A chequered African history of commodity markets. Part II: cocoa

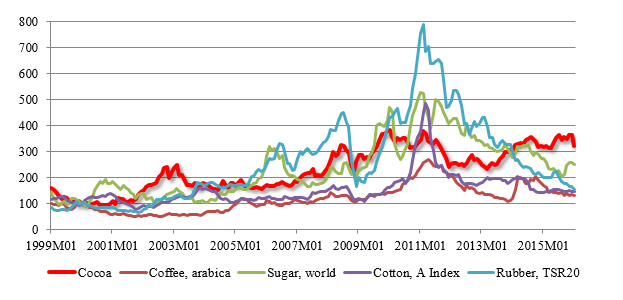

Among commodities, cocoa occupies a special place, probably because this base product for chocolate is associated, in the collective psyche, with times of enjoyment. There are, however, several other reasons to distinguish it from other commodities. Firstly, in contrast to wheat for example, cocoa beans, i.e seeds from the cocoa pod, are a “low-volume/high price” commodity. In 2013, world wheat production hovered around 711 million metric tonnes, against 4.5 million for cocoa. Cocoa is a fragile, shade and humidity loving tree which only grows within the 20° latitudes. Secondly, as shown by graph 1, in a severely depressed economic environment which has hit almost all commodity markets, cocoa stands out as an exception: average world prices jumped from 2.63USD per kg in January 2011, to 3.35USD/kg in December 2015, which represents an increase of more than 27%, whereas cotton prices plummeted by more than 59% during the same period. The fear that cocoa beans may be in structural short supply, combined with several climatic phenomena such as El Nino and the “Harmattan” cold wind which could severely hamper harvests, are two key explanations for this upward trend.

Graph 1: Soft commodities price dynamics (Indices, base 100: jan. 2000)

The World Bank (the pink sheet)

African countries represent the bulk of cocoa bean production with more than 65% of global supply in 2014. As shown by graph 2, Cote d’Ivoire is a juggernaut in that respect with more than 31% of total production, i.e. 1.4 million tonnes, whereas Ghana, Nigeria and Cameroon account for 18.2%, 8% and 6% of world production respectively. With the notable exception of Indonesia -the world's third largest producer, the rest is being produced by South and Central American countries, where cocoa history started as a beverage ingredient and trading unit more than three millennia ago, with the Olmecs and Mayan civilizations.

Beyond ancient times, it was the Hispanic conquest of the New World which rooted, under the initiative of Cortez, cocoa as a globally demanded product. The seventeenth century marked the beginning of the conquest of European markets when chocolate was a cherished beverage in many royal courts and every region’s palates on the continent, allegedly after being originally introduced at the marriage of French Louis XIII and the Spanish princess Ann in 1615.

Graph 2: Top world producers of cocoa beans in 2014

Source: FAO

Cocoa does not have such a long history in Africa since growing started on the island of Sao Tome and Principe in 1870, initiated by Portuguese settlers and missionaries. Seeds were then secretly introduced in Ghana (formerly called The Gold Coast) six years later by a native farmer named Tetteh Quarshie. The very first foundations towards West African countries' supremacy were laid, fuelled by the industrial revolution era in Europe which also contributed to reshape world production. The invention of an improved grinding process by Joseph Fry and of a hydraulic press to extract cocoa butter from cocoa liquor by Van Houten indeed contributed to reduce the cost of producing chocolate and, consequently, its retail price. All the conditions were met to foster its mass-consumption (Cidell and Alberts, 2006). Accordingly, the ever increasing demand for chocolate led historic producers to industrialize their process and consequently to encourage the growing of cocoa trees in coastal regions of Western Africa but also in Asia, where lands were abundant, soil rich, climatic conditions ideal and where the price of labour was cheap insofar as cocoa growing and harvesting could be time consuming. African export agriculture – mainly cocoa beans, but also palm oil or rubber, was born. This would gradually lead to a paradigm shift witnessing the relentless dominance of products of West African origin on world cocoa market. As highlighted by Austin (2014), Ghanaian production started in the beginning of the twentieth century, but soared so rapidly than Ghana became the world's top producer in less than two decades. In this country, production was carried out by native small-scale farmers under the impetus of British colonial administration (Leiter and Harding, 2004). The latter also encouraged the development of farmers’ cooperatives so as to improve both yield and quality.

The role played by the British in the successful development of Ghanaian cocoa remains much debated though, as they didn’t ensure the conditions for success to be met with, for example, low levels of investment in infrastructure. In fact, as stated by Hymer (1971), “the industry was developed by Ghanaian capital, Ghanaian enterprise, and Ghanaian technology, with little help from the colonial government’’ (1971, p. 141).

In some cases, British colonial rule even hampered the development of an efficient agricultural sector, promoting an inadequate judicial system and property laws. Whatever the size of producers and their efficiency, they were nevertheless confronted with large-scale buyers and exporters who held a considerable market power, a reality which hasn’t changed much over the years. In 1937, convinced that market-sharing and price agreements were prevailing among exporters, Ghanaian growers refused to sell their products for a period of five months. In 1938, the Nowell commission, named after its chairman, was consequently set up to investigate whether the marketing conditions of cocoa were appropriate. Two years later, the West African Produce Control board was established as a monopoly purchasing agency for groundnuts, oilseeds and cocoa, under the supervision of the Ministry of Food. One of its roles was to fix minimum seasonal buying prices (Blandford, 1977), but also to act as a taxation body for the government. This would give rise to two marketing boards in Nigeria and Ghana in the aftermath of WWII.

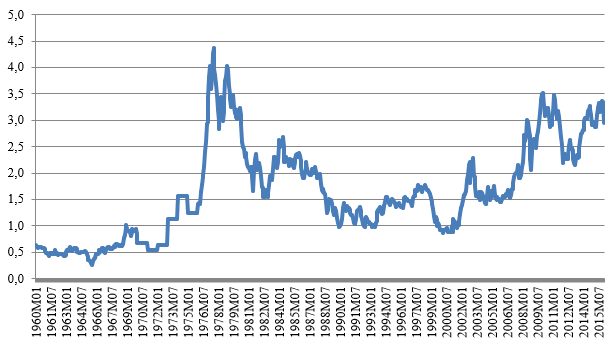

Graph 3: Long term nominal cocoa prices(USD per kg)

The World Bank (the pink sheet)

The early years of independence (Ghana in 1957, Côte d’Ivoire, Nigeria and Cameroon in 1960) coincided with low but stable prices, but this didn’t last long. As shown by graph 3, cocoa prices started to ascend in 1972, before going through the roof in the late seventies with a peak at 4.25 USD per kg in July 1977. As highlighted by Eberhart and Tail (2010), international prices are not those being paid to producers though, and substantial differences between countries, mainly due to their specific marketing mechanisms, have to be acknowledged. Under the Caisstab scheme which prevailed in Côte d’Ivoire from 1960 to 1999, producer prices were lower but correlated with world prices, which wasn’t the case in Ghana under the Ghana Cocoa Board, aka Cocobod.

With progressive market liberalization as an economic backdrop, these different marketing mechanisms, along with differences in monetary and political regimes, explained the opposite paths followed by these two countries. From 1980 to 1989, the annual growth rate for cocoa production was 8.8% in Côte d’Ivoire, against only 0.8% for Ghana. One key explanation was that Ghanaian farmers did not get much benefit from soaring international prices in the mid-seventies/early eighties owing to an overvalued exchange rate and implicit high taxes (Eberhart and Tail, 2010), whereas this fostered plantation investments in Côte d’Ivoire. However, when prices suddenly fell off the cliff and hovered around low levels in the nineties and the beginning of the millennium, Ghana's cocoa economy started to recover thanks to an exchange rate policy reform aimed at reducing the gap between the official and black-market exchange rate, as well as fiscal and market-oriented policy reforms initiated in the early eighties under the IMF/World Bank-supported structural adjustment programme. Prices paid to producers were also increased, and the quality of cocoa beans recognized worldwide, with price premiums being paid by buyers which were particularly welcome in these times of depressed world prices. In contrast, Côte d’Ivoire’s economy came off badly hit. From 1987 to 1989, Côte d’Ivoire attempted to respond to plummeting prices by putting a ban on its exports, however it was without success (Araujo-Bonjean et Brun, 2005). Beans rotted in Ivorian ports whilst international buyers were holding enough stocks to deal with this market withdrawal. 1990 then opened an era of instability and vulnerability for Ivorian growers with significant social and societal ripple effects. Growing deficits of the Caisse stab led the government to cut the producer price from 400 to 250 CFA franc (CFAF)per kg in June 1989, and to 200 CFAF in 1990 (Cogneau and Jedwad, 2012). Plagued with corruption, the system was abandoned in 1999, at a time of a coup d’Etat and a subsequent growing political instability which degenerated into a civil war from 2002 to 2007.

From rock-bottom levels in 1999/2000 to their 32-year high at the beginning of 2010, cocoa prices, akin to the vast majority of base products, have revived their upward trend during the first decade of new millennium. The world supply varied erratically from year to year owing to tree diseases such as the swollen shoot , whereas the demand for cocoa from traders and processors, measured by the ratio of cocoa stocks to grindings, increased steadily, fuelled by a rise in consumption of chocolate confectionery products. On the buy-side, the upward trend in prices has led buyers to further integrate, both horizontally and vertically, in search of greater market power. As a likely strategy to gain influence over prices, the Ivorian government decided in 2011 to nationalize both the coffee and the cocoa industry. A part of this strategy was the creation of the Coffee-Cocoa Council, whose role, among others, is to ensure a minimum price per crop year for producers which should at least be equal to 60% of cocoa international prices.

In May 2016 the third World Cocoa Conference will be held, under the auspices of the International Cocoa Organization (ICCO). Defining ways to better brand cocoa origins will be on the agenda, as a strategy to capture a greater share of chocolate market value and, consequently, to “decommoditize” West-African cocoa. A strategy which is at the very heart of many commodity industries in Africa but which may be put in jeopardy owing to the recent drop in prices. Fortunately, cocoa growers are escaping this reality as for now.