A chequered African history of commodity markets, part one: bauxite and aluminium

History has always been patterned by commodities, from the early Iron or Bronze Ages to the silk road, from the Gold rush to the late shale gas revolution. Albeit not a raw material that often hits the headlines akin to oil or gold, aluminium is no exception to this rule. The aluminium industrial era can be traced back to the beginning of the twentieth century when the electricity required to produce this metal became cheaper and when industry realized its potential and started to consider it as an attractive alternative to steel due to its attractive physical properties (lightness, strength at low temperature, good conductivity, resistance to corrosion). Aluminium is extracted from bauxite, an ore that usually contains around 35-40% of aluminium oxide, aka bauxite. As a rule of thumb, four to five tonnes of bauxite will provide two tonnes of alumina, which will in turn be transformed via electrolyse into one tonne of aluminium at an energy cost of 14,000 kwh. Despite being the most abundant metallic element on earth, bauxite is particularly present in Africa with 32% of proven world reserves, mostly in Guinea, the world’s richest holding country where high grade ore is available. Operated by the Bauxite Company of Guinea (CBG), the Sangaredi mine, aka the Boke mine, is the biggest mine in the country accounting for more than 80% of total output. With productions close to 800,000 and 620,000 metric tonnes in 2013, Ghana and Sierra Leone are respectively the second and the third largest African producers, far behind Guinea, Australia and China, the world’s top producers.

Graph 1: Top world producers of bauxite (2013, 000s of MT)

Source: US Geological Survey

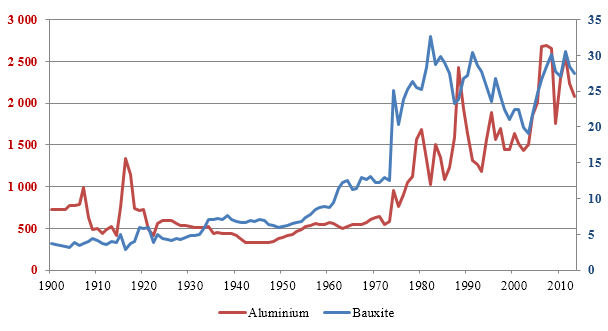

This African endowment in bauxite is, though, a mixed blessing and African countries are a long way off from fully benefiting from the windfall it could potentially generate. There are two reasons why. Firstly, they export unprocessed ore while there is a huge discrepancy between bauxite and aluminium prices (graph 1a). The annual US price of bauxite per tonne hovered around 27USD in 2013, whereas aluminium prices remained close to 2,000 USD per tonne over the same period after approaching 2,700 USD in 2006. The production of aluminium is indeed highly energy-intensive and the complexity of the smelting process requires a qualified labour force. It explains both the high price difference and why alumina and aluminium productions are not necessarily located near production areas, more in countries with abundant and cheap electricity sources and low-cost qualified labour. Guinea, which was the world’s fifth biggest producer of bauxite, has for instance only one alumina factory that in 2012 produced no more than 0.2% of the world’s demand for alumina.

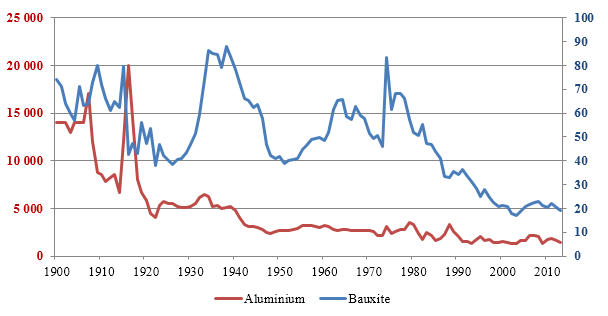

Secondly, the golden age of aluminium seems to have come and gone with both a long term ebb in real prices and an increase in volatility from the end of the 1970s onwards. From this perspective, 1978 should be considered as a seminal milestone in the aluminium timeline, with the launch of a future contract by the London Metal Exchange (LME) paving the way to a new era of financialisation and instability (graph 2a). Aluminium prices have come to be highly reactive to ever-changing market conditions. Driven by soaring demand from the transport equipment and building construction industries, prices climbed at the end of the 1980s in particular and triggered an increase in supply capacities, especially in China. As a result, prices remained relatively low until the 2000s, when aluminium entered the so-called notorious “commodity super-cycle”. Prices indeed went through the roof with a peak on the 11th of July 2008, when they approached 3,270 USD per MT on the LME. Aside from the middle 1910s, when the onset of WWI saw historical highs (in constant USD, graph 2b), and May 1988, prices have never experienced a spike of this magnitude. But it is not only about prices, and these ebbs and flows were marked by major changes in the geographical distribution of the global aluminium industry that nowadays is a far cry from that of the pre-1970s era. The production of alumina has in particular shifted from poorly-endowed countries to bauxite-producing countries (Nappi, 2013). Nonetheless, African countries, and Guinea in particular, have not overly benefited from this evolution.

Graph 2a: Bauxite and aluminium, US annual prices (1900-2013, USD/T)

Graph 2b: Bauxite and aluminium US prices (1900-2013, 1998 USD/T)

Source: US Geological Survey

The African history of bauxite and aluminium is quite recent and started in the early 1950s, when demand exploded, partly because of the Korean War and, consequently, when European and North-American companies or consortiums began to prospect Guinea, Ghana or Cameroon for investment (Lesclous, 2002). Although Alcan had mining concessions on the Loss Islands in the early 1920s, the Guinean saga for this Canadian group indeed really began with the discovery of the renowned Boke ore field in 1952. From this time on, Guinean willingness to process bauxite was explicit but was, with rare exceptions, constantly rebuffed by the multinationals operating in this country (Lesclous, 2002). In fact, the first and only Guinean alumina plant was opened in Fria by the French group Pechiney in 1957. Since then, the company has undergone a number of developments: turned into a semi-public company in 1973 with the republic of Guinea and the international consortium Frialco, sold to the Guinean government in 1998 to become the Alumina Company of Guinea, then resold to the Russian Rusal in 2006. At the beginning of the 1950s, Guinea was not the only country the mining groups had designs on. Two countries have stood out: Ghana and Cameroon. In Ghana, the Volta River Project led to the creation in 1965 of the Akosombo dam, whose main purpose was to provide electricity to the Volta Aluminum Company’s (VALCO) aluminium smelter which, in turn, was expected to provide enough revenues to mine the local bauxite resources in Aya-Yenuhin and end alumina imports. For its part, the history of aluminium in Cameroon began in 1957 when Alucam, a smelter, was established in Edea as a joint-venture to tap onto the existing hydroelectric plant located on the Sanaga river. For these countries and many others in Africa, much less capital-intensive facilities to process aluminium, from the manufacture of kitchenware to the production of corrugated sheets, have also been established to meet the continent’s growing demand for aluminium. Due to its economic potential, South Africa was at that time a preferred destination for investments with the mining giants. In 1949, Alcan established the country’s largest processing facility whereas the Republic Aluminium Company, a subsidiary of the American corporation Kaiser, was set up in 1962. It was not the only country to benefit from the market development of aluminium, and Alcan, albeit challenged by American producers, has proved to be the most dynamic company in this area with several subsidiaries, examples being in Nigeria and Ghana. The first plant in Guinea producing aluminium end products was, for its part, set up in 1966 by the American Harvey Aluminium.

As always with producing countries, a significant endowment in a raw material can cut two ways, entailing the need not only to limit an economy’s dependency on the commodity sector, but also to manage the fiscal instability that arises from fluctuations in export prices. According to the famed “natural resources curse” (NRC), the dynamism of the mining sector is not a token of economic prosperity and development. Guinea is no exception. Notwithstanding its huge reserves in bauxite and hydroelectric potential, it remains one of the poorest countries in the world. This paradoxical situation has spawned a number of analyses, whose conclusions often point to the backdrop of “political unpredictability” as the main reason for this economic backwater. Admittedly, the regime’s stability is an inescapable condition to attract international investors, who need to be sure that substantial investment in production facilities and hydro-power complexes will produce the expected return in the long run, but there is more. The scaling up of Guinean production is also tied to the power play with aluminium giants, as it always has been in this industry. The production of primary aluminium was dominated by the multinationals mentioned above (Alcan, Alcoa, Alusuisse, Kaiser, Pechiney, Reynolds) until the end of the 1970s. Once called the six majors, their stronghold over the market has not only determined international prices, it has also often shaped the geographical distribution of mining and smelting activities, especially on African soil. It was made even easier when this oligopoly received the implicit acquiescence of industrialised countries that saw this as a guarantee for stable prices, as demand shifts were managed by changes in capacity rates for production and inventories. Conversely, the objectives of these companies were indeed largely determined by the international environment in which they operated, and patterned the nature of bargaining with host countries. From the 1980s onwards, a number of disruptions did not make the job any easier for developing countries in general and for Guinea in particular: the soaring supply of bauxite from Australia, the collapse of the Soviet Union, which for historical and political reasons was the mainstay of Guinean export strategies, and the increasing competitive intensity of the aluminium industry. In this context and in spite of a long-standing willingness to increase local processing of bauxite ore, historically Guinea has often either held a relatively weak negotiating position or failed to aim at the right target. The 1980s in particular saw Guinea join what proved to be a wild goose chase to negotiate a minimum price for bauxite, a move that over the long term was doomed to fail (Campbell, 1993).

Guinean political will to pass over dependence on unprocessed ore exports remains intact. In 2006, the government of Guinea and Rio Tinto Alcan set forth a framework for the development of a state-of-the-art alumina refinery but the project, although not officially abandoned, is still in limbo. However, the withdrawal of this mining group from Alucam in 2014 does not bode well. Neither does the closure in 2012 of the Rusal alumina plant in Fria. By contrast, Emirates Global Aluminium has revealed its intention to complete an alumina refinery in Guinea by 2022. As a result, and because things are not all as bright as they could be on this front, considerable efforts have recently been made to scale up ore production and bolster Guinean exports. The government’s ambition is effectively to increase bauxite production from 17 million to 40 million metric tons by 2024. For this purpose, the country’s mining code was reviewed in 2013 to encourage further foreign investments; a new bauxite exporter has emerged in the country and four agreements have been signed. Guinea has also taken advantage of the Indonesian ban on unprocessed ore in 2014 and has grown its market share in China, where resources are on the road to depletion and ore grades declining. Although it does not address the issue of economic diversification, the establishment of a Beijing-Conakry axis is undoubtedly an important component of Guinea’s export strategy in the long run. However, many contenders need to be considered as part of the global equation. While the Chinese economy has hit a spell of turbulence and at a time when global aluminium producers are cutting loss-making capacities, it is not impossible that low bidders alone will throw their hat into the ring. Guinea holds a second trump card, namely untapped rich iron ore deposits near Simandou, but the country will undoubtedly have a tough and subtle game to play out in the near future.