Capital accumulation and productivity gains in Morocco

The continuous and reinforced process of accumulating physical capital, in which Morocco has embarked since the early 2000s, has helped to preserve the stability of the fundamental equilibrium and cushion the economy from various external and exogenous shocks. However, these accumulation efforts have not led to a significant increase in productivity gains or to an accelerated transformation of the productive base. This Policy Brief aims to describe the underpinnings of the capital accumulation process in Morocco and highlight the chronic inhibitors that constrain the Moroccan economy to the impacts of low productivity.

I- Efficiency of the capital accumulation regime

The physical capital accumulation process in Morocco has intensified significantly since the early 2000s, without a corresponding and proportional increase in productivity gains. Several countries, with the same rate of change in capital intensity as Morocco, have been able to generate productivity gains levels that far exceed those of Morocco.

Based on a panel of 20 countries, the efficiency score estimates reveal the extent of Morocco's underperformance.Throughout the entire study period, Morocco was located below the efficiency frontier with an average score of 76% compared to an average of 84% for the countries in the sample. This score means that Morocco produces only 76% of the output using the same level of input as its most efficient comparators, and thus has a marginal productivity increase of 24% for the same level of input.

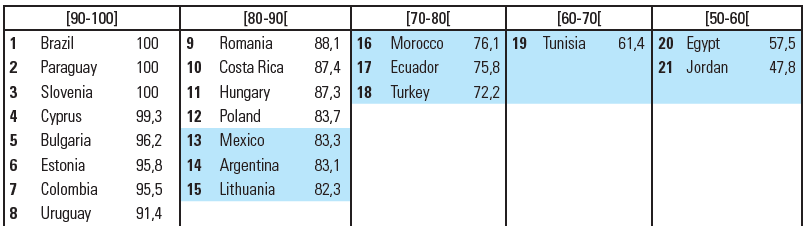

Morocco is part of a third group with a medium-low efficiency score between 70 and 80%. The first group contains 8 countries with scores above 90%, including Brazil, Paraguay, Slovenia, Cyprus, Bulgaria, Estonia, Colombia and Uruguay. The 7 countries in the second group (Romania, Costa Rica, Hungary, Poland, Mexico, Argentina and Lithuania) have a moderately high efficiency score of between 80 and 90%. Tunisia is alone in the range of 60 to 70% with a low score of 61.4%. Egypt and Jordan are considered the least efficient over the entire period, with a very low score (less than 60%).

Table 1 - Classification in descending order based on the importance of the average efficiency score *

Source: Author's calculations based on data from the Penn World Table and DEAP software

* Colored cells correspond to scores below the sample average (83.4%)

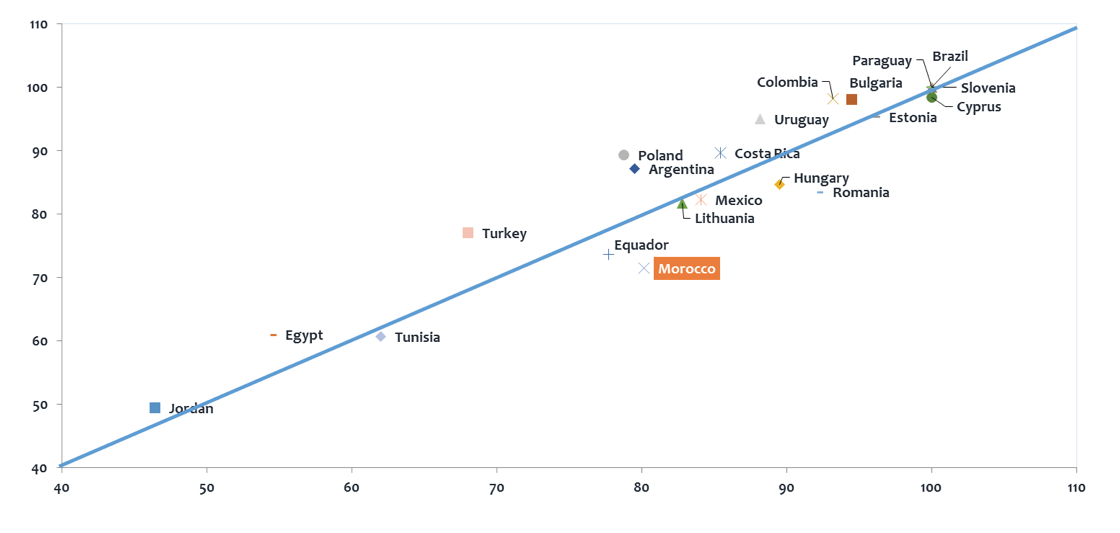

In 2000, Morocco had a score of 81%, with a gap of only 1.8 points compared to the average score of the sample. Between 2000 and 2003, this gap narrowed and Morocco’s score was close to the sample average. Since then, the gap has steadily widened to over 16 points in 2014. Morocco lost 12 points between 2000 and 2014 when the average score of the sample improved by about 3 points.

Chart 1 - Change in the average efficiency score of Morocco and the 21 countries in the sample

Source: Author's calculations based on data from the Penn World Table and DEAP software

Its score deteriorated between the two sub-periods 2000-2007 and 2008-2014, while Uruguay, Turkey, Poland, Bulgaria, Argentina and Costa Rica were able to improve their efficiency scores during the second period. Similarly, Egypt and Jordan’s scores improved slightly between the two sub-periods while however remaining well below the sample average.

Chart 2 - Change in the efficiency score per country between the two periods 2000-2007 and 2008-2014

Source: Author's calculations based on data from the Penn World Table and DEAP software

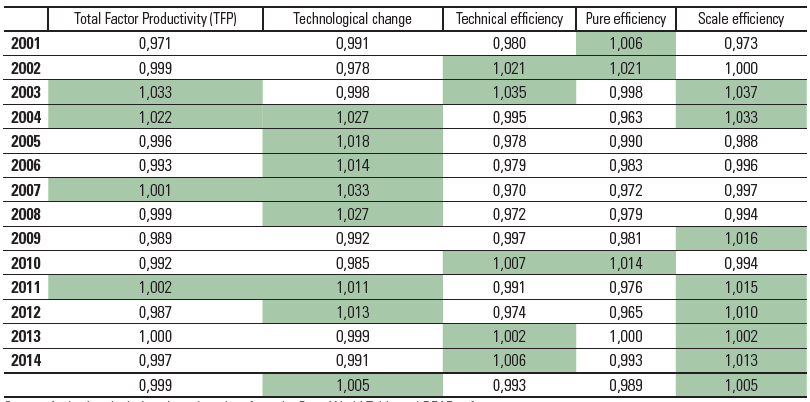

It should be noted that productivity gains come either from technological change (following the acquisition of new technologies) or from scale efficiency (change in production factors). In Morocco’s case, technological change was the main source of productivity growth.

Table 2 - Change in the Malmquist Productivity Index and its components for Morocco between 2001 and 2014

Source: Author's calculations based on data from the Penn World Table and DEAP software

* Colored cells correspond to positive change.

Indeed, Morocco has incorporated new technologies into its productive process at a more sustained pace, particularly between 2004 and 2008. However, pure efficiency, which corresponds to the optimal use of resources, has only meekly contributed to improving the Total Factor Productivity (TFP) and appears to be the main source of the inefficiency of the capital accumulation process in Morocco.

The Moroccan economy is undeniably becoming increasingly capital-intensive, as more capital is needed to preserve the same level of value added creation. For example, an acceleration in the capital stock growth rate by 6.4% during the 2008-2014 period was necessary to achieve economic growth of 4.2% per year, whereas an accumulation of only 5.9% % was sufficient between 2001 and 2007 to generate average GDP growth of 5.1%.

Drawing its momentum primarily from the accumulation of capital with limited gains in productivity, the Moroccan growth regime can be described as extensive (a process by which valuation is assured by an increase in the production factors) and not intensive (a process whereby growth is driven more by high productivity gains).

II- Chronic productivity inhibitors in Morocco

Several avenues are a priori conceivable to explain the different trends in capital intensity and productivity gains.

1. The accumulated capital is of low quality and therefore produces low productivity gains.

Several rough indicators corroborate the finding of the low quality of accumulated capital. The first concerns the production range level. In this respect, it should be noted that the demand for high quality products is relatively insensitive to their prices. In other words, a low price elasticity of exports in terms of volume corresponds to a high product quality level.

The price elasticity of Moroccan exports, in terms of volume, is very high compared to the countries on the northern shore of the Mediterranean. This suggests that the exportable production quality is low, and therefore the accumulated capital has not had a tangible impact on the quality of the productive supply.

Chart 3 - Price elasticity of exports in terms of volume

Source: Natixis, HCP

The second indicator, which is consistent with the first, concerns the content of Moroccan imports of technology. The increasing dependence of the Moroccan production process on imported inputs (capital goods in this case) and the relatively high content of low technology in Moroccan imports could be a factor that explains the low quality of the accumulated capital in Morocco. Since the import content of Moroccan exports is high, low-quality imports in turn have an impact on Moroccan exports, which are also dominated by low-technology products at a rate of 50%.

Table 3 - Technological content of foreign trade: Insufficient degree of sophistication

Calculated from CHELEM data

2. Distortions in terms of capital allocation and shrinking productive sector

In addition to the quality of accumulated capital, productivity gains are based on other structural factors that shape the productive fabric, notably productive specialization and changes in the sectoral composition of economic activities. Despite Morocco's commitment to diversifying its productive base, its economy remains dominated by service activities, while the share of total value added of the processing sector, which has a very high employment multiplier and is considered as an element pivotal to reversing the chronic trade deficit curve, declined between the two periods 2000-2007 and 2008-2014.

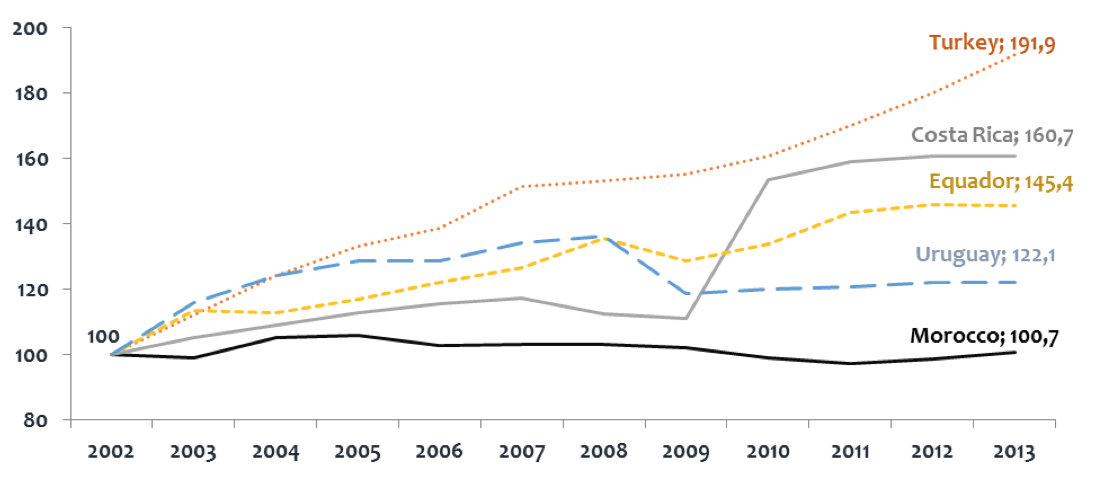

Another element supports the observation of an absence of an extended productive sphere and concerns the productive fabric’s weak vitality. According to data from the World Bank's Exporter Dynamics Database, there were only 5,325 Moroccan exporting companies in 2013, stagnated at this level since the early 2000s with an average annual growth of only 0.7%, a much lower rate than Turkey (6.1%), Costa Rica (4.4%), Ecuador (3.5%) and Uruguay (1.8%).

Chart 4 - Number of exporting companies

Source: Exporter Dynamics Database, World Bank

INFORISK statistical data indicate, moreover, that only one fifth of the startups created in 2010 were able to switch from Very Small Enterprise (VSE) to Small to Medium sized Enterprise (SME) status. This shift concerns, in particular, the companies best endowed with initial social capital. The data also show that Moroccan companies are struggling to grow and reach a size that would enable them to initiate strategies combining innovation, moving upmarket, and increasing export market share. This provides further proof that in terms of startups, the Moroccan economy has a problem with both "start" and "up."

Moreover, the reallocation of the labor force is generally in line with changes in the sectoral composition of economic activities and can therefore have a substantial influence on the intensity of productivity gains. Many empirical studies have shown that the greater the shift of the labor force, the greater the improvement in productivity gains, especially if the shift is from a less productive to a more productive one.

In the case of Morocco, the breakdown of productivity gains rate clearly reveals the predominance of the intrasectoral component, which participates at an average of 82% over the entire period, compared with only 18% for the intersectoral component. The redeployment of the labor force between the different sectors of activity has not led to a significant improvement in intersectoral productivity since it has taken place going from primary to construction and tertiary.

Chart 5 - Breakdown of the apparent labor productivity gains rate

Calculated from HCP data

3. Accumulated capital is made available to a less skilled workforce, which yields its suboptimal use.

In addition to the economic factors discussed above, there is an essential aspect to the quality of labor available in the labor market. Capital accumulation could have a more permanent impact on growth potential and on productivity gains only if the labor supply is adequate for the qualification level of the employed labor force.

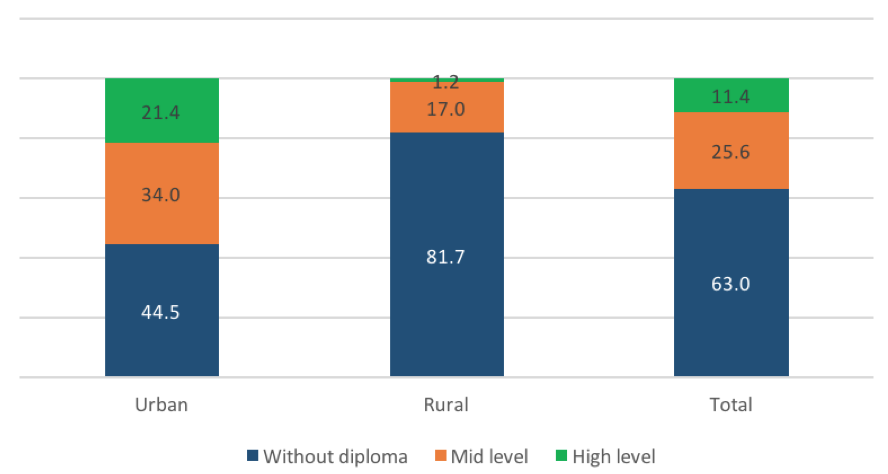

Different works on Morocco by national and international organizations demonstrate consensus about the notion that a lack of workforce qualifications is a shortcoming that undermines the national economy’s competitiveness and sustainability. An analysis of the employed labor force structure shows that the overall labor supply in Morocco is characterized by a low level of qualifications. The latest figures from the National Employment Survey reveal an over-representation of uneducated or poorly educated workers and a minority of highly educated workers.

Chart 6 - Structure of the employed adult labor force per level of education (%)

Source: HCP, National Employment Survey

Chart 7 - Share of graduates among employed persons per economic activity in 2014 (%)

Source: HCP, National Employment Survey

In addition to education, other aspects can influence the quality of the labor force available in the labor market and consequently labor productivity, notably unpaid employment, precarious employment, and underemployment.

4. Moroccan economy affected by rigidities

Is the Moroccan economy affected by rigidities? Has the presence of such rigidities been the source of low productivity gains, distortions in the allocation of production factors, and the slowness of transformation in the productive base? The economic literature indicates that the more rigid a country is, the more likely that the impact of shocks will be prolonged in time, and the slower the transformation rate of productive structures.

Usually, three analysis angles are highlighted in order to understand these rigidities: prices, wages and the labor market.

Prices are considered rigid if they do not adjust quickly to changes in economic conditions. A high degree of rigidity favors a mechanism through which exogenous shocks can significantly affect productive dynamics and real activity as a whole.

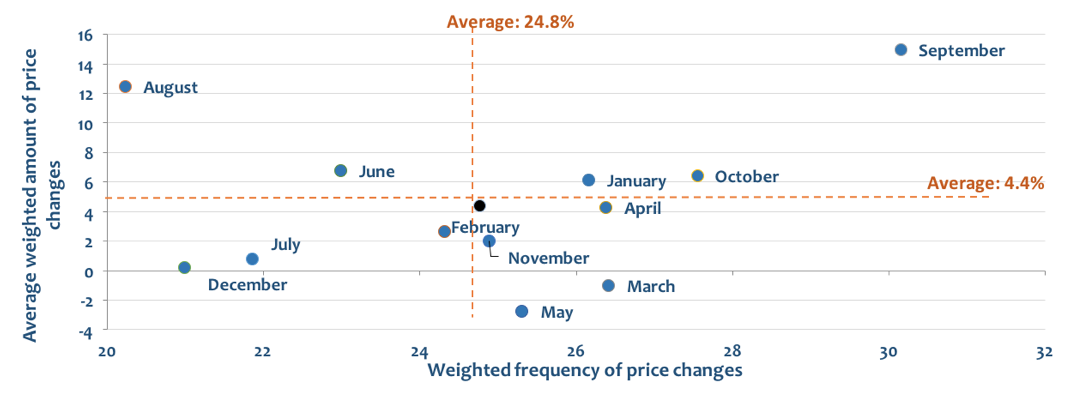

In Morocco, food products play a major role in price volatility. With a weighting exceeding one third, these products contribute significantly to the fluctuation of consumer prices. Indeed, the average frequency of product price changes is 61% during the period from January 2007 to December 2014. In other words, each month, 6 out of 10 prices are modified. If food and non-alcoholic beverages are excluded, the average frequency of price changes is 24.8% per month, equivalent to less than 3 in 10 prices that are modified. These differences clearly reflect food products’ high weighting in the price change frequency volatility.

For non-food products, the price adjustment pattern is characterized by downward rigidity. Indeed, the variations observed in the consumer price index of non-food products are due, on the one hand, only to a size effect (intensive adjustment margin) and frequency effect (extensive adjustment margin) and, on the other hand, seasonal effects (corresponding to September and August) during which we observe a peak frequency of price increases.

Chart 8 - Seasonality of frequency and size of price changes

Calculated from HCP data

Wage rigidity would limit adjustments in the labor market and, in the event of a shock, could constrain the reallocation of labor among the different sectors of activity. Statistical analysis forecasts the conjecture of rigidity with downward nominal wages. The presence of these rigidities has a constraining effect on wage changes and, consequently, narrows the adjustment margins when negative shocks occur.

Businesses in Morocco therefore use employment as an adjustment mechanism by adapting the labor volume and the work pace as the economy dictates. Such rigidity would have negative repercussions on both the unemployment rate and the national economy’s growth potential, since it amplifies the fluctuations in output and employment.

The labor market is considered rigid when firms have insufficient margin to adapt the volume of labor, the pace of work, and production methods to the changes imposed by their environment. The rigidity of the labor market hinders labor mobility between the various sectors of activity and is consistent with a higher level of unemployment.

An analysis of employment statistics shows that four non-tradable sectors (primary, construction and public works, trade and general administration, and social services) appropriate about three-quarters of the labor force available in the labor market, thus reflecting the high concentration of employment in low value-added sectors. The stability of this concentration over time is synonymous with the absence of a proven process of reallocating labor from less productive to more productive sectors.

The Moroccan labor market is also characterized by "slow" and "unskilled" flexibility. The "slow" character refers to the employment level adjustment rate to the cycle of activity, which requires a period of 20 quarters for the actual job to be adjusted to the desired job, whereas this period is only 6 quarters on average in the countries on the northern shore of the Mediterranean.

Table 4 - Period for adjusting employment to GDP (in quarters)

Source: Natixis, Flash Economie, 2015, No. 456

The "unskilled" character is linked to the fact that labor mobility is only low, and to a large extent, concerns the least qualified. The slowness of the average adjustment period for employment is also accentuated by the very large mismatch between job offer and demand.

The Moroccan economy is therefore affected by rigidities. These rigidities reduce the possibility for Moroccan companies to adapt to changes in their economic activity and to the various exogenous shocks. They also hamper the dynamics of the economic system, a more efficient resource allocation, and the full utilization of production capacity.

In conclusion, two qualifiers can be attributed to the capital accumulation regime in Morocco: productive distortions and economic rigidities. Over time, the persistence of these two powerful constraints will have the same effects in the future and could structurally undermine the productivity of the national economy and curb the force of creative destruction with all its implications for the competitiveness of the national productive fabric.

Our growth regime should move more towards a regime of "intensive accumulation" and initiate a productive dynamic in which production conditions are systematically transformed in order to significantly boost productivity gains. This would be possible, in particular, by orienting our industry around productive ecosystems rather than the creation of new family enterprises that are already preponderant in the national economy.

Our growth regime should move more towards an "intensive accumulation" regime and initiate productive momentum where production conditions are systematically transformed in order to significantly boost productivity gains. This would be possible, in particular, by orienting our industrial fabric around productive ecosystems rather than the creation of new family enterprises that are already preponderant in the national economic fabric.

Our growth regime would also benefit from effectively removing the structural rigidities that are affecting the economy today and introducing more flexibility so that firms, particularly in sectors exposed to international competition, can better adjust and adapt to the upheavals of the economic situation and demand requirements.

A successful transition to an intensive and flexible capital accumulation regime will also depend on the decision-makers’ ability to ensure a better coordination of public policies and, above all, to help evolve institutions by setting up incentives and monitoring and evaluation mechanisms that would ensure the most efficient use of public capital.