Morocco’s Green Energy Opportunity

Morocco’s energy landscape has been changing rapidly over the past decades. Population growth, industrialisation and rising living standards that have been accompanied by rising access rates to electricity as well as high rates of rural-urban migration have all contributed to Morocco’s growing energy needs. Neighbouring oil and gas-rich Algeria in the east and energy-hungry Europe in the North across the Mediterranean Sea, Morocco has historically traded agricultural products but imported virtually all of its primary energy resources in the absence of significant own oil and gas reserves.

Introduction

Morocco’s energy landscape has been changing rapidly over the past decades. Population growth, industrialisation and rising living standards that have been accompanied by rising access rates to electricity as well as high rates of rural-urban migration have all contributed to Morocco’s growing energy needs. Neighbouring oil and gas-rich Algeria in the east and energy-hungry Europe in the North across the Mediterranean Sea, Morocco has historically traded agricultural products but imported virtually all of its primary energy resources in the absence of significant own oil and gas reserves.

This traditional way of ensuring access to low-cost energy has supported Morocco’s socio-economic development model for many decades, but a number of developments have prompted Moroccan policymakers to reconsider the vast role played by fossil fuels in its domestic energy mix, including:

- the rising and cost of oil and oil products from international markets during the 2000s up to mid-2014 when global oil prices collapse;

- the resulting fiscal and exchange rate burden of importing large volumes of oil in particular from international markets; and

- the in parallel falling cost of renewable energy technologies, in particular solar photovoltaic (PV), concentrated solar power (CSP) and wind power, resources Morocco holds plenty of.

External funding mechanisms coupled to European and other international incentives in the context of promoting climate-friendly, emissions-reducing energy technologies and the idea of cross-regional electricity trading – such a bringing North African “desert energy” to Southern Europe – that emerged during the 2000s served as important initial building stones to incentivising Morocco to invest in North Africa’s first and to date most important set of renewable energy projects.

Using Morocco’s strategic assets – its strategic geographic location at the interception of Europe, North and West Africa and the Middle East; its political stability and its long-lasting well-established relations with neighbouring Europe; its domestic market size, which is one of Africa’s largest markets for energy; and its abundance in its still under-utilised renewable energy resources solar and wind power – Morocco can benefit from a domestic clean energy transition. In addition to the desired effect of using the country’s substantial renewable energy resources to reduce fossil fuel imports and increase domestic energy security through more reliance on domestically produced energy, renewable energy also has potential other, long-term benefits for Morocco, including the creation of a domestic servicing and manufacturing industry that can one day provide valuable jobs for young Moroccans.

1. Morocco’s domestic energy market: a brief background

Morocco is North Africa’s fifth largest energy market that has grown considerably in recent years; between 2002 and 2012, total primary energy supply increased by over 50% (Figure 1). Morocco’s status as a lower middle-income country reflects its energy profile; with an average per capita rate of energy use, a measure of energy consumed, of around 560 kg of oil equivalent, Morocco is statistically no large consumer of energy. But as with all statistics, reading these averages needs to be done with care. Morocco is characterised by large differences in living standards and energy use patterns between urban centres and the countryside, as well as between its different regions. Large cities such as Casablanca, Marrakech, Rabat and Tangier grow quickly as more of the rural populations migrate into urban areas, while industrial clusters along the Atlantic coast, and touristic areas across both coast sides of Morocco imply vastly different energy needs than those in the countryside.

Figure1. Total primary energy supply in Morocco, 1973 – 2012

Source: IEA (2014)

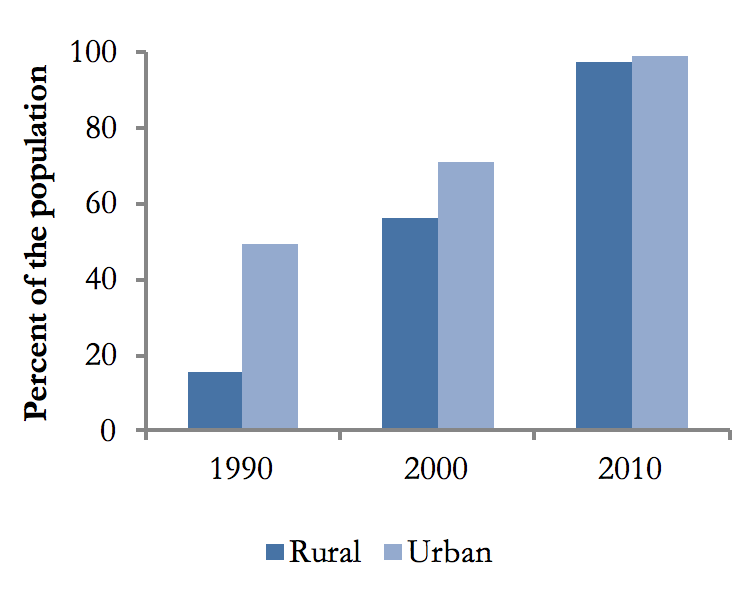

Morocco has also witnessed the rapid increase of electricity access throughout the 1990s and 2000s, when the government systematically expanded electricity access across rural areas. Morocco invested over MD24bn ($2.9bn) in the period of 1996 – 2012 into rural electrification, bring access to modern electricity to an estimated 12 million people in more than 39,000 villages, including through the use of off-grid renewable and hybrid sources of energy (El-Katiri, 2014b). The success of the programme meant electricity access across Morocco rose over the same period of time from 22% in 1996 to some 98% of the population by the end of 2012 (Figure 2).

For this reason, combustible sources of energy, traditional biomass, continues to play a role in many rural areas, although basic electricity access is now available in most remote areas. Morocco’s rural electrification programme PERG (Programme d’Electrification Rurale Global) is in this context a major success story in rural electrification, including due to its use of renewable technologies – where suitable – to power local off-grid communities.

Figure 2. Electrification rates, 1990 – 2010

Source: World Bank (2016)

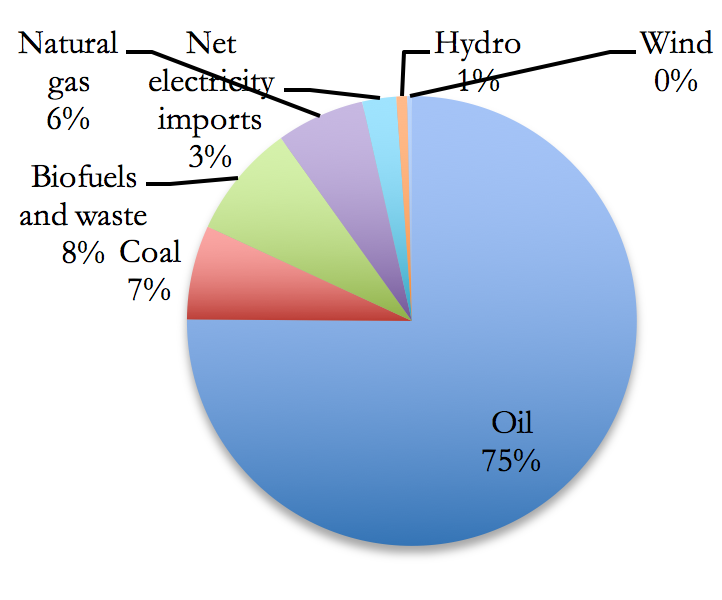

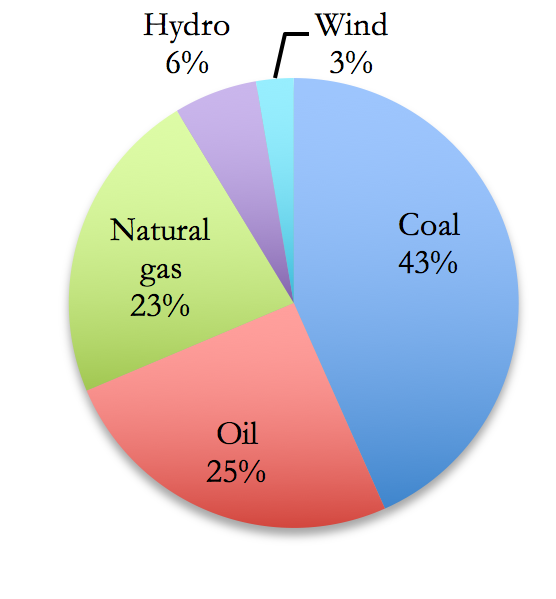

Morocco’s domestic energy mix remains heavily dominated by fossil fuels, particularly on oil. Oil supplies over two-thirds of Morocco’s primary energy needs, followed by coal (16%), and biomass and waste (7%) (Figure 3). Coal dominates electricity generation with over 40% of total production, followed by oil and natural gas (Figure 4). Another 15% of power production is generated by renewable energy sources, primarily large hydropower owing to Morocco’s long-standing reliance on dams to help generate a share of its electricity. Renewable energy sources, primarily solar and wind power, have recently entered Morocco’s market, and contribute a rising share of the country’s electricity needs. Electricity generation from hydropower has nearly doubled and wind power tripled since 2002 (IEA, 2013b). Most future renewable projects are likely to be either solar or wind-related as Morocco has largely exploited its large hydroelectric potential to capacity.

Figure 3. Morocco’s total primary energy supply (TPES), 2012

Figure 4. Morocco’s electricity generation mix (%), 2012

Source: IEA (2014)

Morocco, like Tunisia, is untypical in North Africa in that it holds only very limited own oil and gas resources. Being in the immediate neighbourhood by long-standing energy exporters Algeria, Libya and Egypt, Morocco relies for over 90% of its domestic energy needs on energy imports, all of them fossil fuels as well as electricity from Spain (IEA, 2014). Oil and coal are general imported from international market, prices of which fluctuate, particularly in the case of crude oil and petroleum products, along global price shifts. In 2014, Morocco imported over US$11 bn worth of energy products, about 10% of its nominal GDP that year (MF, 2016a).

Climate change adaptation and Morocco’s carbon footprint

Morocco is vulnerable to climate change induced changes to weather, precipitation, desertification as well as urban air and water pollution. IEA data suggests “a clear progression of the semi- arid climate towards the north”, a trend which the agency sees will worsen in Morocco throughout the 21st century (IEA, 2014: 27; see also Ministry Delegate of the Minister of Energy, Mines, Water and Environment, 2014; Department of Energy, 2009). Overall rainfall in Morocco has been reduced in recent years by between 3-30%, in line with more frequent droughts, hitting particularly the country’s agricultural sector (IEA, Ibid). The Department of Energy foresees an increased frequency of droughts in the southern and eastern provinces in the future, along with greater risk for thunderstorms and reduced snow in the Atlas mountains (Department of Energy, 2009). In addition, climate-oriented policy action offers Morocco the opportunity to seek access to finance for green technologies via mechanisms such as climate funds.

Morocco ratified the 1992 United Nations Framework Convention (UNFCCC) in 1995 and the Kyoto Protocol in 2002. It also hosted the seventh session of the Conference of the Parties (COP 7) in Marrakech in 2001, which enacted the Kyoto Protocol. In preparation of the previous round of negotiations, COP 21 in Paris in December 2015, Morocco was the first Arab country to submit its INDCs (or Intended Nationally Determined Contributions). Morocco’s role in hosting the next session, COP 22, in November/December 2016 in Marrakesh will undoubtedly be another opportunity to strengthen its role in contributing towards positive and constructive global climate change negotiations and the enactment of green, environmental and climate-friendly policies, including domestically.

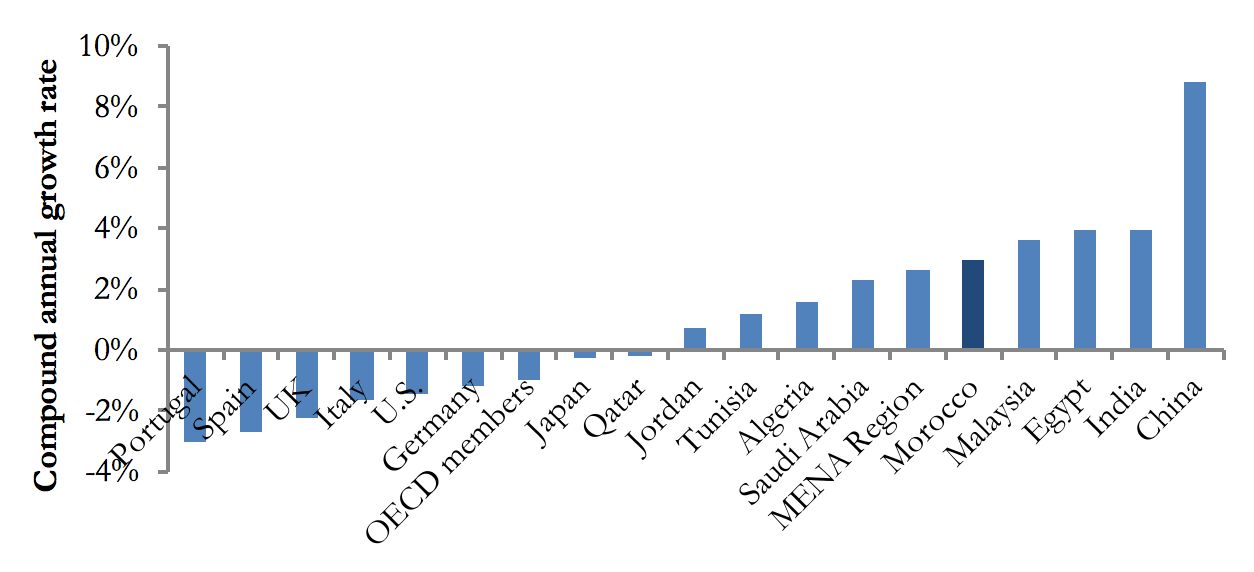

Morocco’s fossil fuel-based energy mix coupled to rising energy and electricity consumption, has meant that the country’s carbon footprint has been growing rapidly in recent years (Figure 5).

Figure 5. Compound annual growth rate in CO2 emissions in selected countries, 2002 -2011

Source: Author, based on World Bank (2016)

Albeit with around 1.74 metric ton per capita still at the lower range – which largely reflects Morocco’s comparably low levels of electricity consumption on a per capita basis. Morocco epitomises the challenged faced by middle-income developing countries in positioning themselves within global climate negotiations in a way that does equal justice to climate change concerns and domestic development objectives, including universal access to affordable energy.

3. Morocco’s green energy opportunity

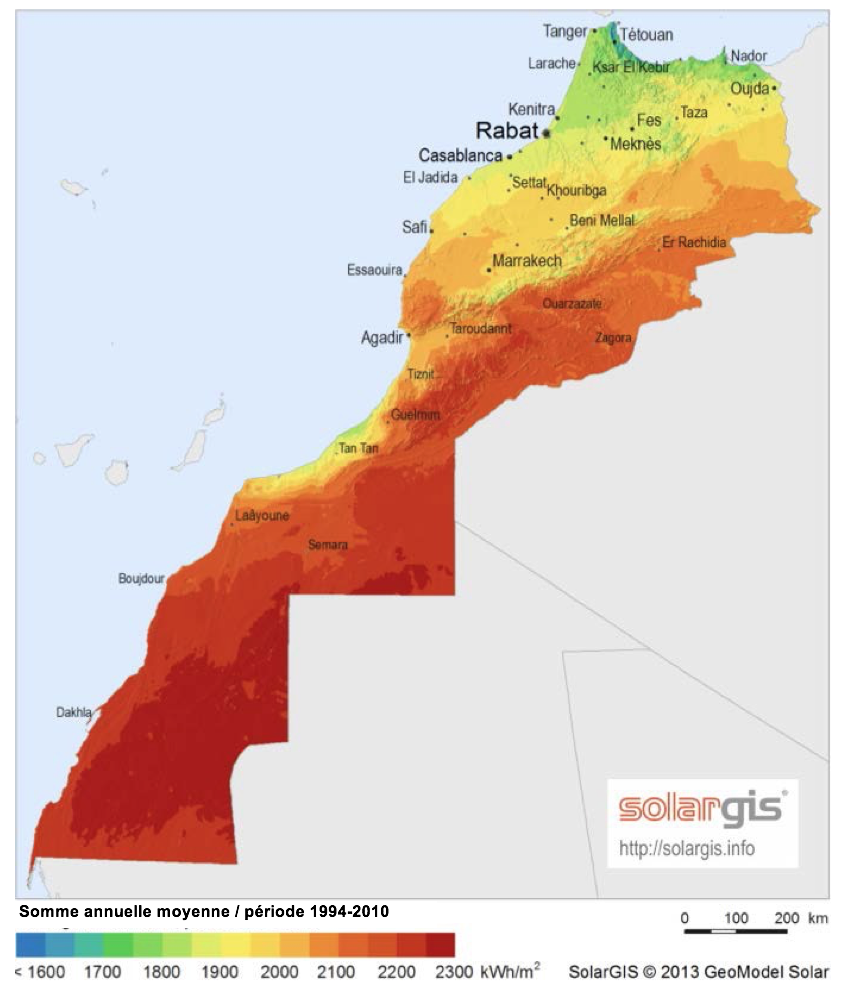

Morocco’s renewable energy potential is undeniably large. Morocco has significant potential for solar energy, with irradiation levels in a range of 2,300kWh/m2/yr (Figure 9), particular in the south and east of Morocco; while the country’s Atlantic coast offers superior wind speeds of above 6 m/s (OECD, 2013: 111; Société D’Investissements Énergétiques, 2016). A study conducted by the Centre du Développement des Energies Renouvelables (CDER) with the GTZ suggests Morocco’s wind potential lies at 5,290 TWh/yr (2,645 GW), with a technical potential for 3,264 TWh/yr (1,632 GW) (OECD, ibid; see also IRENA, 2013).

Morocco is also part of a region that, overall, proves to be one of the most conductive areas for the generation of solar power, particularly CSP – both in terms of the resource potential and its geographic conditions, including “abundant sunshine, low precipitation, and plenty of unused flat land close to road networks and transmission grids.” (CIF, 2009: 5) Morocco is as part of North Africa also strategically located at the interception of different regional markets between Europe, the Maghreb-Mashreq interception, and Sub-Saharan Africa. Morocco’s electricity grid, like that of North African neighbours Algeria and Tunisia already operate to European grid standards synchronously, facilitating electricity trade between the two shores of the Mediterranean. As a result, the Clean Technology Investment Fund’s investment plan for North Africa specifically notes that

“no other region has such a favorable combination of physical and market advantages for CSP.” (CIF, 2009: 3).

A recent technical study by Fraunhofer Institute confirms that North Africa’s technical renewable energy potential for the years 2030 to 2050 as a whole exceeds the combined assumed electricity demand of North Africa and Europe by 2050 by a large factor (2016: 8). Data by Fraunhofer further suggests that wind, CSP solar PV combined could cover the entirety of North Africa’s electricity needs by this time alone (Fraunhofer, Ibid). Exploiting this potential, according to the study’s underlying model, could have significant economic benefits for the entire North Africa region in the long-term.

Global horizontal solar radiation in Morocco

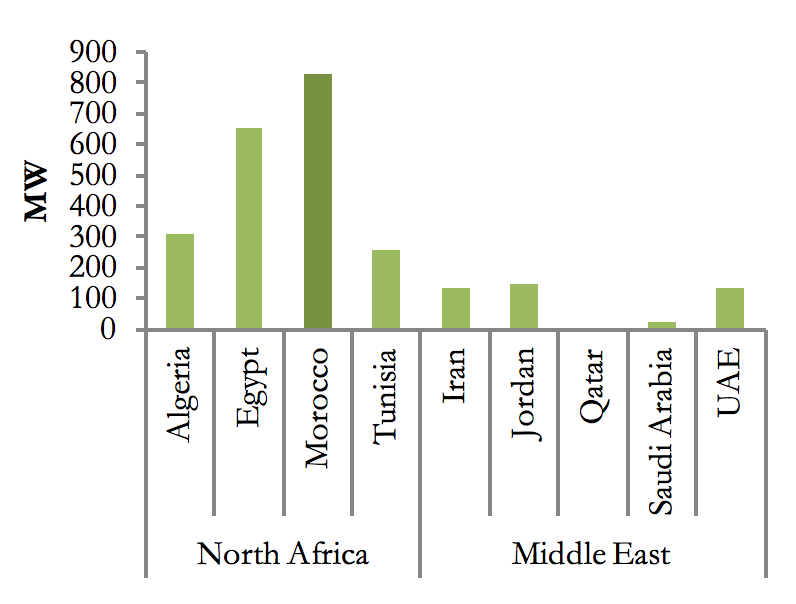

Morocco’s options for renewable energy applications are far-reaching. The primary focus area of Moroccan policymaking is utility-style production. Morocco is already harnessing renewable energy and currently leads regionally in terms of installed capacity for non-hydro electricity. By the end of 2015, Morocco had around 800 MW of installed generation capacity for total wind and solar power, the largest in the Middle East and North Africa (Figure 6). The launch of Ouazazarte’s Nour I CSP plant in early 2016 should add considerably to this capacity, leaving Morocco far ahead as North Africa’s single largest producer of wind and solar energy. Morocco’s total production of renewable electricity output has subsequently risen sharply in recent years, doubling between 2012 and 2013 (Figure 7) alone with a further sharp rise expected for 2015/2016 for which no official data is yet available.

Figure 6. Renewable energy capacity in the Middle East and North Africa, excluding Hydro, 2015

Source: Author based on data from IRENA (2016a)

Figure 7. Renewable electricity output (excl. Hydro) in selected Arab economies

Source: Author based on data from World Bank (2016)

Utility-scale deployment

Morocco has ambitious plans to further harness renewable energy sources more systematically, as part of the government’s plans to reduce its country’s dependency on imported fossil fuels from international markets. Formal plans include the installation of a total of 2GW of wind and 2GW of solar power generation capacity by 2020 – bringing renewable energy capacity in power generation to above 40% of the total energy mix (Ministry Delegate of the Minister of Energy, Mines, Water and Environment, 2014) and further cementing Morocco’s regional position as a leading producer of renewable energy in the MENA region. In addition, Morocco’s submission to the UNFCCC as part of its INDCs includes the objective to reach 50% of installed electricity generation capacity from renewable sources by 2025 (Kingdom of Morocco/UNFCCC 2015).

A particularly important role is in this context played by CSP technology, for which Morocco and North Africa offer a globally highly competitive location (CIF, 2009; Fraunhofer, 2016). Large-scale utility level investment into CSP in Morocco could in this context have significant benefits not only for CSP technology in North Africa, but globally in terms of helping accelerate global CSP deployment, thereby reducing technology costs through manufacturing economies of scale and learning effects. The World Bank’s 2009 Clean Technology Fund’s investment plan in North Africa specifically acknowledges this potential for significant deployment additions to be of significance beyond the region:

“CSP is a technology that is of particular interest to utilities, but with unexploited manufacturing scale economies: CSP could be cheaper relative to PV on a per kWh basis in most cases and is more scalable and more consistent with a centralized and dispatchable generation model. Its adoption and replication by utilities is therefore more assured. CSP is a relatively simple technology with few high-cost materials or proprietary components. If the demand for CSP is scaled up, then equipment costs can fall very substantially, since it has yet to benefit from cost savings that often come from manufacturing scale.” (CIF, 2009: 3)

This reasoning has also played a role in the allocation of significant financial resources through the Clean Technology Fund into CSP in Morocco, though this financing remains below potential in Morocco. Maximising this potential for Morocco will require a further, proactive policy of pursuing precisely this advantage, securing external finance for Morocco to become a demonstration case for CSP applications and cost down-driver for the technology.

Rooftop schemes

Another potent, though not yet overly explored area of renewable energy deployment in Morocco, is the use of solar PV for rooftop installations – both for the purpose of electricity generation and for solar water heating. Morocco’s solar resources are plentiful and suitable for solar PV, and the technology for rooftop installations is easily accessible, making schemes for the promotion of rooftop solar programmes, as used for instance in Europe (see Box 3 with background about the German model). Such schemes could be transferrable to Morocco’s context, for use in both urban and rural areas. Financial aid schemes such as government loans and technological assistance to rural communities could make the initial investment feasible for Morocco’s middle class, making the scheme feasible in quantitative terms.

Widespread home ownership in Morocco, including among lower income households and in rural areas, means incentive structures for feed-in-tariffs (FIT) could be high – with a loan scheme at hand and guaranteed FITs for households feeding surplus electricity production back into the grid, and in view of Morocco’s considerably higher solar irradiation intensity than in Germany, rooftop solar in Morocco could make long-term economic sense for many Moroccan households. Lower income homes, in turn, could be incentivised to install rooftop solar panels with the help of loans structured to account for their lower income – with realistic prospects for households to recover their initial investment eventually over time through FIT premiums and the lower cost of electricity.

Morocco’s electricity tariffs are high in the context of the Middle East and North Africa, at 2013 rates of US$0.122/kWh for intermediate consumption and US$0.167/kWh for higher consumption brackets comparable to lower-cost European electricity. At this rate, savings made in electricity bills through lessened grid consumption and the sale of surplus electricity generated into the grid, this could provide a viable alternative even to low-income Moroccan households to the current model; while a high uptake rate of PV rooftop installations can, as in the German case, contribute significantly towards national goals such as articulated through Morocco’s INDCs to the UNFCCC in December 2015 of boosting the country’s renewable energy capacity to 50% of the country’s electricity mix by 2025.

Off-grid opportunities

Solar and small-scale hydropower offers tremendous potential in Morocco to address electricity access in remote off-grid areas. Morocco’s rural electrification programme PERG (Programme d’Electrification Rurale Global) has since the 1990s shown tremendous results in providing rural communities that could not be connected to the country’s main grids with access to electricity (El-Katiri, 2014a, b). PERG has operated on the basis of chosing local solutions based on local contexts: the programme reviewed local conditions to assess the viability of alternative solutions such as photovoltaic generators, small hydro turbines, wind turbines, diesel generators, and hybrid systems. Over a period of 15 years, more than 35,000 villages and some 1.9 million rural households were electrified, lifting rural electrification rates to from as low as 18% in 1996 to 97 per cent by 2009 (Agence Française de Développement, 2013).

Solar, wind and hydro power offer real advantages to rural communities over exclusive reliance on conventional fuels, because the energy source itself is independent from access to transport roads, and hence outside help. Work accompanying similar schemes in Jordan revealed that many rural communities welcomed the introduction of cleaner and supposedly low-maintenance PV generators, which avoided the running costs associated with diesel fuel (Al-Soud and Hrayshat 2004: 593).

An additional benefit of renewable energy off-grid systems is that installation and maintenance can be trained among a local stock of people, helping locals learn new skills, and help maintain their local communities. For sure, variable renewables such as wind and solar power have limitations, most importantly their lack of 24-hour coverage. Hybrid systems using diesel generators as a backup solution has been one main response in the framework of PERG – using solar and wind power when possible while relying on conventional fuels when necessary. For rural communities in particular, there would also be plenty of potential for R&D within Morocco to explore more economic forms of electricity storage, including village-based mini-grids that run on the basis of concentrated solar power (CSP).

Green job creation

Diversifying into renewable energy technologies and associated R&D could also help promote Morocco as a “green” energy hub in the region – with potential for collaborative links both with Europe in the North and Sub-Saharan Africa in South. To promote and coordinate local R&D activity, Morocco established in 2011 a separate institution, the Institut de Recherche en Energie Solaire et en Energies Nouvelles (IRESEN). Separately, the Centre de Competence Changement Climatique du Maroc (4C Maroc) was more recently as a further specialised institution aimed to be a capacity-building and information sharing platform to forge Morocco’s climate plans –there is potential here for collaboration with neighbouring countries. This institutional landscape focused on clean energy and climate change mitigation is already now unique in both North and Sub-Saharan Africa, though it will now need to be followed up by capacity building and action plans.

Morocco’s demography is generally favourable to the aim of using renewable energy for local value chain and job creation. Its population of more than 33.8 million is young, with some 45% under the age of 25 (Haut-Commissariat Au Plan, 2016). Research and development (R&D) activities would hence be as feasible on practical grounds as would be, in principle, industrial-style manufacturing given the availability of both high-skilled and low-skilled Moroccan labour force to supply both industry strands. Spill-overs from systematic renewables deployment could also be expected for related sectors in Morocco such as construction, transportation, research and service industries (Marktanner and Salman, 2011; El-Katiri, 2014a).

Estimates by IRENA suggest the entire North Africa region could have the potential for around 16,000 jobs in renewable energy (2016: 11), a positive outlook given the comparably low new local job creation potential for conventional energy sources. An earlier World Bank study put the job creation potential significantly higher, at around 50,000 new local jobs for manufacturing components by 2025 in CSP component production alone between the five MENA economies Morocco, Algeria, Egypt, Tunisia and Jordan by 2025 in CSP component production alone (World Bank/ESMAP, 2011).

Maximising opportunities

Financing. To maximise its use of these resources and to take up the vast opportunity Morocco faces in green energy – in particular in Concentrated Solar Power (CSP) – Morocco will need to add further policy focus on the area, and work actively to secure finance options, including from external sources. One key priority area is the opening up of sufficient financing options for Morocco, particularly in the area of CSP at large scale, and in which Morocco has considerable potential to drive down technology costs globally if it is able to expand its CSP deployment in line with its potential.

A major potential source of finance for Morocco’s green energy programme, alongside other clean energy transitional measures will be the Green Climate Fund (GCF) as established by the parties to the UNFCCC at COP 16 in Cancun in 2010. The Paris Agreement that has been adopted by 196 parties to the UNFCCC in Paris in December 2015 recognized the importance of adequate and predictable financial resources for the implementation of developing countries’ climate mitigation and adaptation programmes (UNFCCC, 2016a). Importantly, the meeting also emphasized a range of climate-related activities that could further help broaden Morocco’s commitment to greener development, including tackling deforestation and forest degradation, conservation management, and encouraging the coordination of support from private, public, bilateral and multilateral resources (UNFCCC, Ibid).

Clean energy developments in Morocco may also benefit substantially from other external funding options. The Clean Development Mechanism (CDM) is one potential source of financing was designed under Article 12 of the Kyoto Protocol to assist specifically developing countries in emissions-reducing projects that are counted towards these countries’ set Kyoto targets. It is also the main source of funding for the Kyoto Protocol’s Adaptation Fund (AF) aimed to assist countries that are particularly vulnerable to the negative effects of climate change (UNFCCC, 2014). Problematic alone is that the CDM alone only covers a share of the total investment required – around 10% - and requires specific expertise (Hafner and Tagliapietra, 2013).

Capacity building. In addition to financial requirements, Morocco also faces a range of other challenges, including institutional capacity building. Key to leveraging on Morocco’s green potential within the institutional landscape in Morocco now will be the distribution of clear mandates, as well as a responsive mechanism of consulting, managing and implementing a legislative environment that proves conductive to the creation of innovative industries and R&D. A critical role within this framework will undoubtedly be played by the private sector, ranging from manufacturing to financing of project, installation, operation but also technology research. Managing this complex transition will require many institutions to work together transparently, ensuring credible investment decisions and accountability in the way public funds and foreign investment are channelled into new projects.

Cross-regional clean energy trade. Morocco would also offer itself within the North African context as a key trade partner with Europe, owing to its political stability. Having been largely spared by the political upheaval other parts of North Africa have experienced since the onset of political uprisings, the Arab Spring in Tunisia and later Egypt and Libya, Morocco also holds politically close relations with European member states. Trade agreements with Europe exist in other areas such as agricultural products and textiles, which are based on principally the same logic future agreements on solar energy could be based: lower cost production in Morocco, traded into the European Union to reduce costs for European customers as well.

Despite past difficulties, the reality remains that North African – including Moroccan – wind and solar power offers competitive advantages over those found in Europe. The OECD confirms that solar intensity in most of the countries in the MENA region is above that in France (OECD, 2013: 46). According to DLR data, Morocco’s technical potential for solar thermal electricity generation exceeds with around 20,151 TWh/yr the technical potential of Spain by a factor of twelve, and of Portugal by a factor of 46; Morocco’s economic potential at a DNI > 2,000 kWh/m2/yr is with 20,146 TWh/yr almost as high as its technical potential (DLR, 2005). And Morocco’s direct normal irradiance (NDI) rates are around 18% higher than those of Spain (DLR, Ibid), providing Morocco with an economic advantage over Southern Europe with regards to CSP potential in particular.

To facilitate trade, Morocco not only need clean investment finance, but also, and perhaps foremostly, equal-level market access to European utility markets. This is currently not the case, as the continuation of European policies such as subsidies for their domestic renewable energy producers protect European markets from potentially lower-cost competition from external markets such as North Africa. In the coming decade, exploring options for Europe to open its market to North African clean energy as part of its commitment to, for example, the principles of the UNFCCC and the Paris Agreement’s provisions to lower the EU’s greenhouse gas emissions footprint, could provide a major investment incentive into clean energy in North Africa – with or without the need for additional financial loans and aid packages. Furthering such investment systematically in the future could hence benefit both European and Moroccan climate and clean energy pledges.