieve these benefits, African countries must have the capacity to adapt and the US and EU must make an effort to simplify and standardize rules of origin and minimize non-tariff barriers.

Indeed, besides the fact that the southern Atlantic countries were excluded from the Transatlantic Treaty negotiations, African countries may suffer the negative effects of trade diversion to their detriment, not because of tariff measures already enjoyed by some African countries vis-à-vis the developed partners, but in particular due to the impact of a potential tightening of non-tariff measures. These will become even more difficult to meet by most African countries and may lead to additional costs for African exporters, who will be forced to review their production processes in order to align with non-tariff standards imposed. Similarly, African countries also suffer from the accumulation of rules-of-origin-related problems and their strictness. These hinder a stronger integration between the southern economies and could push African countries wishing to deepen their trade relations with the EU and the US to alter the geographical structure of their inputs, which could result in additional costs and trade diversion effects.

On the South-South dimension, a vital question arises: Can we generalize and talk about integration between Africa and Latin America when we know that these relationships are focused mainly on trade between Brazil and some African countries? Finally, does Africa have any interest in continuing its efforts to economically integrate the opposite shore of the Atlantic in an environment where we increasingly talk of a return of the Pacific or the Asian era? This could be driven by the rise of China, which increasingly focuses on Africa, and which several analyses suggest as a future global economic center, alongside India and Russia’s possible role.

It should be noted, however, that regardless of which scenario materializes, Africa should focus on domestic reforms primarily to promote its productive and absorption capacity for better integration with its regional and international environment, and a more effective assimilation of knowledge, technology, and any kind of positive externalities via trade and investment flows. Similarly, the search for greater intra-African integration based on sectoral complementarities and synergies should be an essential ingredient to take into account by the different economies within the continent for the implementation of their respective industrial strategies. For their part, the northern Atlantic countries are encouraged to rethink their trade and partnership agreements vis-a-vis themselves as well as with the African countries in order to achieve a simplified and flexible framework on which the southern countries can align themselves at a lower cost.